THIS IS NOT INVESTMENT ADVICE.

Please speak with a registered investment advisor or other qualified financial professional before making any investment decisions.

Commentary

We are approaching the heart of earnings season. As of this writing, a little over one-quarter of S&P500 companies have reported their Q3 results. Results are off to a remarkably good start. According to Factset, "The percentage of S&P 500 companies beating EPS estimates for the third quarter and the magnitude of the earnings beats are at or near record levels." 84% of companies have beat EPS estimates and 81% of companies have beat revenue estimates. In aggregate, earnings and revenues have come in 17% and 3% ahead of expectations, respectively. However, the most important news of the week for us was from the housing market. New home sales, existing home sales, building trends, and inventory levels all demonstrate a market and dynamic that shows no end in sight. We’ve stated that housing is arguably the most important data point to watch in order to measure COVID’s impact on the economy as well as prospects for a recovery. Had housing not bounced back as strong as it has, it would have represented a big, red, warning signal for us about the prospects for the US economy and potential for a quick recovery. The reason being that there is a significant secular demographic tailwind driving the housing data. Coming out of the global financial crisis, household formations in the US were below historical averages for many years. It is only recently that the data has approached the historical average levels but the magnitude of the shortfall from 2008 - 2016 left an extraordinary amount of pent-up demand that still exists. Home building stocks have responded, the iShares US Home Construction ETF (Ticker: ITB) is up 28% this year versus 9% for the S&P500. Despite the significant performance this year, a basket of home building stocks that we follow have a current P/E ratio of 11 versus the S&P500’s forward P/E ratio of approximately 21. Household formations, and the resulting need for housing, may mean that the trend still has many years to run. We wonder, given the valuations, if the underlying stocks may have many years to run as well.

Chart of the Week

Source: Citigroup

If you would like to receive the Weekly Macro Summary directly to your mailbox every Sunday, please subscribe. It’s free.

ECO DATA

Atlanta Fed GDPNow is currently tracking at 35.3% for Q3, up slightly from 35.2% last week.

New York Fed GDP Nowcast stands at 13.75% for Q3, down slightly from 13.79% last week.

NAHB/Wells Fargo Housing Market Index reaches all time high of 85.

Source: Wells Fargo

China Q3 GDP up 4.9%y/y which is lower than 5.5% consensus expectation. While the GDP data was disappointing, some other measures of data released point to a more positive outlook for Q4.

September retail sales +3.3%y/y vs +1.6%y/y consensus. The month-over-month rise was a solid +2%.

Industrial production rose 0.9%m/m for September and Fixed Asset Investment grew over 8%y/y.

Container shipping rates from China to the US’s west coast are up over 60% versus last year.

Rates are being driven higher because American companies are looking to re-stock depleted inventories ahead of the holiday season.

Earlier this year, many scheduled routes had been cancelled because of country decisions to close borders in response to the pandemic.

Initial US Jobless Claims 787k this past week versus 875k expected.

This marks the lowest total since the early days of the pandemic, representing a 55k decline from last week’s reversed level.

The 4 week moving average for claims falls to 811k, the lowest since March.

One reason for this decline has been the migration of workers who have exhausted their regular benefits and have moved to the Pandemic Unemployment Assistance benefits program.

Individual claims for this program totals 3.3mln for the week ending October 3rd.

Continuing claims for unemployment insurance dropped 1.02mln to 8.37mln

Source: JP Morgan

Source: Macquarie Bank

September’s Conference Board Leading Economic Index rose 0.7% in September, following increases of 1.4% and 2% in August and July, respectively

Equity market strength is helping to keep the index rising but slowdowns in reopening activity and hiring are limiting the gains in the index.

US September Existing Home Sales +9.4%m/m to 6.54mln, the highest level since May 2006.

This marks the fourth straight monthly increase.

Median price of an existing home sold in September was $311,800, +15% y/y.

Inventory of homes for sale -19% y/y to 1.47mln homes for sale, representing a 2.7-month supply.

This is the lowest since the realtors began tracking this metric in 1982!

Regionally, existing home sales rose in all four of the country’s regions

71% of homes sold in September and were on the market for less than a month.

Source: Citigroup

Source: Macquarie Bank

US single-family homebuilding confirms the strength in home sales. Single-family housing starts +8.5%m/m to 1.08mln units in September, the highest since June 2007.

Single-family building permits and completions +7.8%m/m and +2.1%m/m, respectively.

Overall housing starts +1.9%m/m.

“The relative strength of single-family construction compared to multifamily units could partly reflect a shift in housing demand away from multifamily structures in more densely populated cities and towards sing-family units in [...] less populated areas” -Citigroup

US Markit Manufacturing PMI (October Flash) 53.3, in line with expectations.

Services PMI was 56 vs 54.5 expected.

Employment expectations have been lower for two consecutive months but despite the recent weakness overall economic expectations continue to rise.

Source: JP Morgan

Data from JPMorgan Chase reveals an interesting spending pattern difference among employed vs. unemployed households receiving unemployment benefits.

From April to August households receiving unemployment benefits (i.e. $600 weekly supplement) were spending more per capita than employed households.

Spending was defined as the “...sum of debit card and credit card outflows, cash withdrawals, and a subset of electronic outflows from checking accounts…”

Source: JP Morgan

Goldman Sachs Consumer Spending Tracker

Source: Goldman Sachs

Source: JP Morgan

CENTRAL BANKS

Central banks at a panel discussion hosted by the International Monetary Fund on evaluated the merits of central bank digital currencies (CBDC) this past week.

Federal Reserve Chairman, Jerome Powell: “Given the dollar’s important role globally, it’s essential that we remain on the frontier of research and policy development. The dollar is the world’s principal reserve currency and there continues to be large global demand for Federal Reserve notes.”

Efforts surrounding the research and development of a CBDC in the US have taken place with the Federal Reserve Bank of Boston announcing back in August that it was actively collaborating with MIT’s Digital Currency Initiative to explore more than 30 different blockchain networks.

ECB President Christine Lagarde discussed on Monday at an interview the high likelihood of lost momentum in the euro area recovery due to the recent rise in COVID-19 infections. The recent economic weakness and language from the ECB has led market participants to expect more action from the central bank to support the region in the coming weeks

“The second wave of the epidemic in Europe, particularly in France, and the new restrictive measures that accompany it add to uncertainty and weigh on the recovery”

The ECB has estimated that GDP in the eurozone will fall by at least 8% due to the pandemic.

Similar to the Fed’s promise of providing prolonged economic support, the ECB has made it clear that they expect to keep the rates accommodative for a long time to come and are ready to provide more monetary stimulus if required

EU leaders reached a €1.82tln budget and €750bln COVID-19 recovery package back in July.

Turkey’s Central Bank left its benchmark interest rate unchanged at 10.25% this week.

The market had been expecting a rate hike. The surprise inaction left the currency weaker. For the year is the worst performing currency that we follow driven by a combination of geopolitical concerns, economic mismanagement, and political influence over the central bank

FIXED INCOME, CURRENCIES, COMMODITIES

Global equity markets are seeing a flood of electric-vehicle companies being listed that have no current revenue.

“Never before have so many companies with no revenue pursued a public listing at such high valuations” -University of Florida finance professor Jay Ritter.

Investors are making big bets on revenue projections for electric vehicle companies as they flood the markets through Special Acquisition Companies (SPACs), allowing companies to sidestep traditional IPOs.

Professor Ritter’s work shows that the average three-year return for companies that go public with valuations of $1bln+ and no revenue is -41%.

Companies like Nikola Corp. have benefited from the excitement. At its recent peak, Nikola’s valuation surpassed $30bln, making it worth more than Ford despite having never produced a single car and relying on General Motors for manufacturing and assembling its first vehicle when produced.

The company’s shares are down 75% from their intraday high achieved shortly after its IPO in June

The anticipated boom in EV production is set to completely upheave the landscape for commodities used in the production of the cars over the next 10 years. Demand is forecast to rise dramatically for all the battery commodities required.

The primary commodities to be impacted are cobalt, copper, lithium, nickel, manganese.

EVs already account for 41% of global lithium demand.

For nickel, EV market share of global demand was 3% in 2020 and is forecast to rise to 26% by 2030.

For copper, EV market share of global demand was 2.4% today and is forecast to rise to 9.4% by 2030

Source: University of Florida, Jay Ritter and SPAC Research

Commercial loans outstanding have dropped significantly, a sign of strength for big corporations

The driver of the decrease in debt has been companies willingness and ability to repay loans tapped at the start of the pandemic.

Combined commercial loans at JPMorgan, Citigroup Inc. and Bank of America Corp. (the biggest commercial lends) have dropped by over 10% from Q1 levels.

The Federal Energy Regulatory Commission (FERC) proposed a plan to introduce a US carbon tax in a landmark step towards reducing greenhouse gas emissions.

Carbon taxes have been generally unpopular but the recent proposal has bipartisan support. The goal is to incentivize consumers and companies to switch to renewables.

If passed, expect an important structural shift toward renewables similar to Germany’s ongoing transition, the Energiewende. Carbon pricing has been a pivotal catalyst for Europe’s transition toward low-carbon energy production.

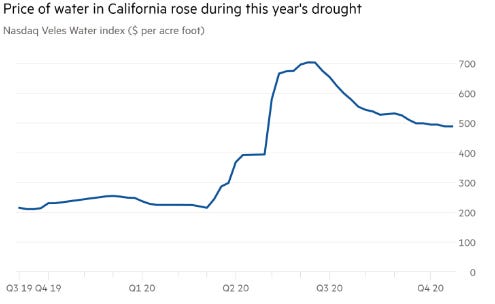

As discussed on the September 20th edition of the Weekly Macro Summary, Water futures are set to debut on the CME. We are following up with some finer details.

Contracts to be tied to the Nasdaq Veles California Water index.

Localization means that the contracts may be hard to trade. Predicted to be a very small market given that this is highly regional.

Contracts will be financially settled, traders will not be taking physical delivery and will not be able to stockpile water or forward-buy. No forward-buying means that farmers may have difficulty hedging for a drought.

Water futures are a bit controversial as a number of critics are “uneasy with such a basic resource becoming a speculative financial-market asset, fearing that trading, which would not be restricted to industrial users, could distort water prices for everyone.”

When considering government subsidies that vary from region to region, it is unlikely that these California water futures will be a strong hedge against water prices in other places.

Water futures (presently) do little to address the water scarcity problem and will act as more of a speculative investment tool (vs. Carbon Credits’ aim to cut down on emissions).

Source: FT

EQUITIES

Q3 earnings are off to a good start. As of this writing, a little over a quarter of S&P500 components have reported Q3 results thus far.

Factset: "The percentage of S&P 500 companies beating EPS estimates for the third quarter and the magnitude of the earnings beats are at or near record levels."

84% have beat EPS estimates versus a 5-year average of 73%

In aggregate, earnings have come in 17% ahead of expectations versus a 5-year average of 5.6%.

81% have beat revenue estimates versus a five-year average of 61%

In aggregate, revenues have come in 3% ahead of expectations versus a five-year average of 0.7%.

While the earnings and revenue figures reported have been strong relative to expectations, they are still down 16% and 3% (respectively) versus last year due to the impact the pandemic has had on companies’ earning ability.

The information technology sector has been a bright spot with +10% y/y growth in for Q3 thus far confirming the market’s preference for tech throughout 2020

Texas Instruments, (NASDAQ: TXN) revenue of $3.8bln ahead of consensus estimate of $3.44bln.

EPS $1.45 ahead of the top-end of forecasts from the company and street’s $1.28 expectations.

"Notable strength from the rebound of automotive demand and growing demand from personal electronics.”

Tesla, (NASDAQ: TSLA) Reported a rise in sales and profit for the 3Q20.

Revenue $8.77bln vs $8.26bln expected.

EPS $0.76 vs $0.55 expected.

The three months ending in September car deliveries were 139,300, a 40% increase,versus a year ago to 139,300

Tesla’s goal is 500,000 cars delivered for 2020, company needs to deliver approximately 180k cars in Q4.

Q3 sales of pollution credits were $397mln and YTD pollution credit sales are now $1.18bln, double the total for all of 2019. Without the profit from selling regulatory sales credits, Tesla would not have achieved a profitable quarter.

Intel Corp., (NASDAQ: INTC), Fell 12% after third quarter results that were inline with expectations.

EPS $1.11 a share vs the consensus of $1.10, a +85 basis point surprise. Revenue also beat expectations by 60 basis points of $18.33bln compared to $18.2bln expected.

Why did it drop? The data-center segment saw its worst growth since 1Q17 and guidance for the fourth quarter is expected to decline an additional 25%. Enterprise and government revenue dropped 47%.

American Airlines Group Inc., (NASDAQ: AAL) Revenue of $3.2bln vs $2.85bln estimated, an 11% surprise. Revenue is down 73% y/y.

Adjusted EPS -$5.54 per share vs the consensus of -$5.86.

As liquidity challenges persist, the company announced a $1 billion dollar equity raise, roughly 15% of its market cap.

Southwest Airlines, (NYSE: LUV) reported 3Q20 results this week.

EPS -$1.96 a share vs -$2.56 a share, a 23% surprise to the upside.

Operating revenues are down 68.2% y/y as the third quarter reporting $1.8 billion.

Netflix, Inc., (NASDAQ: NFLX) Reported its 3Q20 earnings after the bell on Tuesday. Shares fell 6%.

2.2mln net new subscribers fell short of the company’s projection for 2.5mln.

EPS $1.74 a share vs consensus of $2.14 estimated, Revenue of $6.44bln vs $6.38bln expected.

28.1 million paid subscribers added ytd compared to 27.8mln for FY 2019.

The third quarter saw a significant decline in new paid subscribers from the first half of the year, Netflix added 2.2mln new subscribers compared to the the first quarter where they added roughly 15mln new subscribers. Is this a sign that people are not staying home as much?

Company is projecting $6.6bln revenue and $1.35 EPS for the next quarter.

“Since the almost-global shutdown of production back in mid-March, we have already completed principal photography on 50+ productions and, while the course and impact of [Covid-19] remains unpredictable, we’re optimistic we will complete shooting on over 150 other productions by year-end.”

(As of 10/14) Nielson data released shows that only 3% of Netflix’s most-watched content over the last six weeks was a Netflix Original per an analysis by The Entertainment Strategy Guy. Netflix continues to rely heavily on licensed content as even some of their “Original” content is produced by outside companies.

Source: EntertainmentStrategyGuy, Nielson

This past week saw a few acquisitions in the shale energy sector

Pioneer Natural Resources (NYSE: PXD) to buy Parsley Energy (NYSE: PE) for $7.6bn

ConocoPhillips (NYSE: COP) to buy Concho Resources (NYSE:CXO) for $9.7bn.

Smaller investors are finally turning optimistic on US stocks. More individual investors are bullish than bearish on US stocks for the first time since February

A weekly survey released Thursday by the American Association of Individual Investors reported that participants who expect to see higher share prices in the next six months outnumbered those anticipating a decline.

“Bulls had trailed bears for 34 consecutive weeks, the longest stretch since the survey began in 1987.” Extended periods of more bearish than bullish sentiment had been met with rising stock prices, historically.

Source: AAII, Bloomberg

GEOPOLITICS

The United States Justice Department filed an anti-trust lawsuit against Google for anti-competitive business practices.

The complaint alleges that Alphabet (Google’s parent) violated Section 2 of the Sherman Act. It says that Google:

“Willfully maintained and abused its monopoly power in general search services through anticompetitive and exclusionary distribution agreements that lock up the preset default positions for search access points on browsers, mobile devices, computers, and other devices; require pre installation and prominent placement of Google’s apps; tie Google’s search access points to Google Play and Google APIs; and other restrictions that drive queries to Google at the expense of search rivals.”

The focus is exclusively on potential abuses in the search market.

The lawsuit’s scope is narrower than some pundits had anticipated.

The US will remove Sudan from a list of nations sponsoring terrorism for the first time since the early 1990s

This will allow the country to rejoin the global financial system, resolve debts, and potentially attract investments in their $19 billion dollar economy.

Sudan will begin to seek financial assistance, including a possible $1.7 billion dollar loan from the International Development Association.

Peru’s Congress is set to vote on October 31st to start impeachment proceedings against President Martin Vizcarra, the second attempt in five weeks. President Vizcarra is accused of bribery and repeatedly lying to the country as congress seeks to oust him on ground of “permanent moral incapacity.”

PUNDITRY

Blackrock – Restructuring Opportunities in Credit

The distribution of debt structuring has changed significantly since 2007. Sub-investment grade debt outstanding has doubled to to $5.3trln.

Private credit has been a significant driver of the growth. Now accounts for ~$850bln outstanding.

The average interest coverage ratio for middle market buyout transactions is near historic lows. Provides a thin margin of error for companies whose earning abilities are impacted by short-term impacts.

The meager ability to service debt is likely to present significant opportunities for distressed debt specialists over the coming year

The gap between what large corporations pay in interest on their loans versus what middle market companies pay has widened significantly year-to-date. Large companies have access to public markets which have had historically low interest rates. The lack of access to public markets for smaller companies, and the widening cost of debt service between small and large companies, has led to a surge in restructurings.

PIMCO - Secular Outlook

The recovery will widely depend on the “second-wave” and the degree of fiscal stimulus. Europe has already committed to more stimulus, and the U.S. election will provide additional clarity if there will be more to come stateside.

There is a considerable amount of concern for long term unemployment scarring causing a decline in labor productivity, a loss of skilled workers and a lack of business investments.

Four primary secular trends that remain drivers of the global political-economy: China’s rise, populism, climate-related risks and technology.

China is focused on shifting the geopolitical landscape and strengthening its positioning within the global supply-chain and technology.

Populism is likely to be amplified by the pandemic recession and further cause inequality on several fronts. PIMCO does not believe we have yet seen a peak of populism.

Climate-related risks have become more apparent this year, heavily focused on “fat tail” catastrophic environmental events. Mainstream issues will affect fiscal policy, private sector decisions, capital flows, and asset prices over the secular horizon.

Technology has played an integral part this year by allowing workers to safely and productively continue work amid a global pandemic. Digitalization will be an important source of alpha for investors.

Rates in most advanced economies will stay low or go even lower in the next three to five years. However, negative rates are viewed as a desperate tool with adverse long-term side effects.

Emerging market currencies, as with emerging market bonds, offer the potential for higher returns given initial valuations but again are subject to local and global disruption risk.

They see significant risk of fatter tails to the probability distribution in what may be a period of ongoing experimentation in both monetary and fiscal policy.

The World’s COVID recovery viewed with High Frequency Data, via Macquarie Bank

Feedback

Thank you for subscribing to the Primary Dealer Review. If you have any questions or comments, please email me directly at primarydealerreview@gmail.com and I will get back to you.

Do you know someone who would like to receive this publication? Please feel free to share the Weekly Macro Summary with them.

Legal Information and Disclosures

This weekly summary expresses the views of the author as of the date indicated and such views are subject to change without notice. The author has no duty or obligation to update the information contained herein. Further, the author makes no representation, and it should not be assumed that past investment performance is an indication of future results.

Moreover, wherever there is the potential for profit there is also the possibility of loss.

This weekly summary is being made available for educational purposes only and should not be used for any other purpose. The information contained herein does not constitute and should not be construed as an offering of advisory services or an offer to sell or solicitation to buy any securities or related financial instruments in any jurisdiction. Certain information contained herein concerning economic trends and performance is based on or derived from information provided by independent third-party sources.

The author believes that the sources from which such information has been obtained are reliable; however, it cannot guarantee the accuracy of such information and has not independently verified the accuracy or completeness of such information or the assumptions on which such information is based.

This weekly summary, including the information contained herein, may not be copied, reproduced, republished, or posted in whole or in part, in any form without the prior written consent of the author.