Weekly Macro Summary

Week of 8/23/2020

THIS IS NOT INVESTMENT ADVICE.

Please speak with a registered investment advisor or other qualified financial professional before making any investment decisions.

Commentary

A few big retailers reported this week - Wal Mart, Home Depot, Target, Lowe’s - and all of them beat consensus estimates by a healthy spread. Notable was the growth in online sales which pretty much doubled for each of the companies as COVID accelerated the secular trend toward online shopping. Also this past week, several reports related to the housing market show that there is no end in site to its strength. What’s driving this? Employment among people earning $60,000/year or more fell less during the recession and has recovered more quickly than for the rest of the labor market What’s more, by the end of June, employment among workers in this income cohort was just 0.5% below the pre-pandemic level.

Chart of the Week

Source: Opportunity Insights

If you would like to receive this macro summary directly to your mailbox every Sunday please subscribe. It’s free

ECO DATA

Atlanta Fed GDPNow is currently tracking at +25.6% for Q3, down from 26.2% last week.

New York Fed GDP Nowcast is currently at 14.6%, down from 14.8% last week.

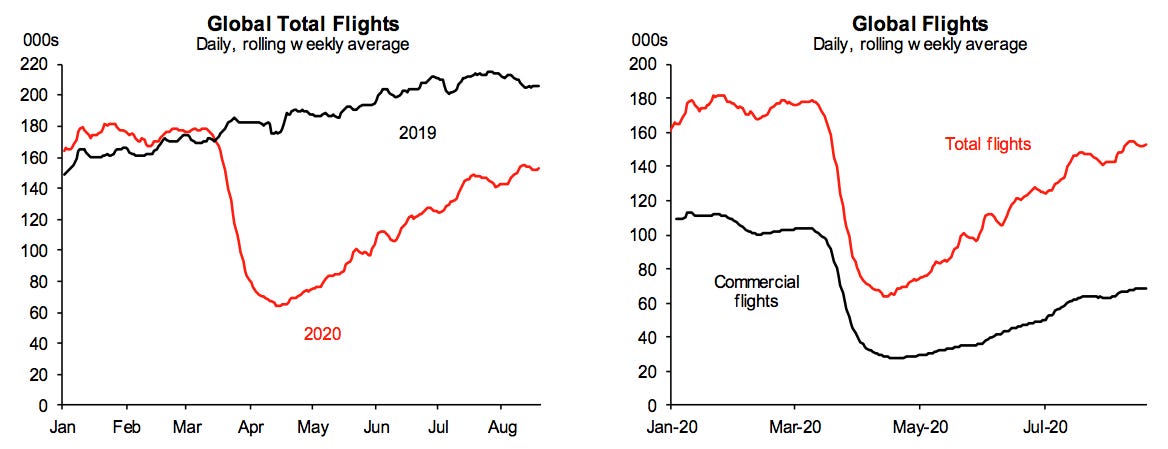

Goldman Sachs: Reopening at a Glance

Source: Goldman Sachs

US Initial Jobless Claims rise to 1.1mln vs 926k expected.

135k more than last week and the biggest weekly jump since March.

The rise in claims is disappointing but it is still lower than it was two weeks ago.

On the bright side: the overall number of continuing claims dropped from 15.4mln to 14.8mln in the most current and the number of states experiencing a week to week decline is 40.

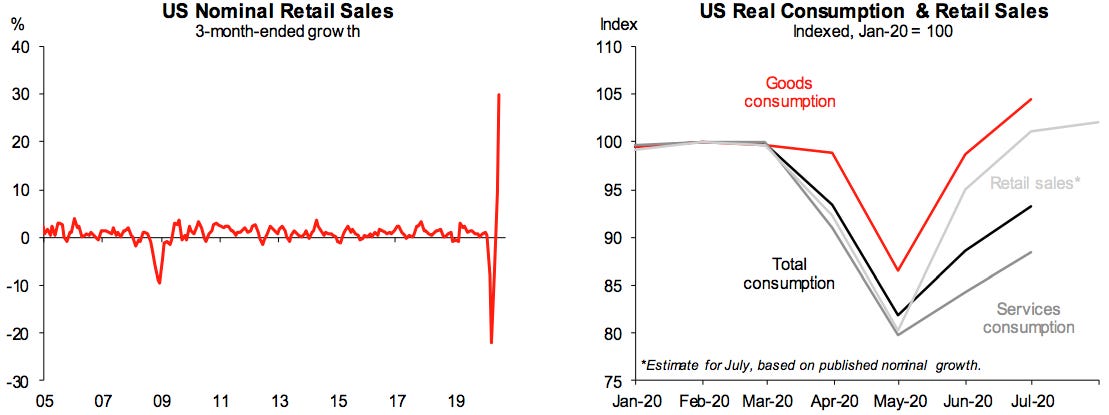

Source: JP Morgan

Source: JP Morgan

IHS Markit US Manufacturing PMI increased to 53.6 in Aug, beating market forecast of 51.9

Strongest factory activity increase since Jan 2019

Driven by quicker output expansions and new orders, a sales boost from resuming businesses

Meanwhile, the rate of input cost inflation was the fastest since Jan 2019 as manufacturers partially passed costs to clients

NAHB housing index, +6 points to 78 in August tying record high set December 1998

Index climbed for fourth straight month

NAHB notes that, “Single-family construction is benefiting from low interest rates and a noticeable suburban shift in housing demand to suburbs, exurbs and rural markets as renters and buyers seek out more affordable, lower density markets"

Housing Starts +1.496mln vs 1.24mln expected, for perspective this is about 20% above the average level throughout 2019

Building Permits 1.5mln vs. 1.32mln expected, highest number since January, up 24% from June

Multi-family starts +57% versus June

Housing market continues to see an extraordinary bounce

Source: JP Morgan

Source: Refinitiv

Existing home sales: 5.86mln unit pace in July, up 24.7% m/m

Homes typically remained on the market for 22 days, on average, in July vs 24 days.

68% of homes sold in July were on the market for less than a month.

Inventory of homes, as measured by months supply of homes, fell from 3.9 months to 3.1

CENTRAL BANKS

Federal Reserve Minutes from Fed Policy meeting were released:

“With regard to the outlook for monetary policy beyond this meeting, a number of participants noted that providing greater clarity regarding the likely path of the target range for the federal funds rate would be appropriate at some point.”

“In the context of outcome-based forward guidance, various participants mentioned using thresholds calibrated to inflation outcomes, unemployment rate outcomes, or combinations of the two, as well as combinations with calendar-based guidance. In addition, many participants commented that it might become appropriate to frame communications regarding the Committee’s ongoing asset purchases more in terms of their role in fostering accommodative financial conditions and supporting economic recovery.”

“A majority of participants commented on yield caps and targets -- approaches that cap or target interest rates along the yield curve -- as a monetary policy tool. Of those participants who discussed this option, most judged that yield caps and targets would likely provide only modest benefits in the current environment, as the Committee’s forward guidance regarding the path of the federal funds rate already appeared highly credible and longer-term interest rates were already low.”

“A number of participants observed that, with some provisions of the CARES Act set to expire shortly against the backdrop of a still-weak labor market, additional fiscal aid would likely be important for supporting vulnerable families, and thus the economy more broadly, in the period ahead.”

In a survey of primary dealers, respondents said that almost all don’t expect the Fed to raise rates until 2024 at the earliest

Last week the Federal Reserve Bank of San Francisco (FRBSF) released a paper called, “Average-Inflation Targeting and the Effective Lower Bound”. An important paper that lays the groundwork for a change in the Fed’s approach to its current 2% inflation target

The economic downturn caused by the Covid-19 pandemic is putting downward pressure on inflation, which raises the concern that economic activity will not bounce back if inflation continues to trend below the Fed’s 2% target.

Current monetary policy does not attempt to make up for past inflation shortfalls. FRBSF argues that average-inflation targeting is better policy for the current economic environment than the Fed’s 2% inflation target.

The paper posits that when inflation sustains a low level for an extended period of time, household and businesses eventually anticipate and plan for such levels, resulting in further downward pressure on inflation and limiting economic activity.

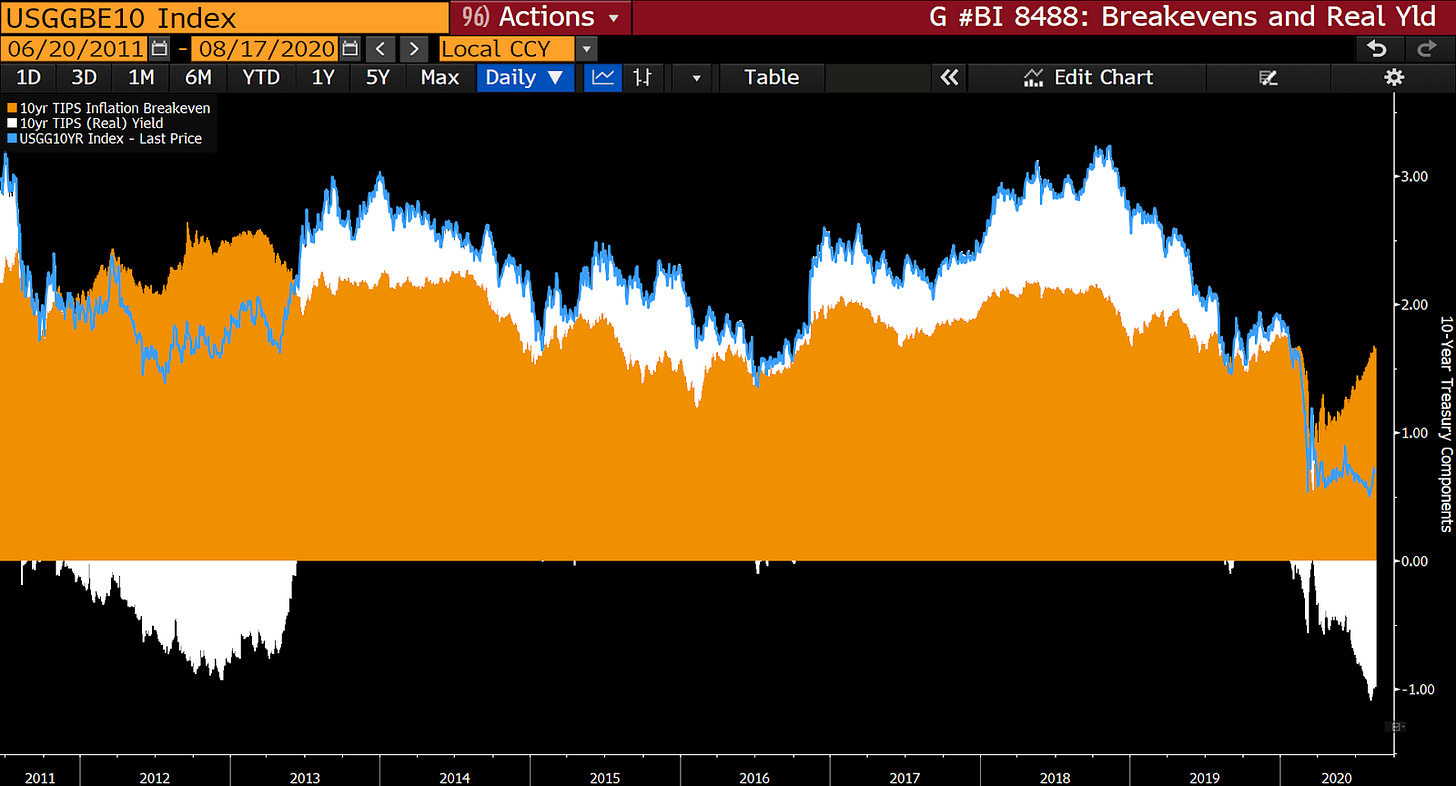

“Despite the longest economic expansion on record, PCE inflation stayed below the FOMC’s target for most of the past decade, as shown in Figure 1. The figure also shows inflation compensation as measured by the five-year breakeven inflation rate, which is the difference between nominal and Treasury Inflation-Protected Security (TIPS) yields.”

“Thus, despite having a 2% inflation target, inflation remains below 2% once the shock has passed, reflecting these lower inflation expectations. By pushing real interest rates higher, inflation expectations below target diminish economic activity.”

There are two frameworks FRBSF has researched that may help inflation rise to assist in economic recovery.

Averaging inflation over a fixed time window

Attempts to guide inflation using current and past rates toward an average-inflation target over a specific time period.

The below graph shows that inflation overshoots the target following the negative shock to make up for lower inflation in the past. To bring the average inflation rate back to target, the central bank sets interest rates lower following the shock than it would under standard inflation targeting. As a result, the more expansionary monetary policy mitigates the initial decline in inflation and boosts it thereafter.

“They also calculate that the optimal averaging period is relatively short, about two years or less, in standard macroeconomic models when policymakers can be constrained by the effective lower bound.”

Averaging over the business cycle

Averaging-inflation over the business cycle will result in the central bank overshooting the inflation rate during an expansionary period and undershooting the inflation rate when the economy enters a recessionary period.

The main difference between each of these average-inflation targeting frameworks and standard inflation targeting is that the central bank sets how much overshooting it wants to achieve whenever the policy rate is not constrained by the lower bound.

FIXED INCOME, CURRENCIES, COMMODITIES

Approximately 7% commercial mortgage-backed securities (CMBS) were transferred to special servicing in the first half of 2020.

This is approximately 1,065 loans, and a little over $40bln in notional value of CMBS.

Special servicers are responsible for handling workouts, loan modifications and default scenarios

“TIPS (real) yields are approaching record lows, meaning that investors have to be confident realized inflation will exceed current market pricing, or face losses. Today's negative real yields of almost 1% for 10-year TIPS eat into inflation compensation. And that's if the securities are held to maturity. On a mark-to-market basis, duration exposure is extremely high.” - Bloomberg

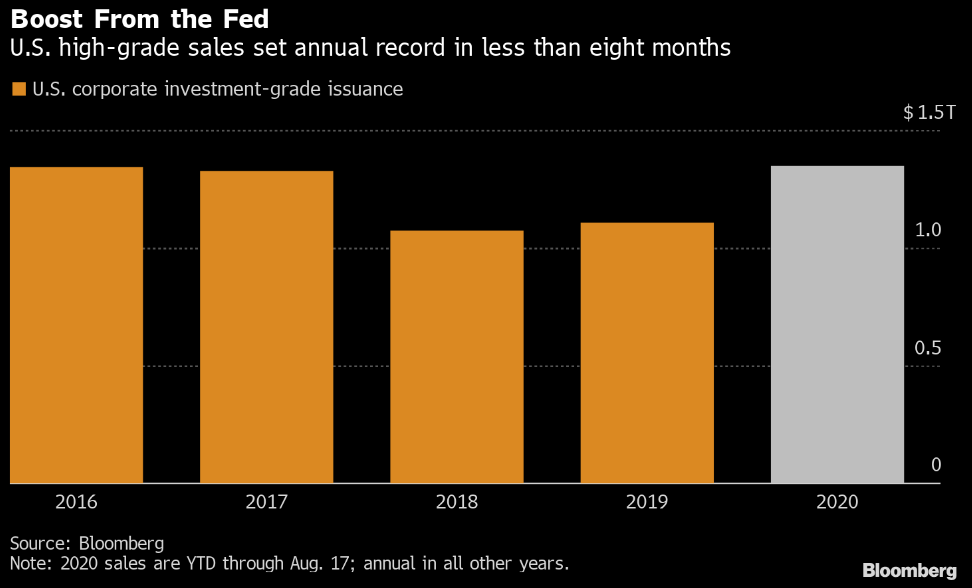

US corporate investment-grade issuance reached an annual record $1.35trln Monday.

Surpassed 2017’s yearly record with 4 month still left in the calendar year.

As yields on US Treasury securities have shrunk to historic lows, investors have put over $100bln into investment grade funds over the past 4 months

Crude Oil Inventories came in at -1.632M vs -4.512M last week

“WASHINGTON—The Trump administration approved an oil leasing program for the Arctic National Wildlife Refuge on Monday, opening up the pristine 19-million-acre wilderness to drilling for the first time and making it difficult to unwind the decision should Democrats recapture the White House in November.”

EQUITIES

The S&P 500 rose to an all-time high on Tuesday

Index is now up more than 54% since hitting a low on March 23, 2020

Although we are back to where we were before the selloff, many sectors have not participated in the sharp rebound

Information Technology and Consumer Discretionary leading the pack up 27% and ~23% YTD, respectively.

Laggards include Energy (-41%) and Financials (-21%)

Source: Fidelity

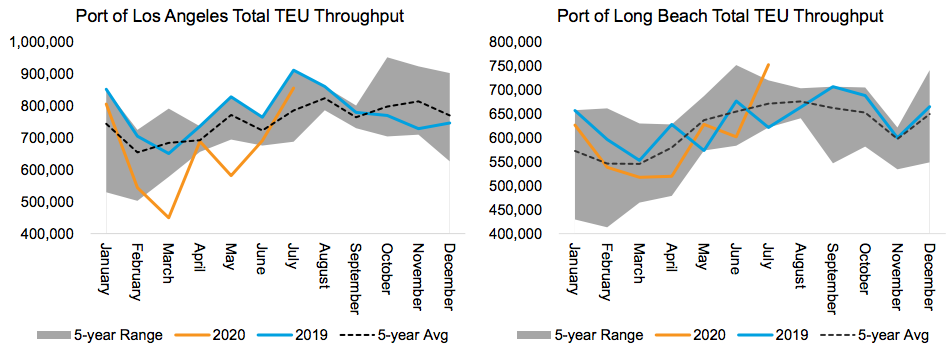

Moller Maersk, the world’s largest container shipping company (transports ~15% of the world’s seaborne freight) reported earnings above consensus (+$1.7bln EBITDA).

More importantly, the company reintroduced financial guidance after suspending it in March. The mid-range of their full year estimates are 12% above what the consensus had forecast and the company sees continued economic improvement

Wal-Mart same store comps +9.3% for the quarter vs 5.4% expected.

E-commerce grew 97%, nearly doubling over last year

Sam’s Club +13.3%, while new member count grew over 60%

All this done while maintaining their margins.

Home depot same store comps +23.4% vs 10.9% expected.

Maintained their operating margin

Constructions of new U.S. homes surged 22.6% last month benefiting Home Depot storefronts with increased demand for building materials

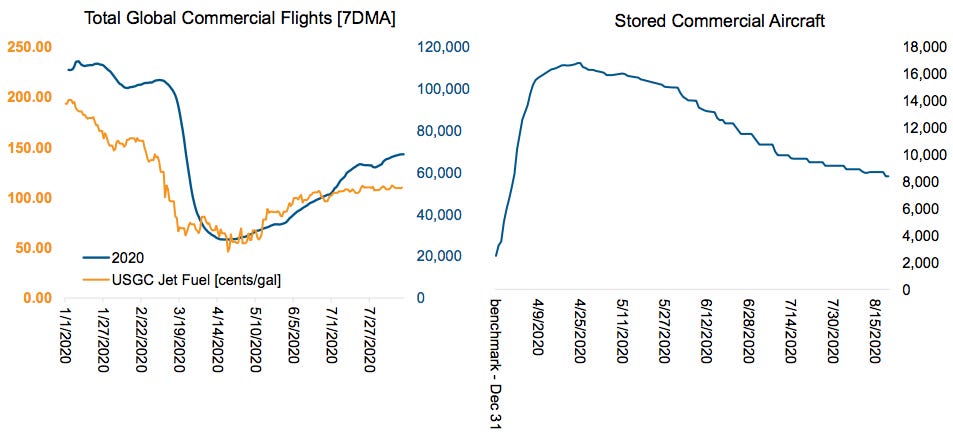

Airbnb has filed confidential IPO paperwork this past week

Had been privately valued at $31bln before this year

Aside from the COVID pandemic, the company continues to face headwinds from regulators and local communities

While the pandemic has temporarily impaired their business, the company had stockpiled cash leading up to the pandemic in order to have capital available for growth in new markets ($3bln with an additional $1bln credit line)

Apple’s market capitalization surpassed $2tln on Wednesday making it the biggest company in the world and the first U.S. company to hit this valuation.

It took Apple 42 years to reach a $1tln valuation, but only two years after that to break $2tln

All of Apple’s second $1tln came in the past 21 weeks

Nvidia Corp. reported strong Q2 profit and revenue on Wednesday trumping the street’s estimates

Data-center business outperforms gaming for the first time

Data-center business generated $1.75bln (+54% y/y), gaming generated $1.65bln (+24% y/y)

Mellanox acquisition that was completed in Q2 ($7.13bln), contributed 14% of revenue

Company guidance came in stronger than street expected

GEOPOLITICS

Protecting United States Investor from Significant Risks from Chinese Companies

In a memorandum published on June 4, 2020, the Trump administration issued a set of recommendations intended to address the long-running inability of the U.S. audit regulator (the PCAOB) to inspect accounting firms based in China whose audit clients are listed in U.S. stock markets.

Current Situation:

Chinese government refuses to allow audit firms registered with the PCAOB to provide audit working papers to the PCAOB.

Thwarts the transparency and reliability in the financial reports provided by Chinese companies, ultimately creating risks to investors.

Recent Events:

Chinese-based company, Luckin Coffee Inc. in April admitted that it booked $310mln in fake sales last year. The company’s stock price fell more than 80% from its previous day’s close.

Chinese e-learning company, TAL Education Group, disclosed it had found inflated class sales, contributing around 4% of its total revenue in 2020.

Next Steps:

The President’s Working Group on Financials Markets (PWG) submitted recommendations on August 6 for actions the executive branch, the SEC or PCAOB should take, including inspection or enforcement actions.

“Chinese companies that cannot hand over workpapers to the PCAOB, would be required to engage an affiliated U.S.-member accounting firm registered with the PCAOB to serve as the principal auditor through a co-audit”

The remaining recommendations are enhanced company and fund disclosures, greater due diligence of indexes and index providers, and guidance for investment advisers.

Potential Issues:

Delisting Chinese companies in the U.S. will drive them to ‘secondary’ listing in Hong Kong

Although US listings remain important for brand-building, the potential of being delisted, plus a loosening of Hong-Kong’s listing rules, has helped spur Hong-Kong offerings

There are currently 233 Chinese companies listed in the US

With the looming possibility of delisting, it is possible that Chinese companies launch preemptive bids to try and privatize companies before more strict takeover codes are allowed.

“To try and prevent Chinese ADRs being taken private cheaply, the U.S. administration may need to prevent US institutions from lending money to the management of Chinese companies…”

Listed stock holders are at the mercy of the controlling shareholders as to how the delisting is handled

What to Expect:

New listing standard gives a transition period until January 1, 2022, for already listed companies

New regulations accelerate the delisting process from three years to less than 18 months

Critical to solidify and further consider this ‘co-audit’ to avoid potential loophole opportunities

“... I assume that the Chinese government is unlikely to agree to the steps necessary to make [co-audit] workable,” - Daniel Goelzer, former acting PCAOB chairman

“The next stage of this [...] could be the administration forcing the sales of stakes in US tech companies held by Chinese entities in the same way as TikTok.”

Top 5 ADRs Subject to Delisting (by avg. daily volume) (Name: Market Cap in $mln)

Alibaba Group Holding Limited: 680,661

NIO Inc.: 15,969

GSX Techedu Inc.: 23,865

JD.com, Inc.: 97,259

Pinduoduo Inc.: 121,174

Sole listings which trade over $5mln per day are particularly vulnerable to accelerated delisting as several of these have Weighted Voting Rights, marking them as not eligible for onshore listing in China implying a Hong Kong listing is the most practical for them.

Top 5 Sole ADRs More Vulnerable to Delisting (Name: Market Cap $mln)

NIO Inc.: 15,969

GSX Techedu Inc.: 23,865

Pinduoduo Inc.: 121,174

Baidu, Inc.: 42,935

TAL Education Group: 46,291

Source: Forbes

SPECIAL SECTION: CHINA’S ECONOMY

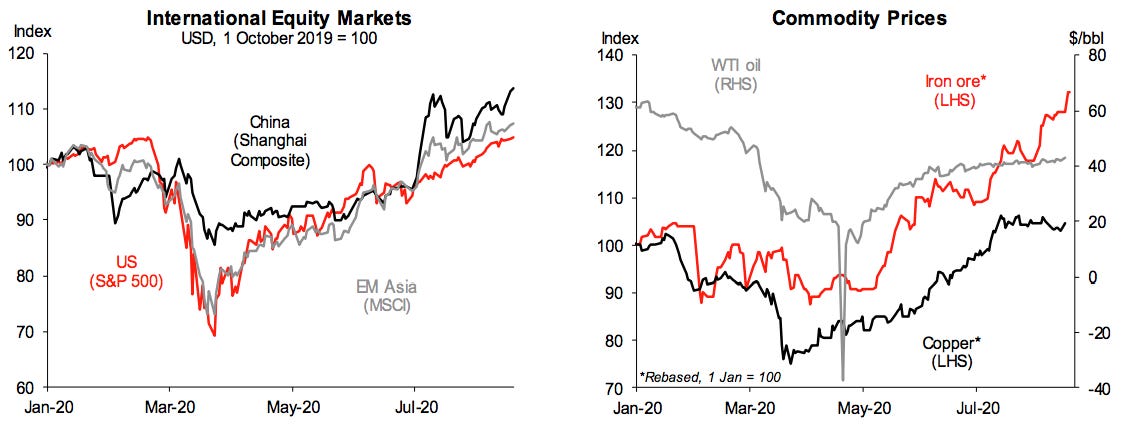

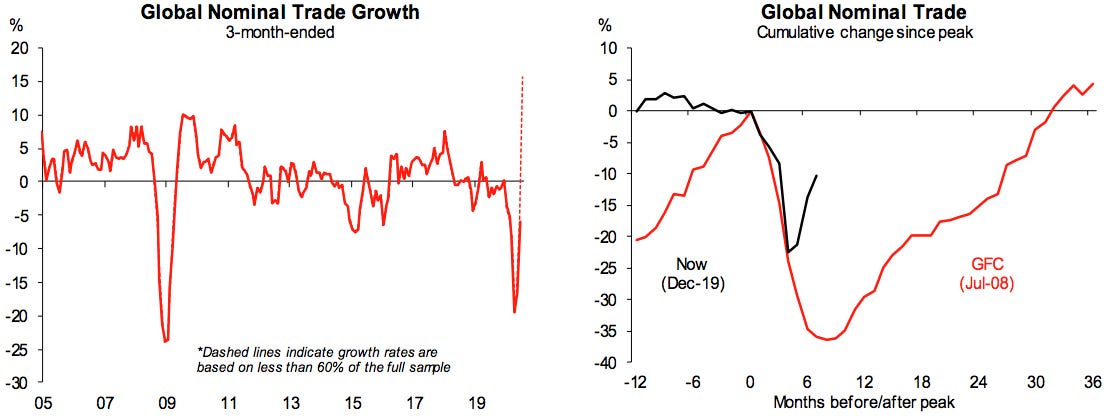

The Chinese economy has staged a sharp recovery since the trough in March. For Q2, GDP grew at 11.5% q/q and 3.2% y/y. The economy is now bigger than it was pre-COVID.

Unlike Europe and the US, retail sales in China are still below pre-COVID level.

Services accounted for 50% of consumption in China before COVID.

Goods are up almost 2% y/y while service consumption is down a little over 14% y/y. The laggards within services are restaurants, tourism, transportation and live entertainment.

China's stimulus in response to COVID has been focused on driving investment and corporates. The result has been a boost to property and infrastructure, unlike in the US and Europe where the stimulus was provided directly to consumers.

The size of the US stimulus via taxes and unemployment benefits combined to 3% of GDP.

Fixed-Asset Investment growth in China has now increased five consecutive months and is up 6% y/y in July and 3.3% for Q2 led by property spending which is up over 16% y/y for July.

Automobile purchases are up 12% y/y for July.

Chinese Credit has been normalizing since July on the back of the government's politburo meeting that called for reasonable growth in credit.

New Total Social Financing (TSF) in July was RMB1.7trln, up 13%y/y for the month and the YTD figure is up a staggering 42% versus last year.

Despite the call for credit growth and a cut to the country's money lending facility rate, country-wide interest rates are back to where they were pre-COVID.

Last week, China Railway Corporate unveiled a 15 year plan to double the country's high speed railway mileage to 70,000km bringing total railway mileage in the country to 200,000km.

Under the plan, there will be railway access for any citi with a population over 200k and high-speed railway availability for any city with over 500k.

Chinese Railway FAI has recently been about $120bln/yr. For comparison, the US spends approximately $30bln/year.

In a series of speeches in recent months, President Xi has promoted a new economic strategy, “domestic circulation.” The aim is to prioritize domestic consumption, markets and companies as China’s growth drivers going forward.

The country is trying to reduce reliance on foreign firms and foreign investors. More details are expected to emerge in October at the Communist party's plenum (a meeting of top officials).

One detail that has already emerged is an attempt to make the country’s stock markets a more reliable source of capital for firms.

China’s exports make up 18% of GDP, down from 33% 10 years ago.

“Domestic circulation” is being developed at a time when China has become a global pariah. A survey done in March by UBS found that 85% of Japanese, Korean and Taiwanese companies have relocated or plan to relocate some of their capacity out of China.

Source: Barclays

PUNDITRY

Last week, prompted by Ed Yardeni, we asked “In a world of zero interest rates, what is the fair value of the S&P 500 forward P/E?” Yardeni offers that, “There’s a precedent for our current times: World War I was followed by the Spanish Flu pandemic of 1918, which infected an estimated 500 million people and killed as many as 50 million. Given that the world population was 1.8 billion back then, that implied a 28% infection rate and nearly a 3% death rate. Both stats are currently significantly lower for the COVID-19 pandemic. Today, the global population is 7.5 billion. There have been 20 million cases and 735,000 deaths worldwide as of yesterday."

The post-war pandemic period was followed by “The Roaring 20s”

"There are plenty of years left for the prosperous 1920s to become a precedent for the current decade. If so, the driver of the coming boom will be technology-enhanced productivity, as it was during the 1920s."

In 1920, 51% of the US population lived in cities, up from 23% in 1870. Enabled by innovations in electricity and plumbing.

Model T, built between 1908 and 1927. Just 8,000 motorcars registered in the US in 1900, there were 8 million in 1920 and 23 million in 1929.

Other inventions of the 1920s: Ford’s assembly line (more efficient production across industries), Subways, traffic lights, fast food restaurants, mail-order catalogues, penicillin, the bulldozer, the radio, and the phonograph

“Typically, it takes roughly a decade for a new vaccine to go through the various stages of development and testing. However, the urgency of the pandemic has mobilized global medical resources as rarely seen in human history. Billions of dollars, provided by both the public and the private sectors, are funding the global campaign to develop tests, vaccines, and cures for the virus.”

Today’s range of modern potential technological innovations includes biotechnology, robotics and automation, artificial intelligence, and nanotechnology.

“There are also significant innovations underway in 5G for cellular networks, 3-D manufacturing, electric vehicles, battery storage, blockchain, and quantum and edge computing.”

Technology capital spending in the US stood at $1.32trln in Q2 and now sits at 50% of total capital spending

“The 1920s ended with a stock market meltup followed by a meltdown. The 2020s may already be seeing a meltup, begun on March 23. We live in interesting, though not unprecedented, times. The Roaring 1920s could be a precedent for the Roaring 2020s.”

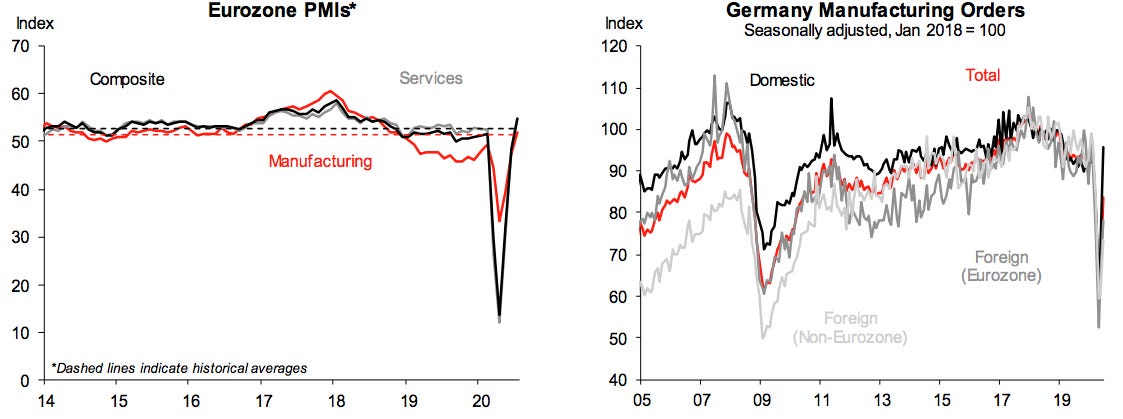

An Economic Snapshot of the World During COVID. Charts from Macquarie Bank

BAML Charting the Recovery

Feedback

Thank you for subscribing to the Primary Dealer Review. If you have any feedback on the content or format, or have any questions, please email me directly at primarydealerreview@gmail.com and I will get back to you.

If you’d like to support the Primary Dealer Review, please feel free to share the publication with your friends and colleagues. Thank you for your readership.

Legal Information and Disclosures

This weekly summary expresses the views of the author as of the date indicated and such views are subject to change without notice. The author has no duty or obligation to update the information contained herein. Further, the author makes no representation, and it should not be assumed, that past investment performance is an indication of future results.

Moreover, wherever there is the potential for profit there is also the possibility of loss.

This weekly summary is being made available for educational purposes only and should not be used for any other purpose. The information contained herein does not constitute and should not be construed as an offering of advisory services or an offer to sell or solicitation to buy any securities or related financial instruments in any jurisdiction. Certain information contained herein concerning economic trends and performance is based on or derived from information provided by independent third-party sources.

The author believes that the sources from which such information has been obtained are reliable; however, it cannot guarantee the accuracy of such information and has not independently verified the accuracy or completeness of such information or the assumptions on which such information is based.

This weekly summary, including the information contained herein, may not be copied, reproduced, republished, or posted in whole or in part, in any form without the prior written consent of the author.