THIS IS NOT INVESTMENT ADVICE.

Please speak with a registered investment advisor or other qualified financial professional before making any investment decisions.

Commentary

The dog days of summer are here but third quarter GDP probably received a significant boost this past week from a combination of the housing market and durable goods orders. The most important news of the week, however, was the Fed’s newly adopted goal of an average 2% inflation target. While the timing was a little earlier than expected, The Fed has been reviewing its monetary policy framework and how best to achieve its dual mandate for nearly two years. While the news had been well telegraphed, and the concept implicitly adopted in the recent past, the importance of the shift is the Fed’s formal commitment to the policy. The Fed has in effect admitted that they were too focused on inflation and not focused enough on the employment market. They may be conceding that the rate hike cycle from 2015 - 2019 may have been premature.

Chart of the Week

Source: Bank of America

If you would like to receive this macro summary directly to your mailbox every Sunday please subscribe. It’s free.

ECO DATA

Atlanta Fed GDP Now is currently tracking at 28.9% for Q3 up from 25.6% from last week.

New York Fed GDP Now cast is currently at 15.3% up from 14.6% last week.

Goldman Sachs: Reopening at a Glance

Economic data released, relative to expectations, has been the strongest in at least 11 years!

Source: Ed Yardeni

New home sales in July +901k annualized, the best since Dec 2006. Up from 791k in June.

Recall last week that we highlighted that the housing market shows no end in sight to the strength, this continues that string of remarkable data.

Overall sales +13.9% in July after +15% in June.

The median price of a new home is up 7% versus last year after the US FHFA home price index increased 0.9% in June and reached an all time high.

Inventories of new homes for sale are near record lows, expect residential investment component of GDP to increase significantly in Q3.

Source: Wells Fargo

Initial claims fell to 1.0mln down slightly from last week’s 1.1mln and in line with the consensus estimate.

Continuing claims down to 14.54mln from 14.76mln last week.

The underlying trend still seems to be falling but more slowly.

Durable goods order spike +11.2% in July versus expectations of +4.3%.

Third consecutive monthly spike after March and April collapsed -17% and -18% respectively.

Core capital goods orders +1.9% and in line with expectations.

Ex-transportation orders +2.4%, also in line with expectations.

Computers and communications orders are now above their February levels.

Orders for machinery and metals also recovering sharply.

This strong data will add 0.2 to 0.3 percentage points to Q3 GDP estimates.

If the data stays flat from August to September, real capex for the third quarter will have jumped 23% for the quarter, on an annualized basis.

Source: JP Morgan

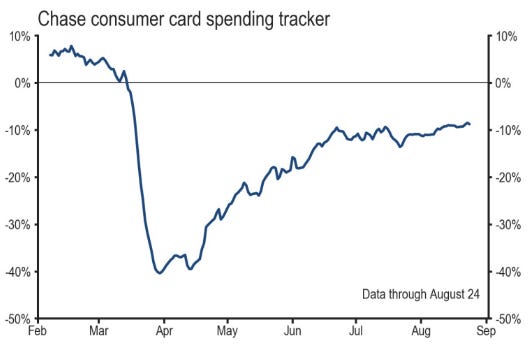

US Personal Income +1.4% in July, Consumer spending: +1.9%, disposable income: +0.2%.

Compensation of employees, +1.3% in July, was the main contributor to the increase in income as portions of the economy continued to reopen.

Gains in proprietors’ income and rental income of persons.

However, government social benefits and income on assets fell.

Source: Chase

Source: Oxford Economics

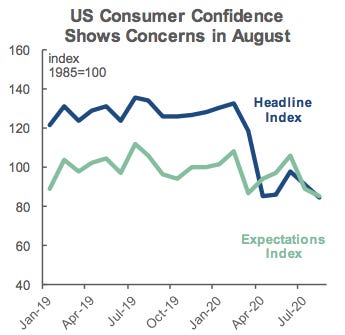

US consumer confidence in August 84.8 vs 93 expected and 91.7 prior.

“Present Situation Index – based on consumers’ assessment of current business and labor market conditions – decreased sharply from 95.9 to 84.2.”

“The Expectations Index – based on consumers’ short-term outlook for income, business, and labor market conditions – declined to 85.2 from 88.9”

“Consumer spending has rebounded in recent months but increasing concerns amongst consumers about the economic outlook and their financial well-being will likely cause spending to cool in the months ahead.”

Source: Scotiabank

Chinese Industrial profits +19.6% y/y in July up from 11.5% in June.

For the year industrial profits are down 8% y/y.

Last week we highlighted China's attempt to transition to new economic drivers of growth and internalizing many high tech and other modern economic sectors.

Equities tied to old line industrial sectors are mostly down double-digits for the year implying they see a much weaker recovery for Chinese industry than economic forecasts suggest.

Source: Macquarie

Capital One Financial (COF) is cutting borrowing limits on credit cards.

COF is third largest credit card lender in the country.

Anecdotes found online shows some customers have seen their limits slashed by 1/3 to 2/3.

This all comes as enhanced unemployment benefits are being cut and Congress has reached an impasse as to how they will proceed with further stimulus measures.

Source: Pictet Asset Management

CENTRAL BANKS

As expected, the US Federal Reserve adopted a new strategy to achieve 2% inflation on average over a period of time by allowing for intentional overshoots of the 2% target during expansions when inflation falls short of the goal (See last week’s deep dive for reference).

The new framework is being called, “flexible average inflation targeting” that permits inflation to rise “moderately above 2% for some time.”

Inflation has averaged 1.5% over the past 10 years which indicates that the Fed is about to embark on a period of accommodating interest rates for the foreseeable future.

In a Bloomberg TV interview, Dallas Fed President Kaplan said it may take a while to get to the 2% inflation target.

This should lead to a more dovish policy implementation because the Fed is acknowledging that they have been too focused on inflation rising when unemployment gets too low and because this permits them to allow the labor market to “run hot” because “employment can run at or above real-time estimates of its maximum level without causing concern”.

By delivering the new framework in August at the Fed’s annual Jackson Hole conference, it gives the Fed the flexibility to provide new forward guidance for the Fed Funds rate in conjunction with the new framework.

Some would argue that this all simply makes official what the Fed has implicitly doing for much of the recent past.

FIXED INCOME, CURRENCIES, COMMODITIES

On Wednesday (8/26) New York City issued a 10 Year municipal bond at a yield of 1.45%.

The city received about $1.9 billion of orders, approximately twice the amount of money they were looking to raise. $1.7bln of bids were from institutions and $200mln from individual investors.

Source: Refinitiv

Germany’s Treasury announced the issuance of green ‘twin bonds’, aimed at increasing investor participation in the sustainable finance market and to raise funds for emissions reduction projects.

The German Treasury expects volume up to €12bn in Green securities.

The concept aims to make the still marginalised green bond market more attractive by allowing larger institutional investors to switch to the conventional market if deemed necessary for liquidity purposes.

Brent Crude settled this week at a 5-month high of $45.81.

Hurricane Laura hit the Louisiana coastline Thursday morning around 1am.

The refineries in Southeast Texas avoided the eye of the storm, allowing production to quickly restart.

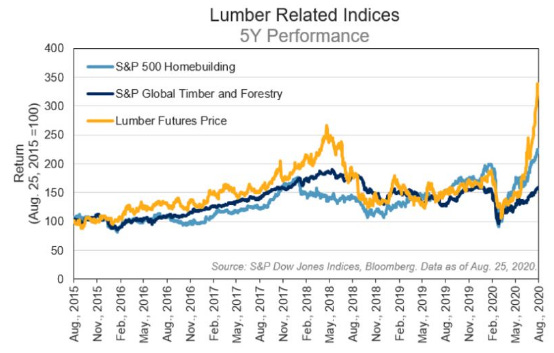

Lumber has surged nearly 80% this year on the CME as home construction and renovation spending surges. It has been one of the year’s best performing commodities.

Price settled at an all time high of 916.30 per thousand board feet.

“There’s no question prices are not sustainable at this level, and if I’m a mill, I’m selling into this rally through futures.” -Paul Quinn, RBC Capital Markets

While volume on Lumber contracts are thinly traded, inventories remain low, with most mills are sold out almost through September, and the Atlantic hurricane season poses risk to second-half production in the U.S. South, adding to a bullish case, Quinn stated.

"This trend may be short-lived and primarily fueled by Covid shutting down lumber mills” -DataTrek Research

Source: Chris Bennett, S&P Global

Source: Bank of America

Source: Bloomberg

Fidelity Investments announced the launch of the first ever Bitcoin fund, through their new business unit Fidelity Digital Funds, led by Peter Jubber, head of Fidelity Consulting. The fund ‘Wise Origin Bitcoin Index Fund I, LP’ has yet to announce its investing approach and has not raised capital at this time but this announcement is good news for the crypto market as larger firms add to the legitimacy of the space.

The fund will be a passively-managed, Bitcoin-only fund and it will be made available to qualified investors through family offices, RIA’s, and other institutions, with a minimum investment of $100,000.

Bitcoin is the world’s largest cryptocurrency, up roughly 60% this year and now trading around $11,500, although it is still off its highs from 2017 by about 40%.

Source: Bloomberg

EQUITIES

While the S&P 500 ascends to record highs, according to AAII less than a third of investors surveyed are bullish

Source: Bespoke Investment Group

Via Bespoke Investment Group: “So far this year, the 50 largest stocks in the S&P 500 are up an average of 11.3% YTD, and if we were to take an even narrower look at just the ten largest stocks heading into the year, the average YTD gain is over 27%!”

The next 400 stocks in terms of market cap are down an average of 2%.

The 50 smallest stocks in the index are down an average of 15.3% for the year and over ⅔ of them are down.

Source: Bank of America

Source: Bank of America

Source: Bank of America

Abbott Laboratories jumped 7.9% after the company won U.S. approval to market a cheap, portable, rapid COVID-19 antigen test. This looks like it is a game changer for COVID testing protocols.

FDA granted emergency use approval late Wednesday to Abbott for its new coronavirus antigen test, estimated to cost about $5 each.

First Covid diagnostic test that can be performed without an analyzer machine. The test results are read directly from the testing card.

Provides results in about 15 minutes and does not require a lab

The Trump administration plans to announce Thursday the purchase of 150mln rapid COVID-19 tests as part of a $750mln agreement with Abbott Labs.

Abbott stated it will “ship tens of millions of tests in September, ramping production to 50mln tests a month in October”.

Salesforce.com, inc. (CRM) shares rallied more than 25% on earnings significantly higher than expectations.

CRM is one of the largest global providers of cloud-based customer relationship management services.

Actual adjusted EPS of $1.44 vs analyst expectations of $0.67.

Revenue at $5.15bln for the quarter vs $4.9bln expected.

Approx. $3.6bln in revenue from Americas, $1.1bln from EMEA, and $0.5bln from APAC.

Overall revenue growth of 29% YoY.

All of this was realized while increasing operating margins.

Raised FY 2021 revenue to $20.7bln to $20.8bln, representing a 21% to 22% growth YoY.

For perspective on the company’s (and sector’s) tremendous growth consider that as recently as 2016 their full year revenues were $8.4bln.

Workday, Inc. provider of cloud-based enterprise management services for human resources and financial management.

Actual adjusted EPS of $0.84 vs $0.66 expected .

Revenue at $1.06bln vs $1.04bln expected, representing a 20% increase YoY.

Expected to continue to see growth as companies navigate through COVID-19 and the large shift in employees who are working from home.

Dick’s Sporting Goods, Inc. The largest sporting goods and apparel chain in the United States.

Adjusted EPS of $3.21 vs $1.30 expected.

Revenue at $2.71bln vs $2.46bln expected, Net sales increased 20.1% YoY, Same-store sales were up 20.7%.

Online sales were up 194%, representing 30% of total revenue for the quarter - compared with about 12% a year ago.

Management highlighted how health and fitness has become more important to many Americans during COVID. It is to be seen whether or not this is a sustainable shift or just temporary.

Dick's is also benefiting from greater participation in outdoor activities where social distancing can be maintained. Management said they have seen these trends continue into the 3rd quarter.

Dollar General Corp. posts better-than-expected second-quarter earnings.

Actual EPS of $3.12 vs $2.47 expected.

Revenue at $8.68bln vs $8.4bln expected, representing a 24.4% increase YoY.

Same-store sales were up 18%.

16,720 stores open at the end of July, up from 15,836 open as of August 2, 2019.

Repurchased common stock reached $602mln, authorized an additional $2bln on Wednesday.

WalMart Inc. teams up with Microsoft on TikTok bid. If that seems unusual to you, you’re not the only one.

Walmart would like for it to play a key role for its future online presence and better suit it to compete against other online retail giants like Amazon.

TikTok is reportedly seeking a purchase price of $30bln

Kevin Mayer joined TikTok as CEO less than 3 months ago and just announced he is stepping down. The strategy behind his hiring at the company was to convince US regulators that concerns about the company’s Chinese ownership were overblown. The departure suggests that TikTok is resigned to it’s fate in America.

Exxon Mobil Corp, the longest-serving member of the Dow, was removed from the index after seeing its value plunge by more than half in the past six years, from more than $450bln as recently 2014 to about $180bln on Monday.

Pharmaceutical company Pfizer Inc. and aerospace and defense manufacturer Raytheon Technologies Corp. were also removed from the index making way for Salesforce.com, a cloud computing company, Amgen Inc., a biotechnology firm and Honeywell International, an aerospace and industrial manufacturer

Unlike other indexes like the S&P 500, the Dow weighs its stocks by price rather than market cap. Because of its weighing convention, the Dow is not a commonly used index when it comes to benchmarking.

So what? The decision to bring in new heavyweights reflects shifts in the economy and the technology sector’s massive growth we have seen in recent years continuing its dominance in market leadership.

Short positions in U.S. stocks dropped to their lowest level since Goldman began tracking back in 2004.

Short interest as a proportion of market capitalization for the median stock in the S&P index feel to 1.8%. The average of the past 15 years has been 2.4%.

Source: WSJ

American Airlines to shed 19,000 workers on Oct. 1, as CARES act’s payroll support ends on 9/30.

107,000 full-time employees as of June 30th, expects they will have 40,000 fewer employees on October 1 after accounting for temporary leaves, retirements and mandatory reductions.

Will operate less than 50% of flights in Q4 vs. same quarter in 2019.

Delta also said it would furlough 1941 pilots.

Recall that United sent notices to 36,000 employees whose jobs were possibly at risk although final cuts have not yet been made.

Interesting data point of the week: Apple’s stock price rally over the past two months has now made it 30% larger than the next largest stock in S&P 500 index.

Source: YCharts

An important consideration: while many pundits claim that stock prices are rallying irrationally, underneath the surface the market is rewarding companies who are performing well in the current environment and punishing those who are not

Source: Renaissance Macro

GEOPOLITICS

On Friday, news came out that Japan's longest ever serving Prime Minister, Shinzo Abe, would be stepping down due to health issues. His plan is to serve out the remainder of his term which has 12 months until completion.

His rise to power and "3 arrows of reform" have been a groundbreaking monetary and fiscal experiment to help break Japan's economy out of a decades long deflation.

His strategy was a catalyst behind the Yen's 65% depreciation versus the US dollar over a period of several years starting in 2012 which made the country's exports more competitive, pricing-wise, on a global level.

Results of his bold strategy which blurred, the lines between fiscal and monetary policy, were mixed but did serve to end the Yen’s persistent strength and the country’s decades long decline in inflation.

Abe’s tenure brought an unprecedented degree of stability in politics and policy predictability to the country.

While the base case, and most likely outcome, is for the transition to result in a continuation of existing policies, any significant changes in policy by a new administration will have dramatic market and economic impacts, not just in Japan but also across Asia. That’s why this is one of the most important stories in the world right now.

Turkey-Greece tensions escalate over Turkish Med drilling plans.

Both countries are planning rival naval exercises off Crete over energy claims in the Eastern Meditterranean

Turkey put out a naval alert back in July sending its Oruc Reis research ship to carry out a drilling survey close to the Greek island of Kastellorizo - prompting alarm in the Greek military.

Two rival warships from Turkey’s TGC Kelmareis and Greek navy’s Limno frigate collided August 12, 2020 as both sides shadowed the Oruc Reis.

Recent developments from Turkey on its decision to begin drilling to the west of Cyprus has led to escalated tensions from EU members Greece and Cyprus.

“Everyone should accept that Turkey and the Turkish Republic of Northern Cyprus cannot be excluded from the energy equation in the region,” - Turkish Vice-President, Fuat Oktay.

On August 6, Greece and Egypt created a deal forming an exclusive economic zone that would cancel out the Turkish agreement with Libya.

On August 12, French president Emmanuel Macron decided to “temporarily reinforce” France’s military presence backing Greece “in order to better monitor the situation [...] and to ensure that international law is respected.”

EU foreign ministers are scheduled to discuss the developments in the Eastern Meditterranean at an informal meeting in Berlin this week.

U.S. Trade Representative Robert Lighthizer, U.S. Treasury Secretary Steven Mnuchin and Chinese Vice Premier Lui He reaffirmed their commitment to a Phase 1 trade deal, which has seen China lagging on its obligations to buy American goods.

The U.S. exported $7.27bln in farm goods to China through June, according to the U.S. Census Bureau. This is far behind the $36.5bln commitment worth of U.S. agricultural goods under the Phase 1 agreement.

China bought only 5% of the targeted $25.3bln in energy products from the U.S. through June.

On Wednesday, the Trump administration added 24 Chinese companies to a trade blacklist for helping China build islands in the South China Sea, a construction program the U.S. has labeled an illegal attempt to control an important shipping route.

The Entity List now includes more than 300 Chinese entities and bars U.S. companies from exporting products to this list of companies without a government license.

SPECIAL SECTION: LIBOR Transition to SOFR (2021)

What is LIBOR?

London Interbank Offered Rate

Benchmark for short-term interest rates, ranging from overnight to 1 year, across different currencies

Reference rate for financial contracts and as a benchmark to gauge funding costs and investment returns for a broad range of financial products (i.e. adjustable-rate mortgages, credit cards, floating-rate bank loans).

Each day a group of large banks, known as panel banks, report their funding rates to the Intercontinental Exchange Benchmark Administration (IBA). Numbers are averaged, adjusted and released at approximately 11:45 a.m. London time each business day.

What is SOFR?

Secured Overnight Funding Rate

A median of rates that market participants pay to borrow cash on an overnight basis, using Treasuries as collateral

The Fed began publishing SOFR in 2018

What is the difference?

SOFR relies entirely on transaction data, whereas LIBOR is based partially on market-data “expert judgment."

SOFR is purely a daily rate—what’s called an overnight rate—vs. LIBOR's seven varying rates on terms of one day to one year.

LIBOR incorporates a built-in credit-risk component because it represents the average cost of borrowing by a bank. SOFR represents a “risk free” rate because it is based on Treasuries.

Survey measure (LIBOR) vs. actual transactions (SOFR).

Why the transition?

Old methodology. Decline in sample size for calculating LIBOR since the 2008 financial crisis means fewer panel banks have been reporting, and those that do are reporting fewer transactions. Instead, LIBOR has increasingly relied on what the IBA calls "market and transaction data-based expert judgment."

What is the potential impact?

Other countries are introducing their own local-currency-denominated alternative reference rates for short-term lending, but SOFR is expected to supplant USD LIBOR as the dominant global benchmark rate.

To account for differences, regulators are encouraging institutions to include “fallback" clauses in all new contracts that will address calculation differences, though many older contracts may not have these clauses.

Valuation differences are likely to arise, particularly for interest rate swaps and derivatives.

Legacy non-agency residential mortgage-backed securities (RMBS) are the most exposed, since most reference LIBOR.

The move could also pose challenges for how lenders communicate rate changes to borrowers. Because SOFR is an overnight rate—vs. varying terms for LIBOR—lenders will need to estimate interest rates for consumers using a prior compounding period.

For those with adjustable rate loans or lines of credit based on LIBOR there will likely be an early change to another index in anticipation of LIBOR’s discontinuation, the impact will vary between providers.

It's too early to estimate how the transition from LIBOR to SOFR will impact earnings for U.S. Banks. Morgan Stanley analysts believe that banks first need a functioning SOFR derivatives market to enable the hedging required to manage their balance-sheet risk.

BANK OF AMERICA: Tracking the Economic Recovery, in Charts

Feedback

Thank you for subscribing to the Primary Dealer Review. If you have any feedback on the content or format, or have any questions, please email me directly at primarydealerreview@gmail.com and I will get back to you.

Do you know someone who would like to receive this publication? Please feel free to share the Weekly Macro Summary with them.

Legal Information and Disclosures

This weekly summary expresses the views of the author as of the date indicated and such views are subject to change without notice. The author has no duty or obligation to update the information contained herein. Further, the author makes no representation, and it should not be assumed, that past investment performance is an indication of future results.

Moreover, wherever there is the potential for profit there is also the possibility of loss.

This weekly summary is being made available for educational purposes only and should not be used for any other purpose. The information contained herein does not constitute and should not be construed as an offering of advisory services or an offer to sell or solicitation to buy any securities or related financial instruments in any jurisdiction. Certain information contained herein concerning economic trends and performance is based on or derived from information provided by independent third-party sources.

The author believes that the sources from which such information has been obtained are reliable; however, it cannot guarantee the accuracy of such information and has not independently verified the accuracy or completeness of such information or the assumptions on which such information is based.

This weekly summary, including the information contained herein, may not be copied, reproduced, republished, or posted in whole or in part, in any form without the prior written consent of the author.