THIS IS NOT INVESTMENT ADVICE.

Please speak with a registered investment advisor or other qualified financial professional before making any investment decisions.

Commentary

“We think that the economy’s going to need low interest rates, which support economic activity, for an extended period of time … It will be measured in years.” This was a quote from Federal Reserve Chairman Jerome Powell given during an interview with NPR. We first discussed the Fed’s shift to a flexible average inflation targeting regime a few weeks ago before it was made official. This week we, again, offer a review of recent statements by Fed officials about the new regime. The topic is, admittedly, academic and while the regime change was largely telegraphed it is still a watershed moment in central banking. Global investment portfolios have likely not yet made the adjustments required to adapt to the new landscape.

Chart of the Week

First US Fed Funds Rate Hike Not Priced in for 4 - 5 Years

If you would like to receive this macro summary directly to your mailbox every Sunday please subscribe. It’s free.

ECO DATA

Atlanta Fed GDPNow is currently tracking at 29.6% for Q3, up from 28.9% last week.

New York Fed GDP Nowcast is currently at 15.6%, up from 15.3% last week.

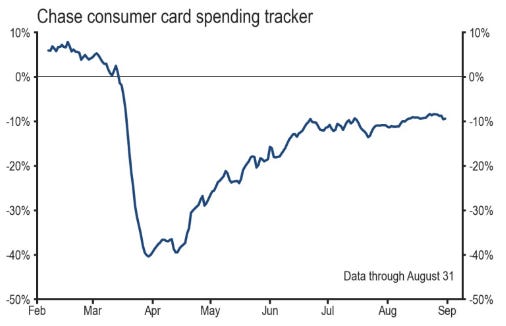

Goldman Sachs: Reopening at a Glance

Source: JP Morgan

US reported its 4th consecutive month of strong labor market gains. August payrolls rose 1.37mln vs. 1.35mln expected, boosted by 238k census hires.

Unemployment rate at 8.4% vs. 9.8% estimates. The decline was a good one because labor force participation rate rose from 61.4% to 61.7% (Still 1.7 percentage points below pre-COVID).

US manufacturing payrolls rise 29k for the month, subdued relative to what is expected given the strength in manufacturing PMIs.

Retailers hired 249k, restaurants hired 134k (after 525k in July).

Hourly earnings +0.4% m/m

The unemployment rate has now fallen below the Fed’s forecast for the end of 2020.

“Some traders are floating the idea that a good report could be bad for the market. In the sense that it puts less pressure on Congress to get a stimulus deal.” Sarah Ponczek of Bloomberg Business.

The bad news: Payrolls are still 11.5mln below their pre-COVID level from February and slightly less than half of the jobs lost have been recovered. Data is also showing that an increasing share of the jobs lost during this time have become permanent.

On the bright side: the US economic recovery is being led by the housing and manufacturing industry. Those are the two sectors with the highest job multipliers. Bodes well for the continued recovery of the labor market.

Source: Cornerstone Macro

ADP private-sector employment +428k in August, short of consensus estimate for 950k.

“The August job postings demonstrate a slow recovery.”

“Job gains are minimal, and businesses across all sizes and sectors have yet to come close to their pre-COVID-19 employment levels.

Change in Total Non-farm Private Employment by Company Size

Source: ADP

US Weekly Jobless Claims fell 130K to 881K in the week ended August 28th.

The lowest level since the effects of the pandemic started (back in March) and below market expectations of 950K.

Continuing Jobless Claims decreased to 13.25mln in the week ended August 22nd, the lowest level since the beginning of April and below market forecasts of 14.0mln.

US trade deficit +18.9% in July to $63.6bln from $53.5 in June and well above consensus forecast of $58bln.

July exports were $168.1bln, $12.6bln more than June exports. July imports were $231.7bln, $22.7bln more than June imports.

The Congressional Budget Office (CBO) released their deficit forecast for 2020 at $3.3trln. This equates to approximately 16% of GDP the largest relative to the economy since 1945.

2021 deficit forecast is 8.6% of GDP, making it the 4th largest since 1945.

Source: Well Fargo

The US Manufacturing PMI registered at 56% for August, up 1.8% from July indicating expansion in the overall economy for the fourth month in a row after a contraction in April. April’s contraction ended a period of 131 consecutive months of growth.

Production Index at 63.3%, up 1.2%

New Orders Index at 67.6%, up 6.1%

Employment Index at 46.4%, up 2.1%

Backlog of Orders Index at 54.6%, up 2.8%

Supplier Deliveries Index at 58.2%, up 2.4%

Although Supplier Deliveries ticked up, it reflects supplier’s difficulty in maintaining delivery rates due to factor labor safety issues and transportation difficulties.

IHS Markit US Services PMI registered 55.0 in August, up notably from 50.0 in July.

“August PMI signaled a strong expansion in business activity across the US service sector, as output rose at the sharpest rate for nearly one and a half years.”

“Higher supplier prices and greater cost for equipment such as PPE drove input prices up.”

Source: IHS Markit

US new vehicle sales in August: 15.2mln (seasonally adjusted annual rate) vs 14.5mln in July.

-13.8% y/y

Source: JP Morgan

The ISM Price Index at 59.5%, up 6.3% from July, indicating raw materials prices increased for the third consecutive month. An increase in input prices was realized across the board for all 17 industries surveyed in the index.

Price growth reflects a power shift toward sellers.

Expectations are for this price pressure upward to be transitory and temporary.

China’s manufacturing PMI at 51% for August, from 51.1% in July.

“...demand was gradually recovering, with new orders for products such as pharmaceuticals and electrical machinery and equipment at a faster pace…” Zhao Qinghe, China National Bureau of Statistics.

Dallas Fed manufacturing index rises to 8.0 in August vs -3.0 for July. First expansionary reading since February.

Employment component up to to 10.6 from 3.1 in July, after 5 months of contraction.

Workweek up to to 10.5 from 5.8.

Wages up to to 15.2 from 9.0.

New orders up to 9.8 from 6.9 (record low was -68.7 in April).

Prices paid up to 19.4 from 9.7 while prices received up to 0.9 from -1.5.

Outlook of general business conditions up to 20.4, highest since November 2018.

The Indian economy contracted by 23.9% in the second quarter representing the worst among the world’s top economies.

US economy shrank 9.5%.

Japan shrank 7.6%.

India’s workforce contains a large body of “informally” employed who often fall beyond government reach. Official numbers from Monday’s release might underestimate the full extent of the damage to the Indian economy.

The Trump administration announced Tuesday that the CDC will halt COVID-19 related evictions through the end of the year. The order is set to start this Friday and last through December 31, 2020.

The new moratorium applies to individual renters who expect to earn less than $99,000 this year on their own or less than $198,000 if they file jointly. It also applies to any renter that received a stimulus check earlier this year.

Renters who qualify will still owe accrued rent.

CENTRAL BANKS

Vice Chairman of the Federal Reserve, Rich Clarida, gave a speech entitled, “The Federal Reserve’s New Monetary Policy Framework: A Robust Evolution”. His views and discussion are important because Clarida has been the lead and architect for the Fed’s new framework. We have discussed this new framework in each of the past two weeks. Please refer to those past summaries for additional background.

“Perhaps the most significant change since 2012 in our understanding of the economy is our reassessment of the neutral real interest rate (r*) that, over the longer run, is consistent with our maximum-employment and price-stability mandates.”

January 2012, median FOMC participant projected a long-run r* of 2.25%, combined with a 2% inflation goal. This indicated a neutral federal funds rate of 4.25%.

The most recent Summary of Economic Projections (SEP) released in June, the median FOMC participant currently projects a longer-run r* equal to just 0.5%, which implies a neutral federal funds rate of 2.5%.

This decline in neutral policy rates since the global financial crisis is an occurrence across developed markets.

Two other important developments that have become evident over recent years is 1) price inflation is less responsive to resource slack, and 2) estimates of resource slack based on historical price/wage relationships are less reliable than previously believed.

The median of the Committee's projections of the rate of unemployment (u*) consistent with the 2% inflation objective—has been repeatedly revised lower. u* was 5.5% in January 2012 and 4.1% in June 2020.

The maximum level of employment that the Fed is mandated by congress to achieve is not explicitly stated numerically like their inflation goal. This is because it is not directly measurable and the number changes over time.

With the new framework a low unemployment rate by itself, will not be a sufficient trigger for policy action. There needs to be evidence of price inflation or a pressing financial stability concern.

“Following periods when inflation has been running persistently below 2%, appropriate monetary policy will likely aim to achieve inflation moderately above 2% for some time."

Federal Reserve Governor, Lael Brainard, “Bringing the Statement on Longer-Run Goals and Monetary Policy Strategy into Alignment with Longer-Run Changes in the Economy.”

Three related features of the economy's new normal called for the reassessment of the Committee's longer-run goals and strategy.

Economy’s equilibrium interest rate has fallen to low levels.

Underlying trend in inflation appears to be somewhat below Fed’s 2% target.

“The sensitivity of price inflation to labor market tightness is very low relative to earlier decades, which is what economists mean when they say that the Phillips curve is flat.”

The Fed’s new framework makes 4 important changes:

“Defines the statutory maximum level of employment as a broad-based and inclusive goal and eliminates the reference to a numerical estimate of the longer-run normal unemployment rate.”

“Adopts a flexible inflation averaging strategy that seeks to achieve inflation that averages 2% over time.... I would expect the Committee to accommodate rather than offset inflationary pressures moderately above 2 percent, in a process of opportunistic reflation.”

Fed will now seek to “mitigate shortfalls of employment from the Committee's assessment of its maximum level and deviations of inflation from its longer-run goal." This means monetary policy’s objective will attempt to minimize the welfare costs of shortfalls from maximum employment. The past the Fed would withdraw accommodation because of outdated models that forecast rises in inflation as a result of low unemployment.

Codifies a big lesson from 2007/2008: “financial stability is necessary for the achievement of our statutory goals of maximum employment and price stability.”

FIXED INCOME, CURRENCIES, COMMODITIES

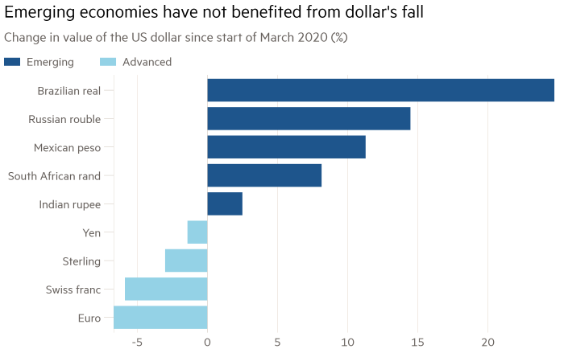

Philip Lane, the ECB’s Chief Economist, made a comment on Tuesday (9/1) that “the Euro-Dollar rate does matter” to the central bank and to the economy. His comment was a catalyst that caused the EUR to give back some of its recent strength as it moved 1.5% lower from the week’s high print of 1.2011 before he made the comment. The day after Lane’s comments, the Financial Times published an article discussing the Euro’s strength in which the paper anonymously quoted several members of the ECB’s governing council.

“The Euro’s rise against the USD and many other currencies risks holding back the Eurozone’s economic recovery.”

“In the last few weeks there has been an appreciation of the Euro, which is always worrisome when you have weak demand, especially as the euro area is the most open economy in the world and unusually dependent on global demand.”

“The problem is that the Fed has already decided and so the market may interpret interest rates as being structurally higher in the Euro area, which could lead to a further appreciation of the Euro.”

“It is a growing concern, though it is not yet huge, and if the trend continues it will be a concern and we will have to watch it.”

“What we have seen reflects the positive story . . . but it also reflects the starting point at which the Euro was probably undervalued against the dollar. It isn’t that concerning today but it could become a problem.”

On a trade weighted basis, the EUR recently reached its strongest rate since 2014. This begs the question, how strong is too strong for the EUR?

Trade Weighted EUR Index

Source: ECB

Source: FT

The Hong Kong Monetary Authority has intervened 40 times to keep its currency’s peg against the US dollar in check in 2020, official data show — the most active spate of interventions since the financial crisis of 2008 and 2009. In total, it has sold HK$132bn to keep the exchange rate steady.

The currency had traded near the strong side since April largely thanks to a popular trade where hedge funds sold the greenback for the HK’s higher-yielding dollars.

The premium between one-month Hibor and the U.S. equivalent is near the widest since 1999, meaning traders will still lose money if they sell HK's currency against the USD.

June will also be a month when local banks hoard cash to meet quarter-end regulatory checks, driving up demand for Hong Kong dollars. Listed Chinese companies will buy HK’s currency to pay dividends in the summer, also pushing up interest rates.

Source: FT

Taiwan has removed a hurdle to a bilateral trade deal with the US, pledging to ease restrictions on American pork and beef imports.

Taiwan has been pursuing a trade deal with the US for at least 15 years.

President Tsai Ing-wen said Taiwan would allow the import of US pork containing the feed additive ractopamine and beef older than 30 months.

Ms. Tsai said she hoped trade relations with the US could now be “taken to the next level”. While a bilateral trade deal was some way off, she said, Taiwan’s move on meat imports marked an important step.

Taiwan is a member of the World Trade Organization but remains shut out of most of the bilateral and regional trade deals that have grown around the global trade body over the past decade. Beijing insists that other governments help it isolate Taiwan, which China claims as its territory.

US crude oil exports reached 3.24mln barrels per day in July (vs. 2.75mln BPD in June) - US Census.

The week's sell-off started on Wednesday after the release of the U.S. Energy Information Administration's weekly supply report. Concerning points: relatively flat market supply and consumption data.

Gasoline supply over the summer was expected to increase as more of the U.S. was able to return to normal activity, and many consumers opted for driving instead of air travel. However, supply continues to outweigh demand as global COVID implications carry on into Q4.

EQUITIES

Citigroup asks, what could derail the tech runaway train?

“About 45% of the S&P 500 market cap weight is comprised of the IT sector plus Media & Entertainment and Internet Retailing, equivalent to the TMT concentration high of early 2000.”

The difference today between 1999/2000 is that today’s high tech heavyweights are proven business models that have relatively moderate P/Es (although not cheap).

Higher capital gains tax rates, especially under a Biden administration. If the idea of a near doubling of capital gains taxes were to take hold, a major sell-off would ensue as investors lock in their gains to get ahead of future higher capital gains rates.

Inflation rising which, in turn, would push up the discount rate for future cash flows and bring valuations lower. The inflation market is already showing a significant expectation of a pickup back to pre-COVID levels.

Protectionist policies from governments which would limit access to markets and ability to grow. Areas of focus have been minimum corporate income tax rates, regulatory oversight, user privacy, and app stores.

Berkshire Hathaway bought a 5% stake in each of Japan’s five biggest trading houses. The combined value of the holdings is over $6bln.

The 5 companies are: Mitsubishi Corp., Mitsui & Co., Sumitomo Corp., Itochu Corp. and Marubeni Corp.

Berkshire Chairman & CEO, Warren Buffett said of the investment, “I am delighted to have Berkshire Hathaway participate in the future of Japan and the five companies we have chosen for investment… [the five companies] have many joint ventures throughout the world and are likely to have more of these partnerships.”

MGM Resorts will be laying off 18,000 furloughed employees.

United Airlines will furlough 16,370 workers when federal aid expires October 1.

7,400 employees have already left the company having taken early retirement or other voluntary programs.

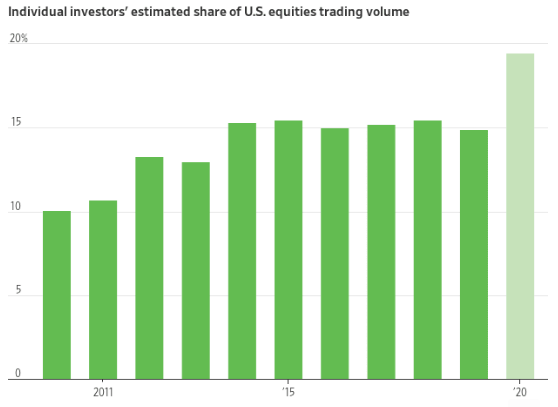

WSJ: “Individual-Investor Boom Reshapes US Stock Market.”

"Trading by individuals accounts for a greater chunk of market activity than at any time during the past 10 years". 19.5% YTD vs. 14.9% last year.

Catalyzed by major brokerages cutting trading commissions to zero.

Market feels more like a casino and less institutional. "Individuals often account for more than 80% of volume on the Shanghai Stock Exchange, while on the Korea Exchange’s main Kospi market, nearly 84%".

Source: WSJ

Hilton Worldwide said that system-wide occupancy for their hotels was 45% in early August versus 13% low in April. Occupancy in China for the hotel chain was last reported at ~60%.

Marriott’s global occupancy was 31% in July, up 19 percentage points from April. Marriott’s occupancy in China at its nadir in February was in the single-digits. The most recent figure was 60%.

Tesla Inc. announces share offering to fund growth and expand with new factories in Germany and Austin, TX.

Announced Tuesday, the company will sell as much as $5 billion in shares “from time-to-time” through an agreement with several banks.

The newly announced capital raise will represent roughly 1.1% of Tesla’s $464 billion market cap, according to FactSet.

Zoom Video Communications, Inc. shares zoom to new highs following second quarter earnings for FY21.

Total revenue for the quarter was $663.5 million, up 355% year-over-year.

GAAP income from operations for the quarter was $188.1 million, compared to $2.3 million in the second quarter of fiscal year 2020 and non-GAAP income from operations was $277.0 million, up from $20.7 million for the same time period.

Free Cash flow increased 2084% to $373.4 million YoY.

DocuSign, Inc. beats on earning as the work from home trend continues into the second quarter of 2020.

Revenue for the second quarter came in at $342.41, growing 45.2% YoY.

DocuSign’s expectations see a modest rise in the third quarter sales of $358 million to $362 million versus $335.11 million estimate.

Cash flow from operating activities totaled $118.1M with FCF of $99.8M.

Macy’s, Inc. reported better than expected earnings for second quarter of 2020.

Online sales remained strong, growing 53% over second quarter 2019.

Diluted loss per share of $(1.39) and Adjusted diluted loss per share of $(0.81).

Finished the quarter in a strong liquidity position with approximately $1.4 billion in cash and approximately $3 billion of untapped capacity in the company’s new asset-based credit facility.

US exchanges last week saw the purchase of 22mln more call contracts than puts, a record disparity.

CBOE Equity Put/Call Ratio at 0.40 as of 9/2.

“The overall nominal value of calls traded on individual US stocks has averaged $335bn a day over the past two weeks, according to Goldman Sachs. That is more than triple the rolling average between 2017 and 2019.”

A report in the Financial Times concludes that the recent rally in tech stocks has been flamed by significant purchases of call options by SoftBank, the Japanese tech conglomerate and investor.

Softbank is purported to be behind billions of dollars of call option purchases which has resulted in the largest ever trading volume in options contracts in individual stocks.

Nomura’s Charlie McElligot eloquently articulated the feedback loop and upward spiral, “this flow is simply larger than an August illiquid [sic.] single-name market can take (or frankly, ever, regardless of month), the hedging of single-names becomes forced lookalike buying in Nasdaq futures and likely S&P 500 futures as well (because it looks relatively “cheap”)—spot up, vol up, as this ‘upside-crash’ has to be hedged.”

Source: FT

The median S&P 500 stock is down 12% from its high and almost ⅓ of S&P 500 components are still trading 25% or more below their 52-week highs.

These stocks are primarily in banking, energy, travel, leisure and hospitality sectors.

Source: Morgan Stanley

Source: Bloomberg

GEOPOLITICS

ByteDance, owner of TikTok announced they will need China’s approval for the sale in the US.

Last Friday (8/31) Beijing imposed new restrictions on the export of artificial intelligence technologies, now requiring the approval of the Chinese Government for the sale of popular app TikTok

The new restrictions will require letters of export permit intentions from Chinese authorities before negotiations can be held, while final permits are required before any transfers are finalized.

ByteDance said they will strictly comply with the Chinese regulations. The new restrictions may delay the sale of TikTok while the company works to fully understand the new rule.

As the story of Japanese Prime Minister Shinzo Abe’s resignation unfolds, potential successors are probed.

Yoshihide Suga, Chief Cabinet Secretary, a front runner for Prime Minister of Japan, already receiving a majority of the Liberal Democratic Party’s support, signaling a potential win as party leader and Prime Minister.

Suga has served under Prime Minister Shinzo Abe since 2012, and seen as a promising successor to keep Abenomics intact and publicly stated that COVID-19 response will be a top priority.

Shigeru Ishiba, former Defense Minister, a potential candidate but less likely to gain enough backing.

Ishiba is running on Abe’s economic policies but specifically focusing on income growth outside the city limits of Japan, which has stalled in recent years.

Fumio Kishia, former Foreign Minister, previously identified by Abe as a potential successor but has little public support, polling around 5% compared to Suga with 38% support, a Asahi Shimbun survey showed on Friday.

Kishia announced his focus on bold fiscal and monastery policy to help the economy during the COVID crisis, but will eventually see fiscal balance in the years to come.

Turkish, Libyan central banks signed a cooperation deal on Monday. The banks will carry out activities to foster bilateral economic relations and strengthen financial cooperation between the two countries.

This cooperation comes at an interesting time coinciding with the increasing tensions between Turkey and Greece as Turkey extends gas exploration in eastern Mediterranean.

Aside from the financial cooperation agreement between Turkey and Libya, Turkish Defense Minister Hulusi Akar and his visiting Libyan counterpart Salah Al-Namroush met in Turkey’s capital Ankara on Tuesday. Akar reiterated Turkey’s stand with Libya, adding that Turkey supports Libya independence, sovereignty, and integrity - agreeing to maintain military cooperation.

Equity Charts to Watch, via Morgan Stanley

Long Weekend: Thought Provoking Charts via Bank of America

Source: Leuthold Group

Feedback

Thank you for subscribing to the Primary Dealer Review. If you have any feedback on the content or format, or have any questions, please email me directly at primarydealerreview@gmail.com and I will get back to you.

Do you know someone who would like to receive this publication? Please feel free to share the Weekly Macro Summary with them.

Legal Information and Disclosures

This weekly summary expresses the views of the author as of the date indicated and such views are subject to change without notice. The author has no duty or obligation to update the information contained herein. Further, the author makes no representation, and it should not be assumed, that past investment performance is an indication of future results.

Moreover, wherever there is the potential for profit there is also the possibility of loss.

This weekly summary is being made available for educational purposes only and should not be used for any other purpose. The information contained herein does not constitute and should not be construed as an offering of advisory services or an offer to sell or solicitation to buy any securities or related financial instruments in any jurisdiction. Certain information contained herein concerning economic trends and performance is based on or derived from information provided by independent third-party sources.

The author believes that the sources from which such information has been obtained are reliable; however, it cannot guarantee the accuracy of such information and has not independently verified the accuracy or completeness of such information or the assumptions on which such information is based.

This weekly summary, including the information contained herein, may not be copied, reproduced, republished, or posted in whole or in part, in any form without the prior written consent of the author.