Weekly Macro Summary

9/13/20

THIS IS NOT INVESTMENT ADVICE.

Please speak with a registered investment advisor or other qualified financial professional before making any investment decisions.

Commentary

It was a light news and holiday-shortened week for markets. Two important happenings came out of Europe, first the ECB left their policy stance unchanged but president Lagarde telegraphed a less dovish than expected discussion surrounding the euro’s exchange rate. Second, new worries about a “no deal” Brexit surfaced and surprised markets driving the pound sterling lower. In the equity section this week, we lay out the case to remain optimistic about the stock market and contrast it with the reasons to be pessimistic.

Last week we posited that most global investment portfolios had not yet made the necessary adjustments in order to reflect expectations of a Federal Reserve that will keep the funds rate accommodative for years to come. Markets, however, have already taken the Fed’s commitment seriously. Our chart of the week shows where the market is implying that the 1 month US treasury interest rate will be in 30 years from now. It last stood at less than 2%.

Chart of the Week

Market implied 1 month US Treasury interest rate in 30 years from now.

Source: Morgan Stanley

If you would like to receive the Weekly Macro Summary directly to your mailbox every Sunday please subscribe. It’s free.

ECO DATA

Atlanta Fed GDPNow is currently tracking at 30.8% for Q3, up from 29.6% last week.

New York Fed GDP Nowcast stands at 15.6% for Q3, unchanged from last week.

The Nowcast currently projects 7.3% for Q4 GDP growth.

News from the JOLTS, PPI, and CPI releases were small, leaving the nowcast for both quarterly broadly unchanged.

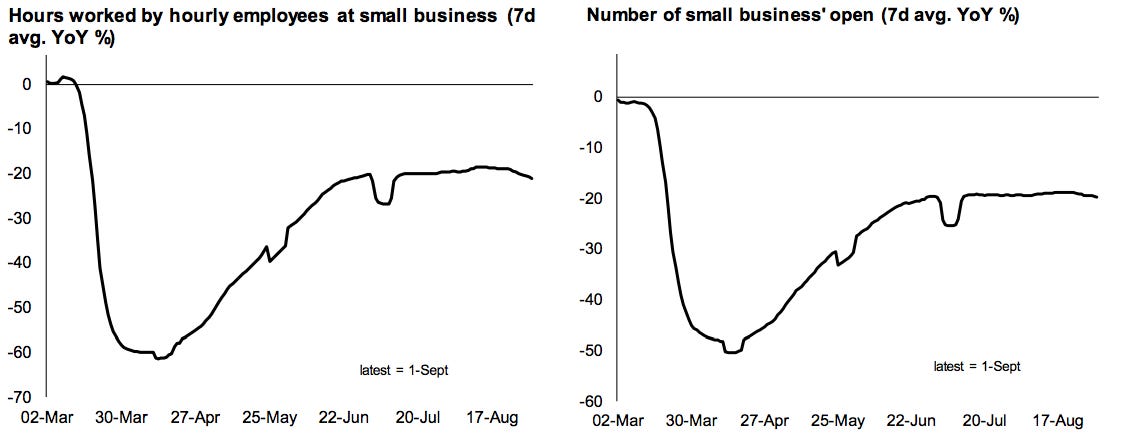

Via Goldman Sachs: The Re-opening at a Glance:

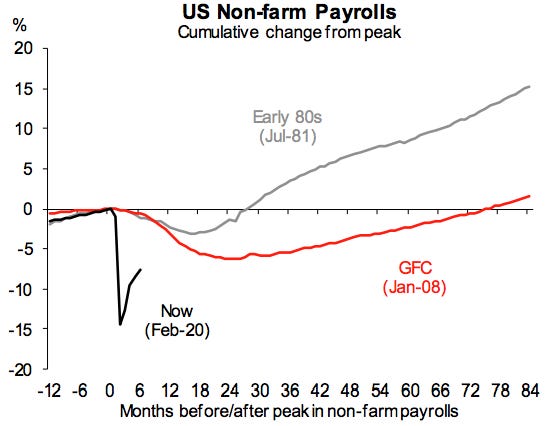

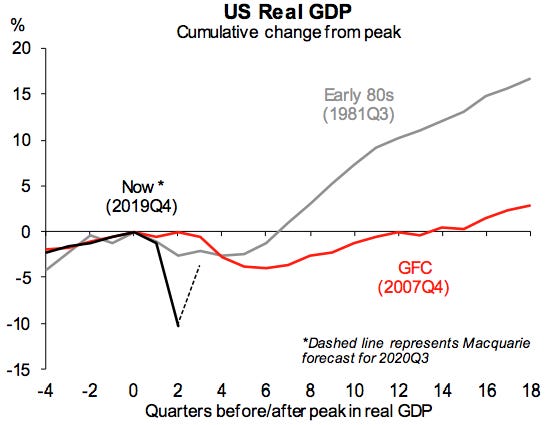

Despite the strong rebound in the US economy, output is likely to be approximately 4% below its peak in Q3. That is more than the low point of the 1982 recession and equal to the low point of the 2008/2009 Financial Crisis.

Payrolls are still 7.6% below the peak compared to 6.3% during 08/09.

Employment to population ratio for prime age workers is near the 2009 low point.

Sentiment of Americans is weary; the household savings rate was 7% at the start of 2020, 34% in April and 18% in July.

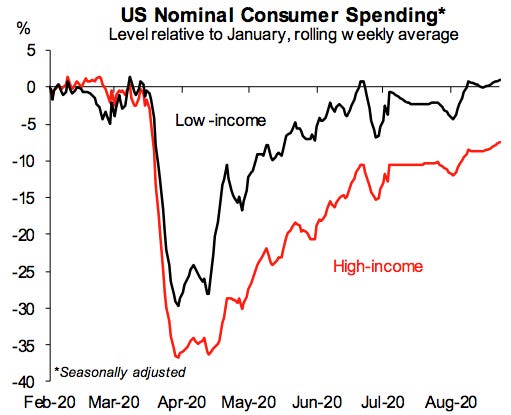

Data from Affinity Solutions shows that consumer spending by low-income earners is 1.1% above levels in January but spending by high-income earners was down 7.5% (as of August 23).

On average, the wealthy are older and so are not as engaged in the economy as they were in January.

NFIB small business optimism ticks back up to 100.2 from 98.8 in July (was 100.6 in June).

Firms report being more optimistic about rehiring and are finding workers in shorter supply.

Only two of ten components fell.

“Expectations sales higher” was one of the two to fall and it’s at lowest levels since October 2016.

“Availability of Loans,” which is not part of the optimism index, is tied for its highest reading on record. This bodes well for the economy and flow of funds but it’s a contradiction to what we’ve seen from senior loan officer surveys that show commercial and industrial loans are becoming less available.

Source: NFIB

Source: NFIB

US Initial Jobless Claims: 884k, continues to trend sideways, averaging less than 2% decline weekly for the past month.

Continuing claims 13.385mln up from 13.292mln. This is because of +0.356 mln from California.

Number of states showing a drop in continuing claims down to 33 states from 47 last week.

“While regular state claims have continued to trend lower, initial claims for pandemic unemployment assistance (PUA; the federal relief program for gig workers and others) rose for the fourth consecutive week with 839K people filing during the first week of September; that’s the most since July and on the verge of overtaking regular claims on a non-seasonally adjusted basis. PUA now represents roughly half of continuing claims as well.” -Wells Fargo

“The July JOLTS data on job openings showed an increase of openings across most categories. With reopening plans still proceeding (for instance NJ and NY plan to resume indoor dining in September), we expect job openings in the leisure and hospitality sectors to re-accelerate.” -Citi

Source: Macquarie

Source: Macquarie

Core CPI inflation +0.4% in August vs +0.2% expected, second consecutive upside surprise, has risen at a +5.1% annualized rate for the past 3 months.

Y/y CPI is now +1.3% versus +1% in July.

Strength from used auto prices +5.4% and apparel prices +0.6%. Used car price surge is likely to be transitory as economies reopen and people become more comfortable taking public transportation again.

Airfares +1.2%m/m and hotel prices +1% for a 3rd consecutive month.

Prices of the Most Virus-Affected Services Jumped by 7.8pp to -8.8% y/y:

Source: Goldman Sachs

Producer Price inflation +0.3% m/m in August (slightly ahead of consensus of 0.2%), -0.2% y/y.

Core PPI +0.4% m/m.

Goods prices +0.1%, Services prices +0.5%.

Rebound in prices has been led by sectors that were hardest hit during COVID and had seen steepest price drops earlier this year.

Source: Oxford Economics

US lenders issued $1.1trln worth of home loans between April and June 2020.

The biggest quarter since Black Knight records began in 2000. For perspective, there were 2.5trln of home loans in all of 2019.

Refinancings have been the catalyst for the increase, up over 200% versus last year.

30 year fixed rate mortgages fell below 3% for the first time ever in July.

On Thursday morning the 30 year fixed rate mortgage was at 2.86%.

Source: WSJ

Christopher Nolan’s move, Tenet, was released in the United States on September 3.

The first major blockbuster released theatrically since the closure of movie theaters in March. Film had a production budget of $200mln

65-70% of US theaters have reopened but with operating capacity restrictions.

The two largest box office markets in the US are still closed: NY and LA, so 30-35% of screens are still closed.

The movie had an opening weekend of $20mln which is low compared to a typical move by Nolan but those metrics are a poor measure of success given the aforementioned restrictions.

CENTRAL BANKS

The European Central Bank (ECB) met this week and their public policy statement release was almost a word for word copy of the July statement. ECB President Lagarde’s remarks and press conference were viewed as slightly hawkish as she did not reiterate or express concerns about the euro’s strength. Recall that last week, the FT published an article that quoted several governors at the ECB who had expressed worry about a potential negative impact that continued strength in the euro might have for the economy.

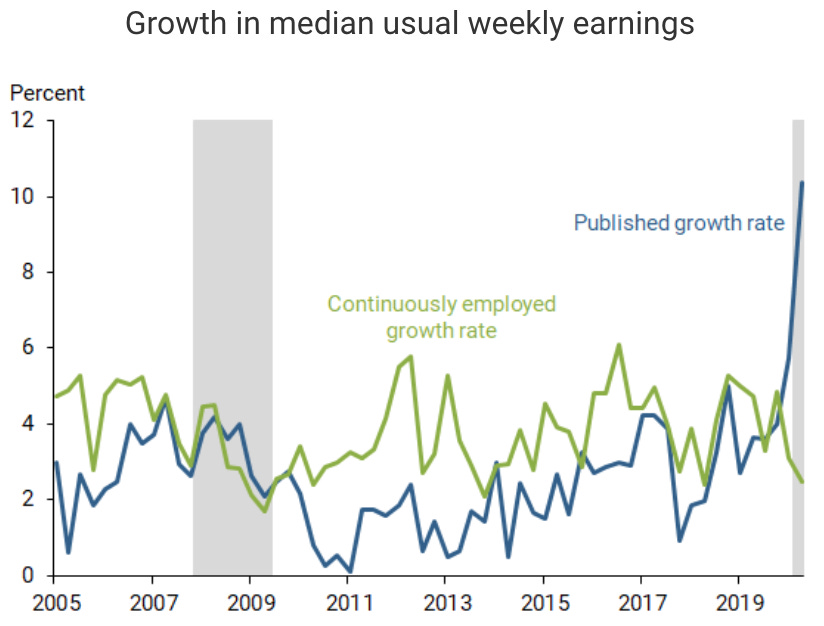

“The Illusion of Wage Growth”, an Economic Research Letter from the Federal Reserve Bank of San Francisco.

“Despite a sharp spike in unemployment since March 2020, aggregate wage growth has accelerated. This acceleration has been almost entirely attributable to job losses among low-wage workers.”

“Since the onset of COVID-19, low-wage workers have been disproportionately affected by job loss. That is, a disproportionate share of those who lost jobs came from the bottom half of the wage distribution.”

“The data [“Share of worker exits to nonemployment by earnings”] show that, historically, exits from full-time employment have disproportionately come from the lower end of the earnings distribution.”

What can be done to measure wage growth when so many workers are losing jobs and exiting employment?

“...compare the official published measure of wage growth, which has been affected by the exits we documented, with one for workers who maintain full-time employment over the entire period.”

The disparity between these two statistics can be seen in the below figure, “Growth in median usual weekly earnings”; illustrating the opposing trends.

Since the last quarter of 2019, the published aggregate growth rate of median earnings has increased by 6.4%. However, wage growth for continuously employed workers shows us that it has slowed by 2.4% throughout the same period.

”...high wage growth captured in aggregate measures should not be seen as indicative of a recovering or a strong labor market.”

Source: FRBSF

Source: FRBSF

Re-highlighting a couple of key sentences from Fed Governor Brainard’s speech from September 1 because US congressional discussions regarding additional fiscal stimulus have stalled and the Fed stands ready to act if there’s a political impasse.

“With the recovery likely to face COVID-19-related headwinds for some time, in coming months, it will be important for monetary policy to pivot from stabilization to accommodation.”

“While the virus remains the most important factor, the magnitude and timing of further fiscal support is a key factor for the outlook.”

Source: Goodjudgment.com

FIXED INCOME, CURRENCIES, COMMODITIES

FT: "For 2020, $250bln worth of US bonds have been issued with purpose of refinancing debt that companies have coming due, rather than funding an acquisition, an internal project or a big buyback of shares. That is almost double the amount for the same period last year, according to data from Refinitiv. Add in cases where refinancing is mentioned in a long list of possible uses, and the number rises to almost $870bn."

The amount of bonds with maturities of 20 years or longer is twice the amount issued all of last year.

The amount of bonds with maturities of 40 years or longer is 5x the amount from 2019.

Total debt issuance by US companies has already reached a full year record level with 4 months to go in 2020.

Source: FT

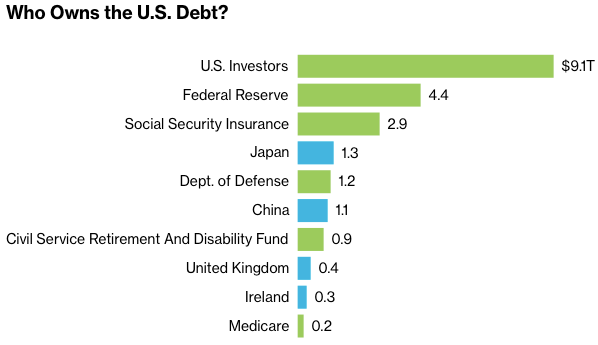

Related to the topic above about corporate debt issuance: The U.S. government is paying less in interest even as it borrows more notionally.

“Interest payments in the federal budget declined about 10% in the first 11 months of this fiscal year, when America was running up its biggest deficit since WWII.”

With the central bank promising to keep short-term rates at zero for the foreseeable future, this will allow the Fed to continue to bolster the economy with “cheap” money.

“Also cited by the dovish camp is Japan, which has national debt about two-and-a-half times bigger than America’s. After more than two decades of low interest rates, its debt servicing cost is approximately zero.”

Source: U.S. Treasury, Bloomberg

Source: CBO

Oil prices hit three-month low on Tuesday.

COVID resurgence fears.

Brent crude, the global benchmark, trades at less than $40 per barrel for the first time since June.

West Texas Intermediate, the US benchmark, last traded $37 a barrel.

The last time American drivers burnt so little fuel in late August was in 1998.

“The weak state of fundamentals and the lack of any catalyst for improvement in the near term are resetting price expectations after the summer…that goes for oil, but also to the broader market.” -Roger Diwan, IHS Markit

EQUITIES

Via Morgan Stanley, 3 reasons to remain Bullish:

New bull markets begin with a recession and typically run for years.

The health crisis that triggered this recession has brought unprecedented monetary and fiscal stimulus that is likely to become structural in nature.

Sentiment and positioning have remained skeptical considering the size and persistence of the rally.

Via Morgan Stanley, 5 Reasons to remain Bearish:

Breadth of the rally has deteriorated since June. That’s normal after the initial surge in new bull market, but also suggests correction more likely.

School re-openings are being challenged by new COVID spikes on college campuses.

Congressional gridlock on CARES 2 fiscal stimulus package creates doubt about whether this bill can get passed in a timely fashion.

Fed’s new inflation targeting scheme in the absence of yield caps opens the door for potentially much higher back-end rates than markets are expecting once CARES 2 passes.

Election outcome likely to remain uncertain.

Goldman Sachs chief global equity strategist, Peter Oppenheimer, “10 Reasons That the Bull Market Will Resume.”

“Market Cycle. From its trough March 23 to its peak last Wednesday, the S&P 500 jumped 60%. This is the “hope” phase of a market rebound, where optimism runs the highest and the returns are the strongest. Next comes the “growth” stage, where valuations are more muted and so is the market acceleration.

Virus Vaccines’ Promise. News on their prospects is more encouraging. Goldman expects one to win regulatory approval this fall, with distribution in 2021’s first quarter.

Better Earnings Sentiment. Forecasts are for negative corporate profits for the balance of the year, but upward revisions of analysts’ estimates could give the market heart.

Low Bear Market Indicator. Goldman crunches a bunch of numbers—ranging from the yield curve to inflation to unemployment—to arrive at this figure, which it says portends high single digits for the next five years.

Washington Commitment. The Federal Reserve’s low rates and asset buying, plus a new stimulus package likely from Congress, means that “tail risk” in minimal. That is, odds are small that the economy will be allowed to tumble into the abyss.

Equity Risk Premium. This metric measures the excess return stocks need over safe Treasuries to make the risk of investing in shares worthwhile. It has been elevated for months, partly due to very low interest rates. With policymakers ensuring the economy won’t tank more, Goldman reasons, the premium should narrow, and stock investors will feel safer.

Negative Real Interest Rates. With rates so tiny, adjusting them for inflation means that fixed-income investors on the short end of the yield curve are losing money. That provides an inducement to invest money into risky assets, i.e., stocks.

Stocks as an Inflation Hedge. While no one anticipates any appreciable inflation in the immediate future, an uptick in the Consumer Price Index (CPI) would demonstrate that stocks tend to fare the best (compared with other asset classes) amid modestly rising prices.

Stocks Pay More Than Debt. Although stock dividends have fallen, it’s not as much as interest rates have dropped. “Consider,” Oppenheimer wrote, “that 60% of US companies and 80% of European companies have dividend yields above the average corporate bond yield.”

The Digital Revolution. The coronavirus has sped up existing trends, the report stated, which has driven a boom for the tech stocks. The tech names may be punished at the moment—and let’s face it, some are way overvalued—but still, “this sector is likely to remain dominant for some time to come,” the note contended.”

Source: Goldman Sachs

Source: EPFR

Airlines continue cutting flights at a breakneck pace:

Finnair will operate no more than 80 flights daily in October vs 200 planned previously.

United Airlines says capacity will fall 70% in Q3 versus 2019.

EasyJet cut its flight schedule this past week.

Ryanair expects to carry 50mln passengers this year versus 60mln forecast in July and 150mln forecast before the pandemic.

Airline industry is forecast to lose over $80bln this year.

Walmart now piloting on-demand drone delivery with Flytrex.

Walmart this week launched a pilot program to test using drones to deliver groceries and household essentials in Fayetteville, North Carolina.

Also revealed Walmart+ membership program to compete with Amazon Prime.

Slack Technologies, Inc., (NYSE: WORK), reported second quarter earnings for FY21. Software as a Service (SaaS) companies continue to perform remarkably

Total revenue was $215.9 million, an increase of 49% year-over-year.

GAAP operating loss was $68.6 million, or 32% of total revenue, compared to a $363.7 million loss in the second quarter of fiscal year 2020, or 251% of total revenue.

Over 130,000 Paid Customers, up 30% year-over-year.

87 Paid Customers with greater than $1 million in annual recurring revenue, up 78% year-over-year.

Lululemon Athletica Inc.,. (NASDAQ: LULU)

Net revenue was $902.9mln, +2% vs Q2 2019.

Direct to consumer net revenue represented 61.4% of total net revenue compared to 24.6% for the second quarter of fiscal 2019.

Company-operated stores net revenue was $287.2 million, -51% vs Q2 2019

One of the few companies that has been able to make up for lost sales from physical locations with direct to consumer sales from e-commerce.

The Kroger Co., (NYSE: KR), the grocery store operator, saw 2Q sales right 13.9% y/y versus the same quarter last year

EPS +66% versus last year.

Operating Profit of $894mln, +43% y/y

Digital sales grew 127%.

Peloton Interactive, Inc., (NASDAQ: PTON), released a new bike and strong earnings for the fourth quarter in FY20, further supporting the work(out) from home trend.

Q4 and FY 2020 ending Connected Fitness Subscriptions grew 113% to over 1.09mln and paid Digital subscriptions grew 210% to almost 317,000; total members now 3.1mln

Connected Fitness Subscription Workouts grew 333% in Q4 averaging 24.7 Monthly Workouts per Connected Fitness Subscription, versus 12.0 in the same period last year.

Q4 total revenue grew 172% to $607.1mln; FY 2020 total revenue grew 100% to $1.8bln and the company’s 12-month retention rate stood at 92%.

Nikola Corp., (NASDAQ: NKLA) the elective vehicle startup, saw shares fall almost 40% in response to a critical report produce by Hindenburg Research. The piece provides a detailed account that depicts the company and CEO (Trevor Milton) as a fraud.

The report, released Thursday, detailed “dozens of lies” about the company’s products, partnerships, and capabilities. It cited internal emails, analyzed photos, and dispatched an investigator to Utah to replicate the company’s demo video

Two days prior to Hindenburg Research, GM announced it is taking an 11% stake in Nikola and will engineer and build its Badger pickup, as well as supply vital battery and fuel cell technology. GM has since publicly stated: “We are fully confident in the value we will create by working together.”

If the accusations made by Hindenburg prove to be true, it may pose a threat to the EV market and the recent popularization of Special Purpose Acquisition Companies (SPACs). Nikola went public in June through a SPAC and others are starting to follow suit-- Canoo, Lordstown Motors, and Fisker have all announced SPAC deals in recent weeks.

GEOPOLITICS

This week, the UK government published details of its Internal Market Bill which would give the country the power to overrule some issues that were agreed upon in their Withdrawal Agreement negotiated with the European Union last year. If the bill is approved by parliament, these violations of the Withdrawal Agreement would risk a collapse between the EU-UK negotiations which would lead to a, “no deal” Brexit. The two parties have until January to ratify a deal otherwise the UK will be subject to significant WTO tariffs after it leaves the EU.

The tumult led to a 3% decline by the GBP versus the euro, the pound is now at its lowest levels versus the euro since March.

UK Prime Minister Boris Johnson has said the government will walk away from negotiations if no deal is reached by October 15.

The EU has warned the UK that it cannot change the terms of the Withdrawal Agreement.

Why does this matter? In 2019, 43% of the UK’s exports went to the EU, and 51% of the UK’s imports came from the EU.

The UK accounts for 6% of Germany’s exports, 7% of France’s, 8% of the Netherlands, 6% of Spain and 10% of Ireland.

Source: FT

On September 14th, Prime Minister Shinzo Abe’s party, the Liberal Democratic Party (LDP), will hold elections to replace Abe as its leader.

The party decided on Tuesday to hold a scaled-back leadership vote that will not include rank-and-file members.

Yoshihide Suga is the favorite to emerge as the next Prime Minister of Japan.

ByteDance Ltd., owner of TikTok, intends to submit a proposal to the White House for approval before the deadline set by the Trump administration for the company’s acquisition.

Negotiations continue between Microsoft Corp and Oracle Corp with a target date for a preliminary agreement by Sept. 20 and a completed sale by December.

On Friday, Reuters reported that the Chinese government has privately disclosed that it would rather ByteDance close TikTok in the U.S. than be forced to sell its US assets. TikTok refuted that rumor, “the government has never suggested to us that we should shut down TikTok in the U.S. or any other market.”

PUNDITRY

Tobias Levkovich, Citigroup, “The Four Key Issues Investors Want Resolved.”

The outcome of the US Election.

The S&P 500 fell 11%, from peak to trough, in the month of Bush v Gore uncertainty.

Will there be more fiscal stimulus and if so, when?

Can effective vaccines and improved therapeutics be approved and distributed in timely fashion?

Will money flow into stocks?

Tracking the Recovery in Charts, from Macquarie Bank:

India and Brazil’s power consumption back to normal despite rising new cases:

Source: Morgan Stanley

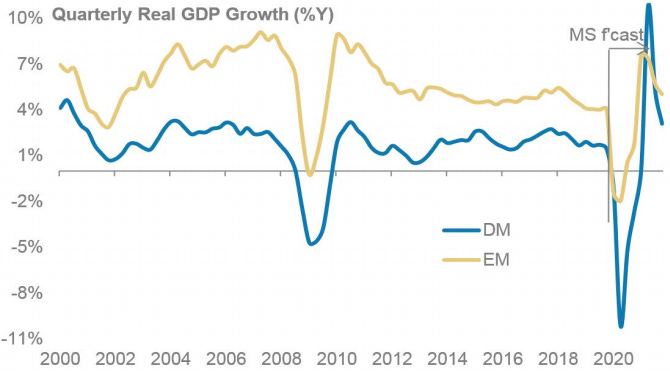

Monthly Perspectives Charts, via Morgan Stanley

Deepest Recession Since WWII, but Potentially the Sharpest Recovery, Too:

Fiscal Policy Response Much Greater Than During Great Depression or GFC:

Fiscal deficit in G4 and China to widen to levels not seen since the GFC:

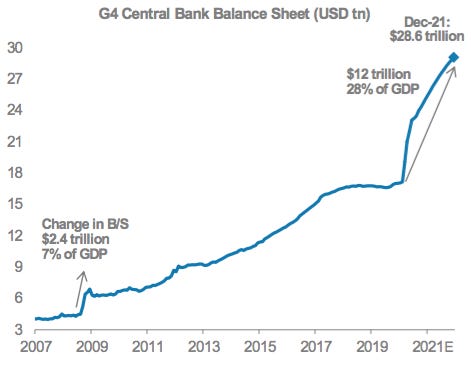

Monetary Policy Also at Unprecedented Levels and 50% Greater Than GFC:

In this cycle, the Fed's balance sheet will expand by more than during QE1, 2 and 3 combined:

While Policy Is a Primary Driver of Markets, it’s Also Driving Earnings Revisions:

Economic Data Surprises Have Surged Higher in V-Shaped Fashion:

The Divergence Between Disposable Income and GDP Explains a Lot …

… Which Explains How Retail Sales Are at All-Time Highs:

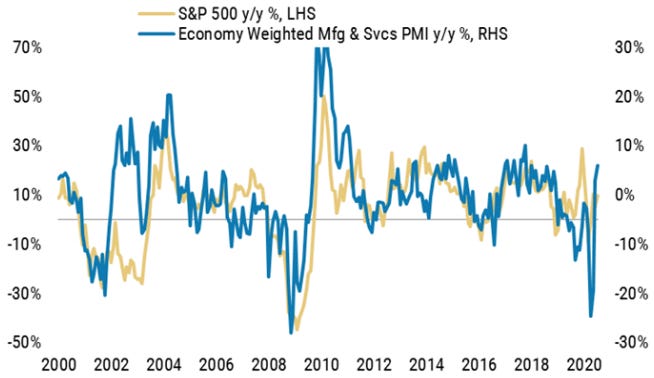

PMI Rebound Supports the Move in Stocks at a High Level Unlike 4Q19 & Earnings Revisions:

Retail Call Buying in FAANG+ Stocks Explains Past Few Months.

US non-financial private sector debt is stable, financial sector debt is lower coming into 2020:

We Would Expect Financials to Outperform if 10-Year Treasury Yields Rise:

Feedback

Thank you for subscribing to the Primary Dealer Review. If you have any feedback on the content or format, or have any questions, please email me directly at primarydealerreview@gmail.com and I will get back to you.

Do you know someone who would like to receive this publication? Please feel free to share the Weekly Macro Summary with them.

Legal Information and Disclosures

This weekly summary expresses the views of the author as of the date indicated and such views are subject to change without notice. The author has no duty or obligation to update the information contained herein. Further, the author makes no representation, and it should not be assumed, that past investment performance is an indication of future results.

Moreover, wherever there is the potential for profit there is also the possibility of loss.

This weekly summary is being made available for educational purposes only and should not be used for any other purpose. The information contained herein does not constitute and should not be construed as an offering of advisory services or an offer to sell or solicitation to buy any securities or related financial instruments in any jurisdiction. Certain information contained herein concerning economic trends and performance is based on or derived from information provided by independent third-party sources.

The author believes that the sources from which such information has been obtained are reliable; however, it cannot guarantee the accuracy of such information and has not independently verified the accuracy or completeness of such information or the assumptions on which such information is based.

This weekly summary, including the information contained herein, may not be copied, reproduced, republished, or posted in whole or in part, in any form without the prior written consent of the author.