THIS IS NOT INVESTMENT ADVICE.

Please speak with a registered investment advisor or other qualified financial professional before making any investment decisions.

Commentary

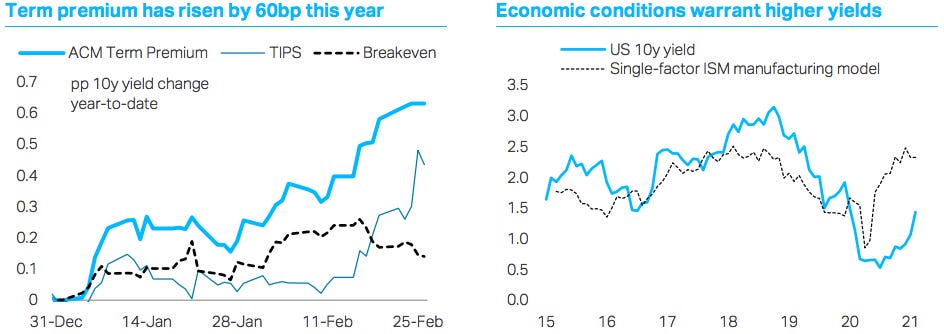

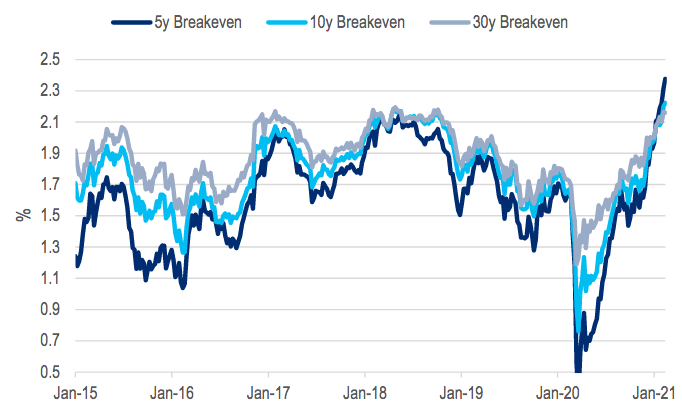

Monday saw the S&P500’s largest one-day gain since June, +2.4%. 92% of index components were up on the day as the market responded positively to global vaccine progress, a new vaccine approval for Johnson & Johnson as well as strong manufacturing PMIs and positive developments toward the passage of a new US fiscal package. What’s more, the RBA doubled their daily bond purchases to demonstrate their commitment to the 0.10% yield cap for their 3 year rate. If that had been all that happened last week, it would have been considered a busy one. But on the week, the average daily range for the S&P500 and Nasdaq was 2.3% and 2.9% respectively. On Thursday, the benchmark Nasdaq ETF (Ticker: QQQ) logged its largest single-day volume in history with 138.5mln shares. The VIX volatility index started the week at 23, peaked at 32 and closed at 24.5. Fed chair Powell stuck to the script, literally, oftentimes reading pre-written responses to questions in an interview with the Wall Street Journal. Market participants continue to see the Fed’s sanguine response to rising rates as a greenlight to sell treasuries. 10 and 30 year Treasury securities rose approximately 10 basis points in yield this past week (1.55% and 2.29%, respectively). Federal Reserve members continue to view the rise in rates as a positive development and a foreshadowing of economic strength. Members are now in their blackout period where they are not permitted to comment publicly any more until after the committee’s March 17th press release.

Chart of the Week

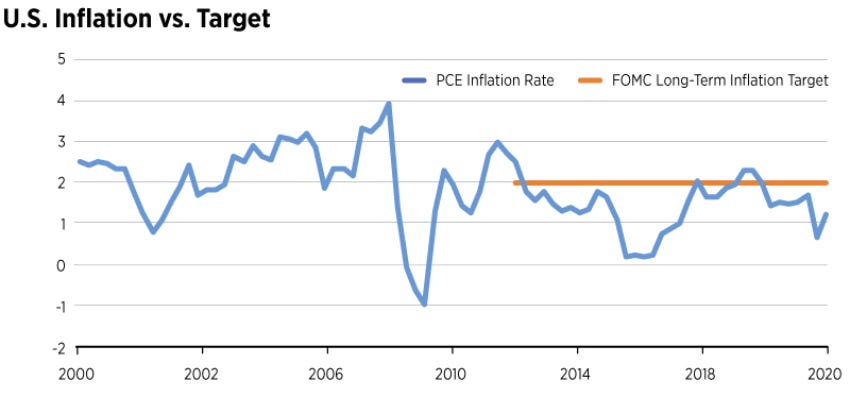

Fed Hikes are Being Priced In

If you’d like to support the ongoing publication of the Weekly MacroSummary, please share the publication with one of your friends or colleagues. Thank you for your readership.

ECONOMIC DATA

The Atlanta Fed’s GDPNow forecast for Q1 growth is currently tracking at 8.3%, down from 8.8% last week.

The New York Fed’s Nowcast forecast for Q1 growth is currently 8.6% down from 8.7% last week.

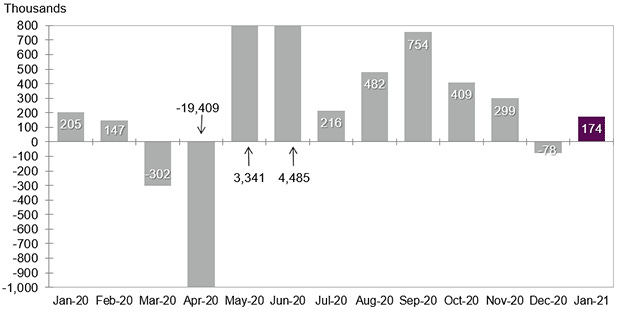

US non-farm payrolls in February rose 379k last month, well above the 200k forecast by the street. January revised up from +49k to +166k. Unemployment rate down to 6.22% and the labor force participation rate steady at 61.4%.

Total jobs are down about 8 million from pre-pandemic levels and the primary source of weakness is within leisure and hospitality. 4 million workers have left the labor force due to the pandemic and another 4.1 million report being unemployed for more than 6 months.

February saw what may be a turning point for these COVID- sensitive serivce sectors, leisure & hospitality +355k jobs added. Specifically, restaurants accounted for most of the gain. 2.25mln people are still on temporary layoffs, we see this as low-hanging-fruit for further strong payroll gains in the months ahead as reopening continues

Construction employment fell 61k because of weather related effects.

Average hourly earnings were up 0.23%m/m and 5.26%y/y

US ADP private payrolls came in much weaker than anticipated, +117k versus +205k street forecast.

“The labor market continues to post a sluggish recovery across the board...We’re seeing large-sized companies increasingly feeling the effects of COVID-19, while job growth in the goods producing sector pauses. With the pandemic still in the driver’s seat, the service sector remains well below its pre-pandemic levels; however, this sector is one that will likely benefit the most over time with reopenings and increased consumer confidence.”

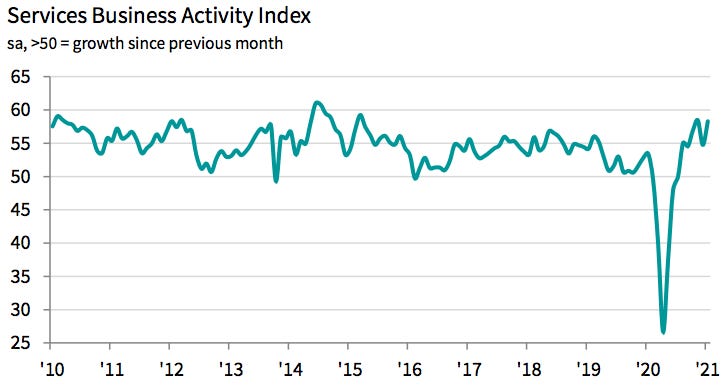

Fed’s Beige Book (Summary of Commentary on Current Economic Conditions): “Economic activity expanded modestly from January to mid-February for most Federal Reserve Districts.”

Every Fed District reported economic growth over this reporting period

Business optimism has improved over the past 6-12 months

Consumer spending is mixed and leisure/hospitality sectors still not close to normal

Employment rose “slowly” over the reporting period and that labor demand was still drastically different across industries and skill levels.

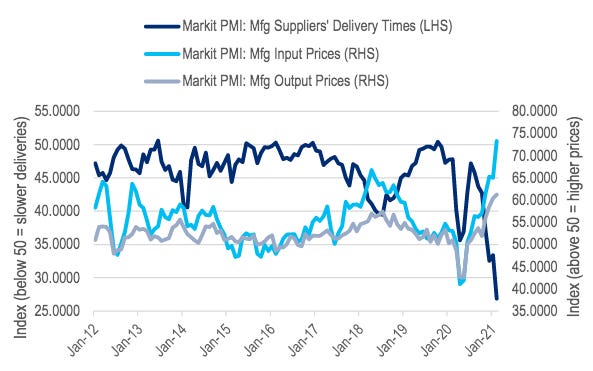

Supply chain disruptions met with strong demand continued to cause higher input costs.

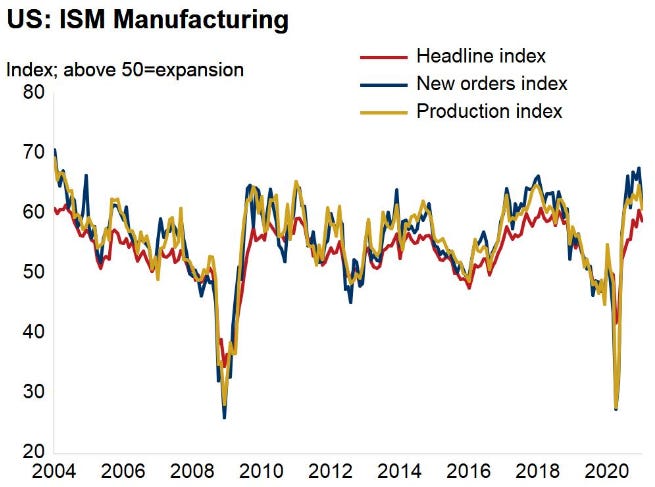

US ISM manufacturing 60.8 for February, ahead of expectations of 59

New orders, production and employment all rose, with employment reaching post-COVID highs.

Prices paid surged 4 points to 86, highest level since 2008

Of the 18 manufacturing industries, 11 reported employment growth for February

“The Employment Index grew for the third month in a row Continued strong new-order levels, low customer inventories and an expanding backlog indicate potential employment strength for the rest of the first quarter. For the sixth straight month, survey panelists’ comments indicate that significantly more companies are hiring or attempting to hire than those reducing labor forces”

Euro area January retail sales -5.9% m/m versus consensus expectations for -1.1% m/m decline

The miss was largely the result of lockdowns. Expect Europe to rebound as their vaccine distribution develops

The euro zone aggregate final manufacturing PMI in line with flash estimate at 57.9

UK manufacturing PMI to 55.1 for the final release for February

Sweden manufacturing PMI down to 61.6 in February from 62.5

Employment component rose to a new high

Norway’s manufacturing PMI for February 56.1, the highest in two years

Almost all subcomponents strengthened for the month

Korea’s February exports +9.5% y/y, continue to show strong global demand for their products

Auto shipments +47% y/y

Semiconductors +13.2% y/y

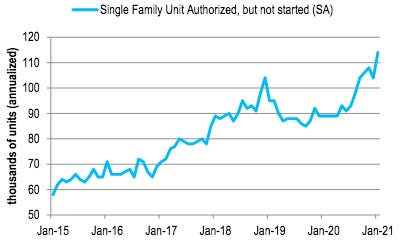

Australian house price growth for February was the highest monthly rate since 2003 at +2% m/m

Strong housing data has triggered discussions of macro prudential policy response from the RBA to slow down the overheating market but leverage and lending standards still look alright so our guess is that we’re a long way from any sort of response.

Australia’s 4Q GDP confirmed the strength of the economy coming in at +3.1% q/q, well ahead of expectations for +2.5%. Overall economic activity is now just 1.1% below December 2019 levels.

Government spending added 0.3 percentage points to growth.

Consumer spending ripped higher, +4.3% for the quarter despite a 3% fall in disposable income. The savings rate fell from 19% to 12% for the quarter.

Why it matters: Several weeks ago we pointed to significant pickups in economic activity in regions of Australia where the economy had been re-opened. We hypothesized at the time that it would serve as a good barometer of what other developed markets would look like once restrictions were lifted. These developments foreshadow significant coming strength in OECD economies.

COMMODITIES

Saudi Oil facilities were attacked via bomb equipped drones and ballistic missiles on Sunday, leading to prices jumping to over $70 a barrel for brent crude, the global benchmark.

“While Saudi Arabia’s ministry of energy said the attacks “did not result in any injury or loss of life or property”, and a person familiar with the matter said no production had been affected, the attacks have still unsettled oil markets that have rebounded strongly in recent months.”

Attacks were claimed by Yemen’s Houthi fighters, allies of Iran.

Allies such as Russia have yet to flood crude oil markets, and barring any changes we expect these elevated prices to continue.

International benchmark: Brent crude +2.9%, $71.28/barrel

US benchmark: West Texas Intermediate also up, $67.98/barrel

While there was no direct hit on oil supplies, traders and investors should still consider the market under threat. Price premiums are likely to continue as geopolitical threats loom.

GEOPOLITICS

US military presence in South Korea is getting a boost. A tentative deal has been reached to increase financial support for additional military presence in S. Korea following 2019’s unusual one year arrangement.

“This proposed agreement, containing a negotiated meaningful increase in host nation support contributions from the Republic of Korea, reaffirms that the US-Republic of Korea Alliance is the linchpin of peace, security and prosperity for north-east Asia and a free and open Indo-Pacific region,” - State Department

This action follows former president Donald Trump’s unpopular demands to increase the amounts S. Korea was paying to host US troops while simultaneously rebuking S. Korea for considering removal of US forces despite the growth of China’s military and the continued development of nuclear weapons in neighboring North Korea.

“The Special Measures Agreement, the cost-sharing deal between the US and South Korea, was renegotiated every five years from 1991 to 2018. … In 2019, only a one-year arrangement was reached after the two sides failed to agree on a way to meet Trump’s demands. An ad hoc arrangement was reached to cover the final period of the Trump presidency and avoid disruptions to US bases in South Korea.”

CHARTS OF NOTE

Feedback

Thank you for subscribing to the Primary Dealer Review. If you have any questions or comments, please email me directly at primarydealer@weeklymacro.com and I will get back to you.

Do you know someone who would like to receive this publication? Please feel free to share the Weekly Macro Summary with them.

Legal Information and Disclosures

This weekly summary expresses the views of the author as of the date indicated and such views are subject to change without notice. The author has no duty or obligation to update the information contained herein. Further, the author makes no representation, and it should not be assumed that past investment performance is an indication of future results.

Moreover, wherever there is the potential for profit there is also the possibility of loss.

This weekly summary is being made available for educational purposes only and should not be used for any other purpose. The information contained herein does not constitute and should not be construed as an offering of advisory services or an offer to sell or solicitation to buy any securities or related financial instruments in any jurisdiction. Certain information contained herein concerning economic trends and performance is based on or derived from information provided by independent third-party sources.

The author believes that the sources from which such information has been obtained are reliable; however, it cannot guarantee the accuracy of such information and has not independently verified the accuracy or completeness of such information or the assumptions on which such information is based.

This weekly summary, including the information contained herein, may not be copied, reproduced, republished, or posted in whole or in part, in any form without the prior written consent of the author.