THIS IS NOT INVESTMENT ADVICE.

Please speak with a registered investment advisor or other qualified financial professional before making any investment decisions.

Commentary

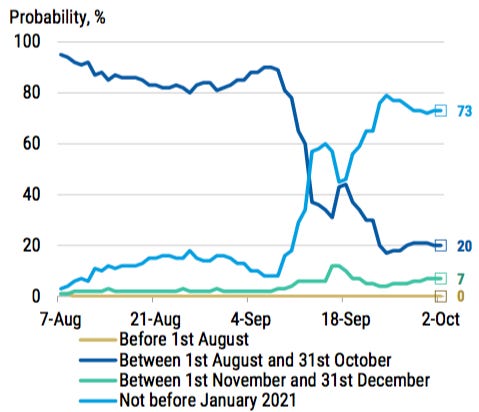

In the past week, global economic data continued to demonstrate improvement but the pace of growth and economic healing has slowed. In recent weeks, Federal Reserve members have consistently expressed the need for, and benefits of, additional fiscal stimulus. As discussions between Democrats and Republicans escalated, US and global markets responded frequently and substantively to headlines related to progress on a new deal. Earlier in the week, Democrats made concessions on the size of the proposed package that improved the likelihood of an agreement. On Saturday morning, the President’s twitter account sent the following message, “OUR GREAT USA WANTS & NEEDS STIMULUS. WORK TOGETHER AND GET IT DONE. Thank you!” Is a deal imminent? Not according to the super-forecasters.

When will federal legislation providing for $750 billion or more of new fiscal stimulus become law in the US?

Source: Morgan Stanley, Goodjudgment.com

Our chart of the week shows a market based measure of inflation that looks at the implied 5 year inflation rate in 5 years from today (inflation for the period from 2025 - 2030). It’s interesting because the Federal Reserve is committed to keeping rates accommodative until they reach their average inflation target of 2% over the course of some time. The market is telling a challenging story. The current implied US 5 year inflation rate is 1.48% (as of 10/2). The current implied 5 year inflation rate in 5 years time is 1.80%. What this means is that the market is predicting that the United States isn’t going to average 2% inflation for at least the next 10 years... will the Fed stay accommodative through 2030?

Chart of the Week

US and Euro Area Market implied 5 year inflation rate in 5 years time (5y5y forward inflation)

Source: JP Morgan

If you would like to receive the Weekly Macro Summary directly to your mailbox every Sunday, please subscribe. It’s free.

ECO DATA

Atlanta Fed GDPNow is currently tracking at 34.6% for Q3, up from 32.0% last week.

New York Fed GDP Nowcast stands at 14.0% for Q3, down slightly from 14.1% last week.

US non-farm payroll employment rose by 661k in September weaker than the 850k consensus forecast. The miss was largely because of education related jobs and the release of 41k temporary census workers.

Private payrolls rose a healthy 877k but has slowed down versus 1mln last month.

Unemployment rate declined to 7.9% (8.2% was expected) but the decline was largely because of a fall in the participation rate of the labor force. Had participation remained at August’s level, unemployment would have been 8.3%.

5th straight month of net job gains, good breadth in the private sector (see diffusion index below).

Leisure and hospitality brought back the most payrolls in September at 318k. The industry has now recovered a little over half of the jobs lost since February.

Retail trade added back more than 142k jobs during the month, and has now recovered 80% of the jobs lost since February.

Manufacturing saw its largest increase in 3 months at 66k.

Still far from a full recovery though as only 11.4mln jobs have been brought back through September from a total employment drop of more than 22mln.

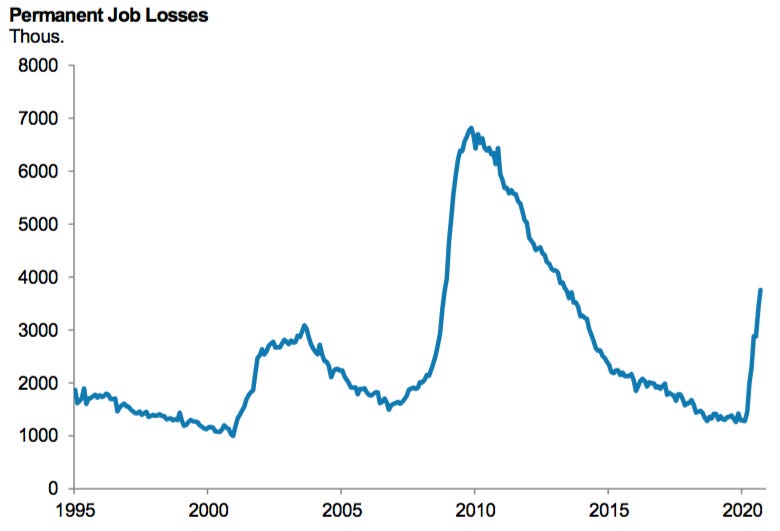

Job losers not on temporary layoff now account for 35.6% of the unemployed population, up from 11.1% in April.

Worrisome is that Permanent layoffs +345k in September and +534k in August. This is the largest 2 month increase in permanent layoffs since March 2009.

Source: Barclays

Source: Morgan Stanley

Source: Morgan Stanley

US ADP Private Employment comes in stronger than expected for September: +749k vs +649k expected.

August was upwardly revised by 53k.

Service producing jobs rose +552k, a positive given how significantly services have trailed manufacturing jobs in this recovery. Leisure and hospitality showed notable improvement.

Gains were broad-based across business sizes: small businesses +192k, midsized +259k, large +297k.

US, September Conference Board Consumer Confidence 101.8 vs. 90.0 expected.

15 point bounce from August is the largest in 17 years.

Present situation rose to 98.5 from 85.8, and expectations increased to 104.0 from 86.6.

Views of jobs as, “hard to get”, now at the lowest since February. Difficult to interpret this information given the aforementioned data about permanent job losses.

China’s official Manufacturing PMI +0.5ppt in September to 51.5 (50 is expansion territory).

Non-manufacturing PMI rises 0.7ppt to 55.9.

The production and new orders now at 2 year highs.

New export orders in expansionary territory for the first time this year.

Dining and accommodation also showing strength.

Source: Macquarie

Germany’s flash CPI for September, -0.2% y/y vs consensus of -0.1%.

Lowest level in five years.

Broad-based, deceleration. Core, energy and food all down.

Japan’s August Industrial Production +1.7%m/m, 3rd straight month of production increases.

Driven by the rebound of economic activity in Japan and abroad.

Production is still 10% below pre-Covid levels.

Recovery in exports saw a significant contribution from autos. Confirms the Chinese data regarding a pickup in exports and therefore global trade.

Good news on global retail sales/consumption:

Germany August retail sales +3.1% m/m vs +0.4% expected.

Japan August retail sales +4.6% m/m. Seasonally adjusted now back to pre-COVID levels.

France consumer spending data for August +2.4% y/y vs +0.4% expected.

US September Auto Sales: 1.35mln, only down 2.3% y/y and now at a 16.35mln annualized rate.

Source: JP Morgan

Source: JP Morgan

US Initial jobless claims 837k, down from 860k last week.

Lowest level since the start of the coronavirus pandemic.

California is not accepting new applications until early October while it processes a large backlog and investigates reports of widespread fraud.

California’s likely causing lower numbers given the state’s size.

California’s Employment Development Department released a statement September 19th announcing a partnership with two federal agencies in order to conduct multiple formal investigations in an attempt to crack suspected fraud rings.

“Scammers are using a complex profile of stolen personal identifying information most likely obtained from national and global data breaches”

This halt is expected to last anywhere from six to eight weeks potentially skewing US Initial jobless claims as noted above.

Source: Bureau of Labor Statistics

CENTRAL BANKS

Bank of England announced they have reached their Corporate Bond Purchase Program target of at least £20bn.

No more corporate bond purchases until further notice.

Bank of England Governor Bailey reiterates of view negative rates for the bank: looking into it but no decision.

BOE is not out of ammo with regards to QE.

Relieved that there has not been a house price shock in the UK

Chief Economist Andrew Haldane said the bank’s research on negative rates will take several months.

Negative rates are not imminent, “judgement [..] will depend on the economy outlook at the time and on whether that necessitates further monetary stimulus”.

UK economy has recovered faster than anyone expected or forecast.

Positive news has received less attention than it deserves.

Overly pessimistic economic recovery interpretations risk becoming self-fulfilling.

ECB President Lagarde, at “ECB and Its Watchers” conference said that a new inflation policy could be examined as part of the ECB’s strategic review.

“Worth examining an inflation policy more in line with the Fed”. Such a strategy, “could produce encouraging outcomes in the context of monetary policy, acting as a stabilizer for the economy when rates are at the lower bound.”

Philadelphia Fed President Harker said he does not forecast recovering to pre-COVID employment levels until 2023.

Called for further stimulus from Congress.

Dallas Fed President Kaplan expects Fed to hold rates at zero until 2022 or 2023.

“There are real costs to keeping rates at zero for a prolonged period of time. Keeping rates at zero can adversely impact savers, encourage excessive risk taking and create distortions in financial markets”.

Kaplan was one of two FOMC members to dissent at the September FOMC regarding the Fed’s new inflation framework implementation of the new inflation framework so not surprising to hear his more cautious tone.

NY Fed President Williams: US economic recovery has been better than expected, so far.

Does not expect to get back to pre-Covid employment levels for another 3 years.

Not worried about expanding the Fed’s balance sheet.

Proponent of giving the economy all the support the Fed can.

Higher fiscal debt not of great concern currently.

A Solution to Every Puzzle, Federal Reserve Bank of New York.

President of the Federal Reserve Bank of New York John Williams stated at this week’s 2020 US Treasury Market Conference that the U.S. recovery has been better than expected but it could be about three years before the economy regains its full strength.

“Like the post-financial-crisis reforms, this is an opportunity to think hard about what changes will help fortify the financial system against future shocks.”

“Recent events have reaffirmed what many already knew. Liquid, well-functioning markets for Treasury and related securities are absolutely essential for credit to flow and the economy to prosper.”

FIXED INCOME, CURRENCIES, COMMODITIES, & EQUITIES

The story of the past week was summarized at the beginning of the macro summary. The market impact was interesting in that stocks went up, bond prices went down (yields rose), and the dollar was broadly weaker. A “reflation” trade.

Year to Date IPOs in the US now over $80bn, most ever for a single year.

Previous peak issuance years were 1999 and 2000.

Renaissance IPO Index outperforming the S&P500 by 65% since the March 23 market low.

Source: Bespoke Investment Group

Source: Morgan Stanley

Micron reported their FY20 results. Revenue -8.4% y/y ($21.44)

The DRAM portfolio strengthened with 1z ramp and high-value NAND shipments reached record levels during the year.

PepsiCo reported 3Q20 earnings

Stock is up 3.3% YTD vs -1.4% for the S&P 500 Soft Drinks Sub Industry

Revenue +5.3% q/q and now +3% y/y

Constellation Brands reported 2Q21 sales -4%

Reduced debt by $600mln, and generated $1.2bln of cash (+10% y/y)

Corona Brand Family has seen a successful launch ofCorona Hard Seltzers.

Constellation’s Canopy Growth investment (marijuana) lost $34.1mln

Investment grade corporate bond issuance continues at a rapid pace in 2020, now at $1.66trln, the most ever issued in a single year.

High Yield corporate bond issuance stands at $335bln.

Source: Bespoke Investment Group

Source: Bespoke Investment Group

Source: JP Morgan

ECB published a case for creating a digital currency. The council has yet to make a decision about whether to introduce the digital euro but intends to do so in mid-2021. “Experimentation will start in parallel, without prejudice to the final decision.”

Would complement cash and wholesale central bank deposits.

Christine Lagarde, ECB President: “Europeans are increasingly turning to digital in the ways they spend, save and invest. Our role is to secure trust in money. This means making sure the euro is fit for the digital age. We should be prepared to issue a digital euro, should the need arise.”

The ECB is considering two design approaches:

1) Centralised, would record digital euro transactions in the ECB’s own ledger.

2) Decentralised, transactions will be settled and recorded by supervised intermediaries under guidance set by the ECB.

The ECB outlined potential scenarios “that would require the issuance of a digital euro”.

Higher demand for electronic payments and an overall need for a “risk-free digital means of payment.”

Potential cyber attack that would disrupt the existing payment system and requires a digital euro as a back-up.

A further drop in cash usage that leaves people financially excluded.

Potential rapid adoption of other digital currencies that could possibly “threaten European financial, economic and, ultimately, political sovereignty”.

Challenges:

In a financial crisis people may seek shelter in a digital currency backed by the ECB, pulling money out of commercial banks.

Privacy concerns if ECB will be able to monitor transactions (unlike cash).

ECB is considering “remunerating digital euro holdings at a variable rate over time, possibly using a tiered remuneration system, or by limiting the quantity of digital euro that users can hold and/or transact” to reduce potential impact on the banking system.

Digital currencies are a hot topic, with other central banks initiating projects of their own.

Includes Sweden’s Riksbank, the Swiss National Bank and the People’s Bank of China.

GEOPOLITICS

The Azerbaijan conflict has claimed 100 lives in the recent dispute over the Najorno-Karabakh region. Disagreement over the land goes back to the 1980's. Some nations recognize the land as independent but Armenia does not.

Important transit route for the supply of oil and natural gas to the EU. The south Caucasus pipeline, which runs alongside the Baku-Tbilisi-Ceyhan Oil Pipeline (BTC), delivered 9.2 billion cubic meters of natural gas to Turkey in 2019, and is due to start supplying Greece and Italy with up to 3% of the EU's total supply next month.

The conflict could pull in both Russia and Turkey. If Turkey comes under attack, NATO treaty requires it to become involved.

In our weekly summary released on September 20th , we highlighted the “U.S. Officials Visit Taiwan amid escalating tensions with Beijing.”.

China Premier, Li Keqiang stated “[China will] remain consistent in our policies and guidelines toward Taiwan,...We will adhere to the one-Chine principle and the 1992 consensus, firmly oppose and curb any ‘Taiwan independence’ moves or external interference, strengthen cross-strait exchanges and cooperation and promote the peach development of cross-strait relations.”

Dozens of military aircrafts have entered the island’s airspace in the past month. Defense officials say it’s comparable a crisis experienced in 1995. The confrontation could indicate that Beijing no longer wants to respect tacit agreements on official boundaries. Is Taiwan’s independence being threatened?

Cuba plans to devalue the peso for the first time since 1959 due to a shortage of tradable currency.

The coronavirus pandemic impact on tourism, a fall in foreign earnings and tougher US sanctions had created the worst cash crunch since the early 1990s.

Long time scarcity of basic goods and long queues at shops have been exacerbated by the pandemic as Cuba imports about 60% of its food, fuel and miscellaneous necessities in the pharmaceuticals and agriculture sectors.

UN Economic Commission for Latin America and the Caribbean predicts Cuban economy will contract 8%. No formal data points have been released by Cuba at this time.

Cuba operates two currencies: the peso and the convertible peso.

According to Financial Times’ sources and limited government statements, the peso will be devalued significantly from its current level on paper of one per dollar and the convertible peso will be eliminated completely.

Cuba’s government has said it will keep the peso’s current rate for an unspecified amount of time to allow a timely exchange of convertible pesos to pesos. It will convert bank accounts priced in convertible pesos.

Purchases in US dollars will again be allowed, though only with a bank card. This last happened in 2004.

Bert Hoffmann, Latin America expert at the German Institute of Global and Area Studies: “Instead of monetary unification Cuba is moving into an economy with two different monetary circuits: the dollarized debit card shops and the normal domestic economy, in which the Cuban peso will be under strong inflationary pressures”.

Final plans to be outlined in October.

Legal Information and Disclosures

This weekly summary expresses the views of the author as of the date indicated and such views are subject to change without notice. The author has no duty or obligation to update the information contained herein. Further, the author makes no representation, and it should not be assumed that past investment performance is an indication of future results.

Moreover, wherever there is the potential for profit there is also the possibility of loss.

This weekly summary is being made available for educational purposes only and should not be used for any other purpose. The information contained herein does not constitute and should not be construed as an offering of advisory services or an offer to sell or solicitation to buy any securities or related financial instruments in any jurisdiction. Certain information contained herein concerning economic trends and performance is based on or derived from information provided by independent third-party sources.

The author believes that the sources from which such information has been obtained are reliable; however, it cannot guarantee the accuracy of such information and has not independently verified the accuracy or completeness of such information or the assumptions on which such information is based.

This weekly summary, including the information contained herein, may not be copied, reproduced, republished, or posted in whole or in part, in any form without the prior written consent of the author.