Weekly Macro Summary

9/20/20

THIS IS NOT INVESTMENT ADVICE.

Please speak with a registered investment advisor or other qualified financial professional before making any investment decisions.

Commentary

Confidence in the US economy has rebounded to the highest levels of the pandemic era. Only 16% of Americans surveyed in the most recent consumer confidence survey expect the US economy to get worse over the next year. The bounce in sentiment is not strictly a US phenomenon. As you’ll see in the chart of the week below, confidence has bounced globally. Manufacturers’ sentiment levels are nearly back at the average of the past 12 years while consumers have rebounded strongly but still have some way to go before landing back at the average level. This bodes well for spending and for the trajectory of the recovery to continue.

Chart of the Week

Global Confidence, Standard Deviation from the 2007 - 2019 average (ex-China)

Source JP Morgan

If you would like to receive the Weekly Macro Summary directly to your mailbox every Sunday please subscribe. It’s free.

ECO DATA

Atlanta Fed GDPNow is currently tracking at 32.0% for Q3, up from 30.8% last week.

New York Fed GDP Nowcast stands at 14.3% for Q3, down from 15.6% last week.

German September ZEW investor expectations rise to 77.4 (consensus: 69.8) up from 71.5 in August.

The latest reading puts expectations at a 20 year high.

U.S. Empire Manufacturing in September at 17 vs 6.9 expected, up 13 points from August.

Prices paid up 9 points to 25, highest since January.

Strong rises in new orders and inventories.

Employment unchanged but still sitting at the highest levels since February.

U.S. retail sales report for August +0.6% m/m.

Core retail sales (excluding autos, gas, and building materials) unchanged in August (vs. 1.9% in July).

Consumer spending was positive in 7 out of 13 categories.

Retail sales now $10.3bln above its pre-COVID level in February 2020.

Aggregated daily card spending by major category (% year-over-year growth)

Source: Bank of America

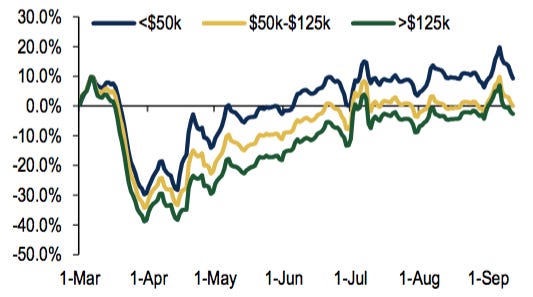

Daily total card spending by income group (% yoy, 7-day moving average)

Source: Bank of America

Source: JP Morgan

University of Michigan consumer sentiment 78.9, up 5 points versus 1 point gain expected.

Near highest levels since April and current conditions continue to improve.

16% of consumers expected the economy to worsen over the next year, the smallest proportion since 2015.

“Over the next several months, there are two factors that could cause volatile shifts and steep losses in consumer confidence: how the election is decided and the delays in obtaining vaccinations. While the end of the recession will depend on these non-economic factors, the hardships endured by consumers can only be offset by renewed federal relief payments.”

US Initial jobless claims 860k, down from 884k last week and roughly in line with expectations.

Continued claims fell 916k to 12.6mln, better than consensus forecast of 13mln.

Source: JP Morgan

The Philadelphia Fed Manufacturing Index in the U.S. decreased to 15 in September of 2020 from 17.2 in August.

The lowest reading since May.

Nearly all of the future indexes increased, suggesting more widespread optimism among firms about growth over the next six months.

U.S. August housing starts -5.1% m/m (consensus was -0.6%).

Building permits were also below consensus, -0.9% m/m vs +2% expected.

Hit a six-month high in July.

Permits for buildings with five units or more -17.4%

Single family authorizations +6%.

Source: U.S. Census Bureau

Housing market has been a remarkable bright spot for the economic recovery, this is not likely to be a persistent setback, expect to see the housing market continue to perform well with rates so low and secular tailwinds from household formation.

NAHB Builder Survey came in this past week at an all-time high of 83 re-affirming this optimism.

China continues to see a pick up in economic performance.

August industrial production +5.6% y/y versus 4.8% in July.

Retail Sales +0.5% YoY in August versus -1.1% in July... the first positive y/y growth this year.

Fixed Asset Investment growth -0.3% y/y for the first 8 months of the year, a remarkable rebound led by capital expenditures in the manufacturing industry.

Source: Macquarie

The current account deficit in the US widened by $59B to $170.5B in Q2 2020.

The largest deficit since Q3 2008.

Equivalent to 3.5% of the GDP, compared to 2.1% in Q1.

Reflects an expanded deficit on goods and reduced surpluses on primary income and on services.

Source: Trading Economics

Mexico announced that it is working on a fiscal support package for banks and consumers.

To be announced between September 22nd - 25th.

Will feature regulatory measures to help banks and families who have outstanding loans.

The number of people infected with the coronavirus across the world above 30M.

At least 946K people have died and 20.5M have recovered

CENTRAL BANKS

U.S. Federal Reserve leaves policy unchanged. New summary of economic projections by the board sees the Fed Funds Rate unchanged until at least the end of 2023. “The Committee decided to keep the target range for the federal funds rate at 0 to 1/4 percent and expects it will be appropriate to maintain this target range until labor market conditions have reached levels consistent with the Committee's assessments of maximum employment and inflation has risen to 2 percent and is on track to moderately exceed 2 percent for some time.”

Did not clarify what “some time” and “moderately exceed” mean.

Covid-19 remains the #1 risk to the outlook.

St. Louis Fed President Bullard spoke on Friday and was more bullish than the consensus at the Fed.

Expects the unemployment at 6.5% by the end of 2020 and said, "I actually think you may see more inflation than we have during the pre-pandemic era [...] when inflation was very subdued.”

Atlanta Fed President Bostic was less optimistic than Bullard. Said in Atlanta, “Eviction levels are higher now than a year ago and the trend is going in the wrong direction. I have heard reports this is happening all over the place.”

About the Fed’s new policy framework, “The policies coming out of the long-run framework are important because we are committing to letting the economy grow a little more robustly than we might have otherwise.”

Minneapolis Fed President Kashkari wrote an essay explaining his dissent at the Fed meeting.

He would prefer to drop references to maximum employment because the Fed has continually been wrong about its assumptions regarding how tight the labor market can become before triggering inflation.

His preferred language for inflation guidance, “The Committee expects to maintain this target range until core inflation has reached 2% on a sustained basis.”

A comparison of the September and June Summary of Economic Projections

Source: Bank of America

Bank of England holds rates and quantitative easing levels unchanged during the September meeting. Expressed continued concerns over 1) coronavirus resurgence across Europe and 2) a potential unfavorable end to the Brexit transition.

The BOE indicated that it will explore the potential to implement negative rates in the event of a further downturn in the economy.

The central bank’s current baseline assumes an orderly Brexit that results in a trade deal between the UK and the EU but they will discuss the potential of a “no deal” resolution in November.

Bank of Japan unchanged in its current monetary policy stance.

Economic assessment was revised upward, “Japan's economy has started to pick up."

BOJ Governor Kuroda stressed that coordination of monetary and fiscal policy will remain unchanged with the new Prime Minister Suga’s administration.

BOJs thinking the same as the Fed with a commitment to overshooting inflation to achieve an average 2% target over the business cycle.

Reserve Bank of Australia September meeting minutes reiterate “a lower exchange rate would provide more assistance to the Australian economy in its recovery…[Australian dollar remains] broadly aligned with its fundamental determinants.”

FIXED INCOME, CURRENCIES, COMMODITIES

U.S. Municipal Taxable Bond Issuance nears record highs.

$92bln of new debt issuances this year — largest amount issued since 2010.

Borrowing costs falling are at record lows, this allows issuers to refinance debt with taxable securities that cost less than what they are paying on outstanding tax-exempt bonds.

Cities and states have seen a decline in tax revenue due to the ongoing global pandemic. Kent Hiteshew, deputy associate director with the Fed’s financial stability division,“While state and local governments cannot cut their way out of this recession, neither can they borrow their way out of it, and if the legacy is operating deficit financing on state and local balance sheets after this crisis is over, that will limit their ability to finance infrastructure, to educate our students and to care for our elderly.”

10-year, AA-rated, taxable yield is roughly about 1.64%, .21% higher than a 10-year, AA-rated, corporate bond

The credit market benchmark CDX investment grade index will be receiving a significant upgrade in its composition as fallen angels are removed from the index (e.g. Ford, Macy’s)

Market expectations are for the newest iteration of the CDX to be 20 basis points cheaper to buy protection. This is the largest drop since March 2009.

Delta Air Lines is issuing $9bln in bonds that will be secured by the company’s frequent flyer program. The issuance will be investent grade.

Will be the industry’s largest corporate bond deal ever and will allow Delta to avoid taking federal aid.

Investor interest is high, with ~16bln in orders as of Wednesday.

Cash raised can be used to help repay a $3bln term loan due in March, and a a revolving credit facility of the same amount.

Current guidance on the issue is a 4.875% coupon versus 2.31% on the company’s lowest-rated unsecured investment-grade bonds

Company’s ridership volume is 1/3 of what it was one year ago

OPEC+ Joint Ministerial Monitoring Committee (JMMC) meeting on Thursday. Saudi Arabia’s Prince Abdulaziz bin Salman expressed dissatisfaction towards OPEC+ members that exceed their production quotas.

“Attempts to outsmart the market will not succeed and are counterproductive when we have the eyes, and technology, of the world upon us.”

Current global oil consumption is about 93m b/d which is ~7% lower then pre-pandemic levels.

Demand currently exceeds supply by about 1.5-2.0m b/d

August and July stockpiles fell by about 45m bbl and 34m bbl, respectively.

OPEC+ output cuts were 7.8m b/d in August.

OPEC+ compliance was 101% in August vs 95% in July.

Crude oil closed at its highest price in 2 weeks

CME will launch Future Contracts on Water later this year

Water Futures will allow big water consumers — like farmers and municipalities — to hedge against surging prices. The contracts will also act as a benchmark to track the supply of water around the globe.

Almost 2/3 of the world’s population is expected to face water shortages by 2025

In California, nearly 40% of water is used for crop production. The new CME contracts will help to create a forward curve so users can hedge future price risk as the water supply tightens in the future

Next week we’ll explore the market impact of 2000’s contested election and what that might mean if there is a contested election again this year in the United States

Source: JPM

EQUITIES

NVIDIA to buy ARM.

Potentially helps NVIDIA expand into the CPU market and provide the future data center AI architecture, particularly computational storage, a relatively new and efficient technology area where the processing of data is moved to where the data is stored.

Democratizes AI on the edge and expands NVIDIA’s markets to $250B by 2023

Should add sustainable and high margin IP recurring contract sales that can stabilize a lumpy data center biz.

Probably is accretive to gross margins and EPS upon closing.

Leverages Arm’s 13M+ developers to expand NVIDIA’s 2M+ CUDA developer ecosystem.

Carnival Cruises reports a $2.9bln loss for Q3 2020 and announced a $1bln sale of stock to raise capital.

To put the loss in perspective, Carnival averaged an annual profit of $2.7bln from 2015 - 2019.

Since March, the company has raised $10bln, most of that was via the debt market. At the end of 2019 the company’s total long term debt load stood at $9.7bln.

The company’s reported average monthly cash burn rate for Q3 was $770mln. Company is forecasting $530mln/month for Q4.

Accelerating the exit of 18 ships, representing a 12% decline in passenger capacity.

Light at the end of the tunnel? Advanced booking for the 2nd half of 2021 is currently at the higher end of the company’s historical range.

Oracle Corporation wins bid for TikTok in U.S., U.S. officials must still approve the deal as of Tuesday.

Oracle to be TikTok’s “trusted technology provider” in the U.S.

The deal will likely not be structured as an outright sale

Bytedance plans to keep majority of its TikTok stake

“The deal on the table does not appear to involve TikTok’s coveted artificial intelligence algorithm,” according to Chinese state-run media CGTN.

ByteDance’s ability to retain the app’s technology brings up the concerns to how valuable this deal really is.

Oracle has had a difficult time growing business in recent years with revenue only increasing 5.5% from 2016 to 2020 YTD. Although EPS increased to 3.16 during this time, this was mainly because of a drop in outstanding shares; 4.22bln to 3.21bln from 2016 to 2020, respectively. This would provide the company with a large and significant cloud customer.

To put Oracle’s performance into perspective, Microsoft Azure has realized revenue growth of 47% YoY as of 2Q 2020 with revenue of $13.4bln

The Nasdaq 100 Volatility Index (VXN) had been rising at the same time as the index was rising. Typically volatility for an equity index rises while the underlying index falls in price. The driver behind the pick up in volatility has been the significant amount of options activity in the last 2 months (see September 6th Weekly Summary for details)

Source: Bloomberg

Option volume in single-stock equities averaged a record 18.4mln contracts a day in August, up about 80% from the average monthly volume during 2019

So far this month, activity has increased to an average of 23.8mln contracts a day through September 8th.

Source: Cboe Global Markets

Aside from an increase in overall option volume in the recent months, a growing share of the equity options trading is in options that expire within two weeks, further driving volatility and market maker hedging needs.

Reduced broker fees and trading commissions have also helped fuel this option frenzy.

Source: Susquehanna Financial Group

Snowflake Inc. (NYSE: SNOW), a software maker that helps companies analyze and share data in the cloud, went public this past week.

Largest software IPO ever, valued at $33.33bln

On Wednesday, Snowflake shares opeend at $245 per share after pricing the IPO at $120

Salesforce and Berkshire Hathaway each purchased $250mln stakes in a private placement at the IPO.

The partnership with Salesforce is important as it provides them with new tools to compete in the cloud platform space with Amazon, Microsoft, and Google.

Apple announced “Apple One” bundled subscription service offering customers Apple Music, Apple TV+, Apple Arcade, iCloud, Apple Fitness+, and more.

Apple Fitness+ is the latest addition of Apple’s services and will incorporate metrics from Apple Watch for users to visualize right on their iPhone, iPad, or Apple TV. It will provide customers with studio-styled workouts similar to that of Peloton.

Apple’s increasing involvement in the fitness space with the recent announcement of Apple Fitness+ and the additional Apple Watch functionalities (new blood oxygen sensor, ECG ability, etc.) bolsters the company’s ambition to be a powerhouse in the health industry

GEOPOLITICS

Morgan Stanley has increased the risk of Britain and the European Union falling under "WTO rules" to 40% from 25%. World Trade Organization rules (i.e. no-deal WTO option) would drastically increase taxes on UK imported goods.

"Japanese bank Nomura has warned that the chance of a no-deal could be as high as 50-60% if relations continue to fracture, while ratings agency Fitch has made WTO terms its base case outcome" -Reuters

U.S. Officials Visit Taiwan amid escalating tensions with Beijing.

China sees Taiwan as a breakaway province that will eventually be part of the country again, but Taiwan has made it clear that they wish to remain self-governed. The U.S. visiting Taiwan suggests that the U.S. might be willing to back Taiwan if relations between China and Taiwan worsen.

Secretary of State Keith Krach arrived in Taipei, Taiwan on Thursday to attend a memorial service for former President Lee Teng-hui in hopes of bolstering its support of the island in defiance of threats from Beijing as reported by the U.S. Department.

China has recently escalated military activities with Taiwan in hope of isolating it from the global light, but Tsai Shih-ying, a legislator from the governing Democratic Progressive Party of Taiwan made it clear that they wish to maintain self-governed, “Right now, the focus is to let China know that Taiwan will not bow to the threat of force.”

This move from the Trump administration marks an important moment for the Taiwanese foreign ministry as they mentioned that the envoy, Keith Krach, was the highest-level official from the State Department to visit the island in decades.

China, which claims Taiwan as its territory, has made it clear that it opposes formal exchanges. In response to the visit, China sent two anti-submarine aircraft into Taiwan’s air defense identification zone (who were later warned off by the Taiwanese Air Force according to the Taiwanese defense ministry).

Although the risk of an accidental military clash is growing between Beijing and Washington, they still appear to want to avoid direct conflict. If anything, it shows a growing effort by the Trump administration to counter China’s attempts to regain the island’s status.

US-China Tension Barometer

Source: Goldman Sachs

PUNDITRY

Four Key Risks Converging for Stocks at the End of September via Morgan Stanley:

The fate of additional U.S. stimulus (CARES 2.0).

The first U.S. presidential debate (September 29th), which could impact how close the election will be.

COVID-19 cases, by end of September we should have a clearer idea of the impact of school re-openings.

Recent credit card trends show that areas that are further along in reopening or where schools are open are doing better.

Brexit, rising chances of no deal.

Mark Phelps, CIO of AllianceBernstein Concentrated Growth: "Market gains for the year are more rational than perceived," because of low rates and impact of stimulus measures.

Looser monetary conditions should stimulate economic activity, which in turn should boost corporate profitability, justifying higher share prices.

"Central banks have taken unprecedented action to provide liquidity for the financial system over the last six months." "Aggressive central bank purchases of government bonds in the US, Europe, Japan and the UK allow governments to issue more debt and suppress the cost of that debt, which has a very powerful effect."

"If inflation does rise significantly, and bond sales by the bond vigilantes more than offset the central banks’ efforts to manage the yield curve, central banks may be forced to take additional action to slow economic activity."

"If governments begin to reduce fiscal stimulus before economic activity has recovered enough to sustain further growth, this would create a fiscal drag that would damage the recovery and potentially lead to growth reversal once again."

"We believe that the necessary conditions for equity values to rise are positive developments toward a COVID-19 vaccine—which currently seem on track—sustained monetary expansion and significant fiscal stimulus. For now, all these conditions are still in place."

BlackRock: “The main reason tech companies continue to dominate: earnings and margins remain remarkably resilient.”

S&P 500 Technology Sector earnings expected to grow 19% this year.

Margins have remained high despite COVID-19.

Low and negative real rates are supportive of long-dated asset prices (i.e. cash flows being further out in the future) and so it’s been supportive of growth stocks.

Online retail sales are still tracking up 50% year over year despite many states re-opening in the U.S.

Steve Raineri, Franklin Small Cap Value Fund, Five reasons small cap funds will perform well as the U.S. continues to recover from the COVID recession:

Compelling Valuations: Russell 2000 Value is near 10 year lows compared to P/E of large cap value.

Earnings growth potential: EPS for profitable Russell 2000 Value components grew at a 5% compounded rate for the 10-year period ended August 30, 2020.

Performance During Value Stock Rallies: “value stocks only outperformed growth stocks 40% of the trading days in the 12 months ended August 31, 2020. However, on those days when value stocks outperformed growth, small-cap value stocks outperformed large-cap value 68% of the time.”

Performance over the past 20 years: Small cap has outperformed large cap value over the past 20 years.

Potential Acquisition Targets: From 2010 to 2019, 140 Russell 2000 companies were the target of acquisitions with a 30% average purchase premium. M&A activity has slowed in 2020 but expect activity to pick up and regress to long term levels.

Feedback

Thank you for subscribing to the Primary Dealer Review. If you have any feedback on the content or format, or have any questions, please email me directly at primarydealerreview@gmail.com and I will get back to you.

Do you know someone who would like to receive this publication? Please feel free to share the Weekly Macro Summary with them.

Legal Information and Disclosures

This weekly summary expresses the views of the author as of the date indicated and such views are subject to change without notice. The author has no duty or obligation to update the information contained herein. Further, the author makes no representation, and it should not be assumed, that past investment performance is an indication of future results.

Moreover, wherever there is the potential for profit there is also the possibility of loss.

This weekly summary is being made available for educational purposes only and should not be used for any other purpose. The information contained herein does not constitute and should not be construed as an offering of advisory services or an offer to sell or solicitation to buy any securities or related financial instruments in any jurisdiction. Certain information contained herein concerning economic trends and performance is based on or derived from information provided by independent third-party sources.

The author believes that the sources from which such information has been obtained are reliable; however, it cannot guarantee the accuracy of such information and has not independently verified the accuracy or completeness of such information or the assumptions on which such information is based.

This weekly summary, including the information contained herein, may not be copied, reproduced, republished, or posted in whole or in part, in any form without the prior written consent of the author.