Two Americas: A Divided Nation and Economy

Weekly Macro Summary 11/8/2020

THIS IS NOT INVESTMENT ADVICE.

Please speak with a registered investment advisor or other qualified financial professional before making any investment decisions.

Commentary

As of this writing, Joe Biden is projected to be the President-elect of the United States. The market responded to Biden’s win and, what appears to be, a split Congress with a show of significant strength. The S&P 500 rallied 7% and the tech-centric Nasdaq 100 rallied 9%. There are two uncertain issues likely to capture investors attention in the coming weeks. The first issue will be the prospects for fiscal stimulus. With the employment situation in the United States still resembling what would be expected at the depths of recessions, we suspect that the coming weeks will focus on what kind of stimulus the new government intends to deliver in order to make-up for a lack of demand that results from the poor condition in the labor market, especially for those in lower income brackets. Senate Republican leader Mitch McConnell demonstrated a more willing tone early this week regarding the potential for a deal. The second issue will be COVID-19. Specifically the development and production timeline for vaccines and therapeutics as well as the impacts of further lockdowns in light of a pickup in cases globally.

Chart of the Week

Election Results by County - Circle size is proportional to the amount each county’s leading candidate is ahead.

Source: New York Times (November 7, 2020)

If you would like to receive the Weekly Macro Summary directly to your mailbox every Sunday, please subscribe. It’s free.

ECO DATA

Atlanta Fed GDPNow is currently tracking at 3.5% for Q4 up from 2.2% last week

New York Fed GDP Nowcast stands at 2.86% for Q4, down from 3.24% last week

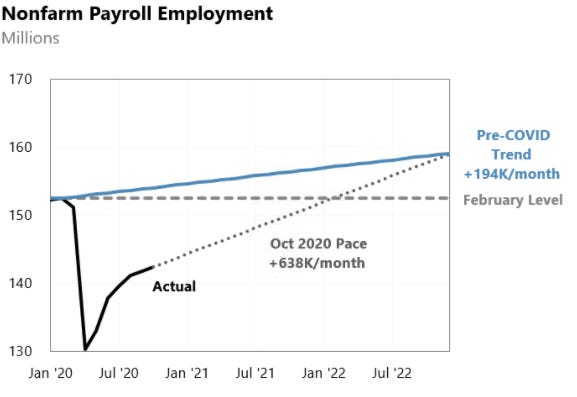

US October Nonfarm payrolls +638k vs 600k expected, internals were strong too. The US has now recovered approximately 60% of the jobs lost from the trough.

Private payroll growth up 906k in October.

The beat came despite a 268k drop in government jobs: 138k jobs lost because Census workers came off payroll. State & local governments jobs jobs by 61k and 98k, respectively

Unemployment rate fell one full percentage point to 6.9%, with a corresponding 0.3pp rise in the labor force participation rate.

One weak point was that the median duration of unemployment rose from 17.8 weeks to 19.3 weeks

“One thing I'll be looking at is labor force participation for women in October. School closures in Sept were associated with -5.5pp lower LFPR among mothers that month. The overall school closure rate in early Oct was flat but with a lot of state variation” - Ernie Tedeschi, Macro Research Analyst Evercore ISI via Twitter.

“Between February and September, participation for mothers declined by 3.3 percentage points, adjusting for normal seasonal variations. For fathers, it declined by 1.3 percentage points. That’s the equivalent of 900,000 fewer mothers and 300,000 fewer fathers in the workforce over the last seven months.”

Source: Ernie Tedeschi, Macro Research Analyst Evercore ISI

Source: Quartz, International Monetary Fund

U.S. ADP Private Payrolls came +365k vs. the consensus of +643k. The prior month was +753k.

The majority of jobs added were in the service industry with a total of 348k out of the 365k. That accounts for 95% of new jobs compared to the prior month where service jobs only made up 73% of new jobs.

MBA mortgage applications index rose +3.8% last week compared to the prior week of +1.7%. That's a 62.6% increase y/y.

30 year mortgage rates fell to a record low 2.78%, the 12th time this year that mortgage rates have set a new record low!

New home purchases are up 25.5% y/y and refinancing has increased 87.8% y/y. Most of this growth is going into fixed rate loans, with a y/y increase of 67.9% compared to adjustable rate loans which are down -34.1% y/y.

ISM Manufacturing rises to 59.3 in October from 55.4 in September. Consensus expectation was 56

New orders rose to the highest level since 2004

The employment subcomponent rose above 50 for the first time since July 2019 a signal of continued strong hiring intentions for the manufacturing sector.

Source: Citigroup

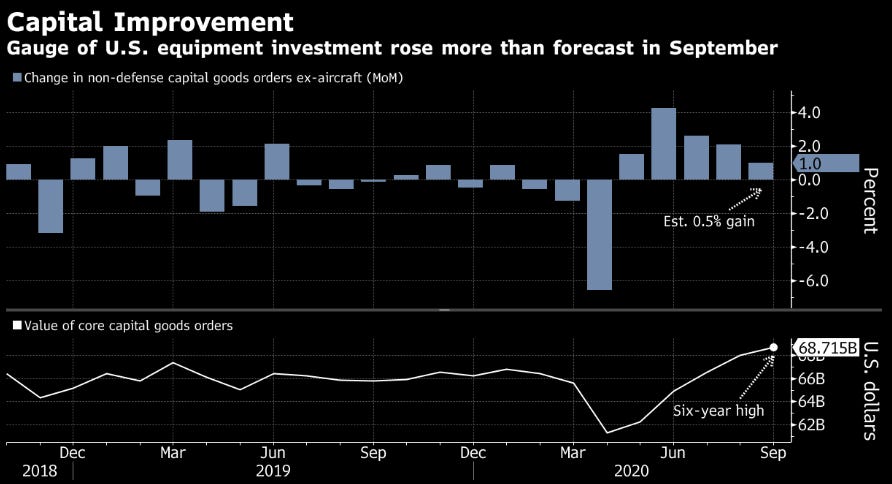

US Durable Goods for September finalized at +1.9%, which was in line with estimates.

Source: Bloomberg

German industrial production for September +1.6% m/m vs +2.7% consensus

August was -0.2%m/m so a nice pickup relative to prior month

Production is still 8% below February levels

Canada payrolls +84k vs 100k expected, slightly week but participation rate was strong

Unemployment rate of 8.9%,

Most of the jobs added were full time (rather than part time), a positive indication for Canadian growth

CENTRAL BANKS

The US Federal Reserve made no major changes to monetary policy at their most recent meeting. The Fed kept the benchmark interest rate unchanged at 0 - 0.25%.

Chairman Powell, acknowledged that the labor market’s recovery is only halfway complete and more stimulus would likely be needed to return to pre-pandemic levels. Reiterated their plans to keep rates low for the foreseeable future.

There exists significant downside risk of rising COVID cases throughout the country, "the path of the economy will depend significantly on the course of the virus"

The Bank of England surprised markets with an announcement that they will ease monetary policy further

Expanding asset purchase program by £150bln, brings program size to £895bln

The BOE’s news coincided with U.K. Chancellor Sunak announcing an extension of the government’s salary support program until the end of March 2021.

The Reserve Bank of Australia lowered its Cash Rate and three-year yield target by 15 basis points to 0.10%

Increased bond purchases by A$100bln of 5-10yr government bonds over the next 6 months.

Expects GDP growth to be around 6% through June 2021

Expects the unemployment rate to remain high but peak at 8% instead of 10% previously

FIXED INCOME, CURRENCIES, COMMODITIES

ETFs tracking long-duration bonds saw their largest inflows in 18 months according to Bloomberg’s Fixed-Income ETF Tracker.

~$3.5bln inflows in October, the largest in a month since April 2019.

Investment grade funds saw $19.4bln added in October.

Source: Bloomberg

Bonds with below-zero yields have surpassed $17 trillion, surpassing the previous record that was set last year.

Source: Bloomberg

Moody’s raised Greece’s sovereign credit rating despite the announcement of a new three-week long lockdown.

Long-term foreign currency debt was upgraded to Ba3, the first change since January 2019.

Moody’s projects Greece’s debt ratio to increase to about 200% of GDP and its economy is expected to contract by 9% in 2020.

“Ongoing reforms support a sustainable improvement in institutional strength and have already brought tangible progress in areas including tax administration and compliance and the fight against corruption”

The Greek government announced on Thursday a €3.3bln package of additional support measure for enterprises and workers hit by the introduction of a second round of a lockdown in the country beginning Saturday

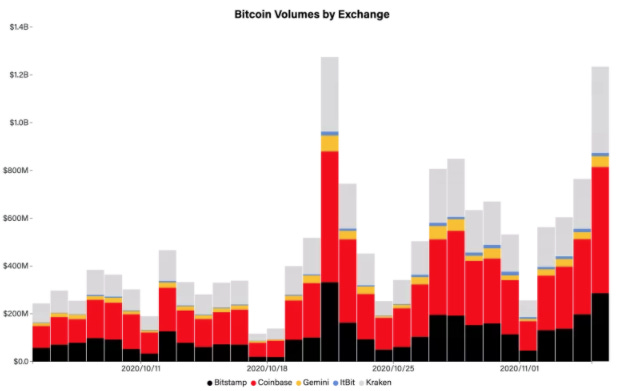

Bitcoin (BTC USD) extended its recent rally this past week as the benchmark digital currency rose above $15k; its highest level since January 2018.

The cryptocurrency has recently benefited greatly from high-profile investments and interest from various companies and central banks.

Source: Bloomberg

Source: CoinDesk Research

US crude oil refinery inputs averaged 13.6mln b/d during the week ending October 30, 2020, +163k b/d from previous week

US crude oil imports averaged 5.0mln b/d, -0.6mln b/d w/w

The four week average of crude oil imported is down 15.4% vs same time last year

China’s crude oil imports -4.88% m/m a

10.96mln b/d for October, -560k b/d compared to the September average.

October average was higher by 367k b/d versus last year

China has low storage availability so imports are expected to be weaker in Q4

EQUITIES

Zillow (NASDAQ: ZG), share price +14% after reporting 3x better than expected for Q3

Share price +167% YTD

Aligns with our recent coverage of a strong US housing market. More opportunities for remote work coupled with low interest rates have been motivators for young professionals to purchase homes in less dense cities.

Etsy (NASDAQ: ETSY) reported Q3 profit of $0.70/share.

Share price +227.1% from the start of the year. Added to S&P 500 in September.

Bolstered by sales in face masks and home décor during lockdowns, Etsy has been able to pick up a niche that has been COVID-proof. With major furniture retailers and big box stores regularly selling out of items, people have been turning to personalized and/or handmade alternatives from small sellers that can quickly add to their selections.

Main advantages:

Little market overlap with major retailers Amazon and Walmart. Amazon and Walmart are more often for commodities while Etsy has more of a unique assortment of goods and are more likely to attract people that are looking to browse.

Quicker to respond to new trends and events. i.e. Dodgers 2020 Championship memorabilia designs made available seemingly overnight.

See also: pet ownership is on the rise during the pandemic. Etsy and other retailers (i.e. Chewy) have been reaping the benefits of a $53 billion market (Source: Jeffries). With the holidays on the way, seasonal attire for pets is sure to be popular as millennials continue to delay having children in favor of pets.

Source: Bloomberg

Square, Inc. (NYSE: SQ) Adj. EPS $0.34 vs $0.16 expected, Total Net Revenue of $3.03bln vs $2.04bln expected, +140% y/y.

Net Income of $36.5mln, +24% y/y.

Square enables sellers to accept card payments and also provides reporting and analytics, and next-day settlements

Square’s Cash App digital wallet realized gross profit of $385mln, +212% y/y.

Square achieved strong international market growth realizing of 46% y/y in Seller Gross Payment Volume in markets outside of the US for Q3.

Square, Inc.’s investment in the cryptocurrency, Bitcoin, has done well: Over $1bln in quarterly Bitcoin revenue for Q3.

“Cash App generated $1.63bln of bitcoin revenue and $32 million of bitcoin gross profit during the third quarter of 2020, up approximately 11x and 15x year over year, respectively,” as reported in their Q3 investor letter.

GEOPOLITICS

Turkey’s President Recep Tayyip Erdogan removed central bank Governor Murat Uysal on Friday. Turkish Lira fell 2% this past week and is now down 43% YTD

Erdogan named former Finance Minister Naci Agbal the new head of the central bank

The Lira now sits at a record low of 8.58 per USD as the country experiences significant capital outflows on the back of political uncertainty and fear of capital controls

President Donald Trump demoted Neil Chatterjee, the Republican head of an energy regulation panel as reported on Thursday.

Chatterjee, who had been the chairman of the Federal Energy Regulatory Commission, promoted the use of carbon markets by US states to reduce greenhouse gas helping curb climate change.

Republican James Danly will replace the then-chairman of FERC and will oversee interstate transmission of electricity and natural gas.

Biden Presidency & McConnell-led Senate

Note that not all Senate seats up for election have been called as of this writing.

Because of Biden’s more centrist approach and his history of almost-amiability with McConnell, there is likely going to be more of a give-and-take between the Senate and the Presidency than seen in the last four years.

EU to hit nearly $4b of US goods with tariffs over aircraft subsidies dispute.

EU to hit US for illegal state aid of Boeing following US complaint for EU Airbus aid.

The EU is preparing to hit US casino tables, aircrafts, gym equipment, and other targeted products.

In the complaint the US made against the EU last year, the US was awarded up to 7.5b from the World Trade Organization, significantly more than the EU's present retaliation rights.

“Valdis Dombrovskis, the EU’s trade commissioner, told the FT last month that Brussels would introduce the tariffs if US authorities did not swiftly withdraw the ones they had slapped on EU products because of the subsidies dispute. Washington has given no such indication.”

Spat dates back to 2004 when the US made a case claiming that $22b in illegal aid had been given to Airbus by the EU. The EU had countered at the time stating that the US had offered $23b in illegal aid to Boeing.

PUNDITRY

Jeffrey Gundlach of Doubleline expects the split government with a Biden presidency, to be positive for US equities but says stocks are now, “really overvalued.”

Cited several metrics to indicate US equity overvaluation:

Market capitalization-to-GDP is the highest of all time

P/E ratios are higher than in 1930, before the Depression

Shiller CAPE ratio is near 30.

The S&P 500’s advances have been concentrated in just six stocks Facebook, Apple, Amazon, Netflix, Google and Microsoft.

The other 494 stocks have barely moved in 2 years

“Narrow markets are not very attractive…Beware if the super-six stop outperforming.”

Surprised by how deeply and evenly split the country is and warns that, “Republicans won’t give money to blue states…which are the hardest hit.”

“The Fed won’t see an inflation scare and it will be easier and more willing to do asset purchases”

Fed’s QE injection of liquidity into the markets is, “a money spray that has fueled market speculation by retail investors.”

Gold and bitcoin are highly correlated to each other, and their moves up represent a flight to safety.

Predicts a “very large decline” in the dollar over the coming years because of the growing fiscal deficit

The US is close to monetizing the fiscal deficit and monetization always leads to hyperinflation

“It is hard to see how you don’t ultimately go there.” The US has unfunded liabilities of 750% of GDP.

Only two options to deal with this unfunded liability, either default or devalue

At some point, the Fed will use yield-curve control to keep rates down

Economists predict US real growth will be 3.7% and global growth will be 5.2%. Says the US is “way weaker” than the rest of the world.

Feedback

Thank you for subscribing to the Primary Dealer Review. If you have any questions or comments, please email me directly at primarydealerreview@gmail.com and I will get back to you.

Do you know someone who would like to receive this publication? Please feel free to share the Weekly Macro Summary with them.

Legal Information and Disclosures

This weekly summary expresses the views of the author as of the date indicated and such views are subject to change without notice. The author has no duty or obligation to update the information contained herein. Further, the author makes no representation, and it should not be assumed that past investment performance is an indication of future results.

Moreover, wherever there is the potential for profit there is also the possibility of loss.

This weekly summary is being made available for educational purposes only and should not be used for any other purpose. The information contained herein does not constitute and should not be construed as an offering of advisory services or an offer to sell or solicitation to buy any securities or related financial instruments in any jurisdiction. Certain information contained herein concerning economic trends and performance is based on or derived from information provided by independent third-party sources.

The author believes that the sources from which such information has been obtained are reliable; however, it cannot guarantee the accuracy of such information and has not independently verified the accuracy or completeness of such information or the assumptions on which such information is based.

This weekly summary, including the information contained herein, may not be copied, reproduced, republished, or posted in whole or in part, in any form without the prior written consent of the author.