Things That Go Up: Housing Starts, Jobless Claims, Business Confidence, Industrial Production, Equities, COVID-19 Cases, and the GBP

12/20/2020

THIS IS NOT INVESTMENT ADVICE.

Please speak with a registered investment advisor or other qualified financial professional before making any investment decisions.

Commentary

The S&P500 has gained 2.4% for December, thus far, bringing its year to date total just shy of 17%. The tech-centric Nasdaq 100 is up a remarkable 47%. All of this is occurring while several major economies, including the US, are experiencing a second wave of COVID infections and a new peak in deaths and hospitalizations as a result. In November we dubbed it, “Two Americas”. In risk assets, sentiment measures are stretched. The stock market looks expensive relative to historic valuations whether measured by trailing earnings or forward-looking measures. At his press conference this past week, Jay Powell addressed equity prices, “If you look at P/Es they’re historically high, but in a world where the risk-free rate is going to be low for a sustained period, the equity premium, which is really the reward you get for taking equity risk, would be what you’d look at.” He came just shy of saying the four most dangerous words in markets, “this time it’s different”. The most recent edition of Bank of America’s fund manager survey showed that cash holdings were now at the lowest levels in 2020 at approximately 4%. This also marks the first time that respondents in the survey have been underweight cash since May 2013. In October we asked, “There seems to be plenty of worry in the markets but does anyone think that the stock market can rally furiously again in the 4th quarter?” This week we ask the inverse question, with valuations stretched, markets rallying furiously and animal spirits alive, does anyone think that US markets can fall while the global economy continue to improve?

Chart of the Week

2020 Holiday Season

Happy holidays to all of our readers. The Weekly Macro Summary will briefly pause for the holidays, and delivery will resume on January 3rd, 2021. We always appreciate hearing from you. If you have any suggestions for how we can make the weekly summary more informative for you in the coming year, we’d love to hear your feedback: primarydealer@weeklymacro.com

If you would like to receive the Weekly Macro Summary directly to your mailbox every Sunday, please subscribe. It’s free.

ECONOMIC DATA

Atlanta Fed GDPNow is currently 11.1%, down slightly from last week’s 11.2% for Q4.

New York Fed GDP Nowcast is currently at 2.36% Q4 down from 2.45% last week.

Goldman Sachs US Financial Conditions Index

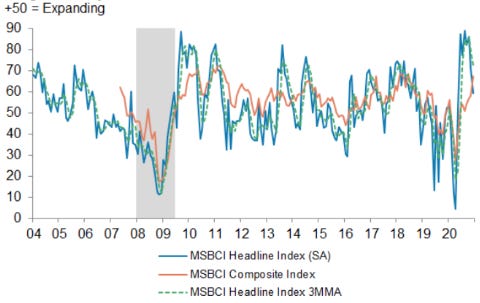

Morgan Stanley Business Conditions Index

US Jobless Claims hit a 3-month high to 885k up from 862k the prior week, this is the highest claims number since early September.

About 455K people applied for the Pandemic Unemployment Assistance program, vs 415K the week prior.

Pandemic Emergency Unemployment Compensation beneficiaries +268k on the week as of the most recent data from November 28. The highest increase since the middle of October. Currently there are a staggering 20.6mln individuals receiving unemployment benefits. The key question is: How much of this is temporary?

US November retail sales report below expectations. Headline -1.1% m/m (-0.3% expected).

Excluding autos, -0.9% m/m (+0.1% expected).

Core retail sales (retail sales & food services excluding autos, gas, and building materials) -1% m/m.

October’s figure were revised lower to indicate a month-over-month decline.

Some of the categories with the steepest declines were ones where people do their heaviest holiday shopping such as department stores (-7.7%), clothing stores (-6.8%), sporting goods stores (-0.6%).

E-commerce only saw a +0.2% gain for the month.

The silver lining in all of this is that sales are 4% higher y/y and above their pre-COVID levels:

US Housing Starts continue their strong run. November surprises to the upside with upward revisions for October.

+1.2% m/m to 1.547mln in November 2020, highest level since February (1.53mln expected).

October was revised upward by 1.4 points for a m/m change of 6.3% from September.

Single-family housing starts +0.4% to 1.186mln, units in buildings with five units or more +8% to 352k.

Regionally, housing starts +58.8% to 135K in the Northeast, +8.2% to 407K in the West. In contrast, housing starts -4.9% to 196K in the Midwest and -6% to 809K in the South.

US Building Permits hits 14-year high. +6.2% MoM to a seasonally adjusted annual rate of 1.639mln in November of 2020.

Single family authorizations +1.3% to 1.143mln and permits for buildings with five units or more +22.8% to 441 thousand.

Permits up across all US regions: Northeast +12.9%, Midwest +3.8%, South +4.7% and West +8.3%.

US Industrial production +0.4%m/m vs +0.3% expected. Details were strong but industrial production is still 5 points below February 2020 levels and down almost 8% y/y.

Capacity utilization increased to 73.3%. Low print was 65% in May. Pre-COVID utilization was 77%.

Manufacturing production +0.8%m/m vs +0.4% expected.

Durable goods +1.5%m/m, 7th consecutive monthly increase.

We look for Industrial production to get back to pre-COVID levels once vaccines are more widely distributed, so some time around summer 2021.

China November industrial production +7.0% y/y, in line with forecasts.

Fixed Asset Investment growth now stands at 2.6% driven by manufacturing capex.

Retail sales growth +5% in line with expectations. The bounce in retail sales is being led by discretionary consumption on items such as cosmetics, jewelry, and mobile phones.

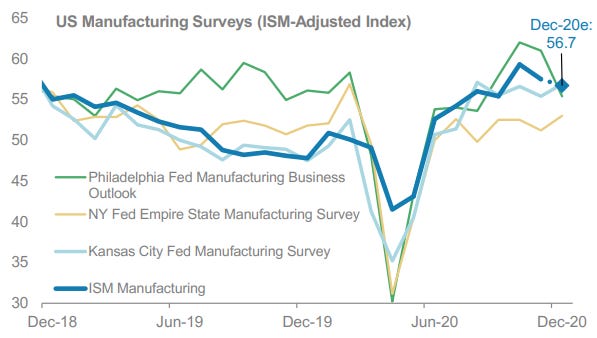

The US composite PMIs (flash reading for December) still in expansion at 55 but down 3 points from November.

Manufacturing surprises to upside by 1 point to 56.6.

Services PMI came in 1 point below consensus at 55.

European preliminary December PMIs stronger than expected. Composite PMI at 49.8 is pretty much neutral. Surprising strength given the second wave of lockdowns across Europe.

Manufacturing 55.5 vs 53 expected.

Services PMI 47 vs 42 expected.

UK retail sales for November -2.6% m/m versus consensus -4%, another sign of resilience in the European economy.

Overall retail sales are still above pre-COVID levels.

Clothing sales -19% m/m because stores have been shutdown on back of COVID.

Manhattan apartment landlords in NYC see lowest rent prices since October 2010.

Median rental price dropped 22% in November y/y to $2,743 per month.

Canada's October 2020 government budget deficit widened to CAD18.51bln up from CAD3.25bln in October 2019.

Due to a combination of economic downturn and temporary setbacks due to COVID.

Revenues -$1.4bln, (-5.5%) to CAD24.07bln.

Public debt charges -$0.2bln, (-11.6%) to CAD 1.58bln, reflecting lower interest on Canada treasury bills, pension, etc.

Russia's GDP -3.7% from November 2019, following a revised -4.5% drop in October. YTD 2020, the economy contracted 3.5%.

COVID-19 Update: The number of infected across the world has surpassed 75 million amid positive news and distribution of vaccine (nearly 50k people have been vaccinated in the US).

At least 1.66 million people have died, 42.4 million have recovered.

Europe’s new infections for last week:

In Germany, a new record high of 33,777.

UK also recorded a new record 35,383.

France new infections rose by 18,254, the most since November 20th.

Italy recorded 18,233 and Spain 12,131.

CENTRAL BANKS

US Federal Reserve delivers no change in level or composition of monetary stimulus.

Fed projects a stronger economic picture for 2020 - 2022 while maintaining Fed Funds rate at 0 through at least 2022 (see chart below).

No strict guidelines were delivered regarding how long they will keep accommodation via asset purchases but said that they will continue "until substantial further progress has been made toward the Committee's maximum employment and price stability goals."

Why it matters: While not strict, this guidance is more specific than before. Most importantly it permits the FOMC tremendous flexibility to keep policy accommodative for the foreseeable future even if there is a significant improvement in the economic landscape.

10 participants ranked the risks to the outlook as balanced in December, up from 4 in September.

Despite the pick-up in expectations for economic performance only 5 members (versus 4 in September) see a rate hike in 2023. The market implied first rate hike is in 2024 (see chart below)

“In effect, the FOMC projection rates on hold with inflation beginning to reach 2.0% and the unemployment rate below 4% at the end of 2023 underscores a message from the FOMC of just how patient they plan to be in firming rates.” -Morgan Stanley

US Federal Reserve Vice Chairman, Richard Clarida in CNBC interview on Friday: “We think we are providing very ample support for the economy with the combination of our guidance and the purchases which are at a very very robust pace...we think that the current constellation of policies is exactly where we want it to be.”

The rising number of COVID cases is, “clearly impacting the economy,” and he expects the next couple of months to be “rough.”

Regarding the vaccine’s rollout, “makes me individually very optimistic about the economy as we get into 2021.”

“The path of policy will be dictated by the path of the economy. This will be a different cycle than past cycles because of our new monetary policy framework...policy is going to remain accommodative longer to give the support the economy needs to achieve our dual mandate goals on a sustained basis.”

Bank of Japan (BOJ) December Monetary Policy Meeting, bank remains accommodative.

Short-term interest rate to remain at -0.1% and 10-year Japanese government bond yield also unchanged at around 0%.

Japan's consumer prices -0.9% y/y in November. The bank intends to conduct an assessment to explore further effective and monetary easing measures to deal with deflationary pressures. The results of the assessment will be made public in the March 2021 meeting.

No changes to yield curve control or quantitative easing programs, “it has been working well to date, and the Bank judges that there is no need to change it."

A standout change: the BOJ will extend the additional purchases of CP and corporate bonds until the end of September 2021, with an amount outstanding upper limit of approximately JPY 20 trillion. The BOJ stated, "economic activity and prices are projected to remain under downward pressure for a prolonged period due to the impact of COVID-19.”

The Bank of England (BOE) also voted to maintain current operations in a laissez faire approach to the current uncertainty around a Brexit trade deal and COVID-19.

Bank Rate to remain at a record low of 0.1%, bond-buying program to remain at £875bln.

Inflation target of 2% also remains unchanged. Given the uncertainty of the year ahead, officials pledged to take whatever action necessary to sustain growth and employment, including exploring negative interest rates (as mentioned in our Elevated Volatility and While the Going is Good issues).

Bank of Canada Governor, Tiff Macklem: “there is room for cautious optimism that international trade will recover more quickly from the pandemic than it did from the global financial crisis.”

Warned that the recent appreciation of the Canadian Dollar is “hurting the competitiveness of Canadian exporters in our largest market.”

The comment about the recent CAD appreciation is strange to us, the Canadian Dollar has been largely range bound for several years, on a trade-weighted basis (see chart below).

The Swiss National Bank (SNB) kept rates unchanged at -0.75%, continues to call the Swiss Franc “highly valued” and “remains willing to intervene more strongly in FX markets.”

Expects the economy to grow 2.5% - 3% next year.

SNB was recently labeled a currency manipulator by the US Treasury. SNB Chair Jordan repeated that they are not currency manipulators and that their FX interventions are necessary to achieve monetary policy objectives.

FIXED INCOME, CURRENCIES, COMMODITIES

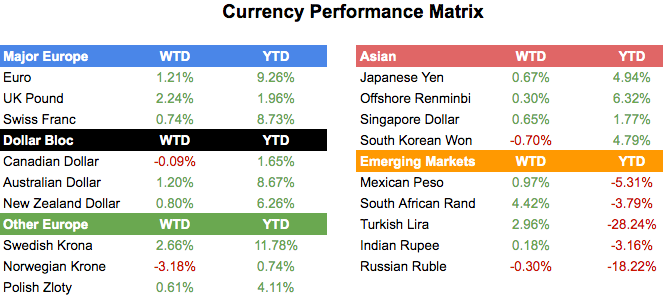

The UK unemployment rate rose less than expected, 4.9% versus 5.1% consensus.

More than 800k jobs have been lost since February, ⅓ of jobs lost are from the hospitality sector.

Bank of England’s Monetary Policy Report sees a peak in the unemployment rate at 7.7% in Q2'21.

Why it matters: The better than anticipated unemployment trajectory permits the BoE to avoid additional monetary easing measures. This has translated into a strengthening GBP. It was the 3rd best performing currency in our matrix this past week.

What we’re thinking about: Is this the beginning of a sustained move for GBP to its pre-COVID level versus the EUR?

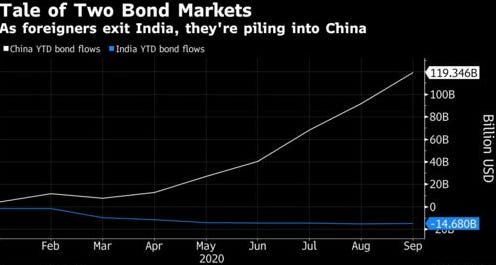

India sees record-setting outflows ($14bln) from their bond market .

This has coincidentally aligned with Chinese bonds attracting record foreign inflows highlighting the investor sentiment toward India’s pace of capital-market reforms led by prime minister, Narendra Modi.

China has seen over $119bln of inflows this year; mainly facilitated by China’s efforts in recent years to dismantle the barriers for foreign investors to access their onshore bond market.

Foreign holdings of Indian bonds are just under 2% at the end of November.

India’s strict restrictions on foreign funds and failure to join China in global debt indices has severely limited the country’s capital mobility.

“We are now carrying out the process and institutional changes needed to allow all participants to be able to buy and sell rupee Indian bonds without difficulty,” said Sanjeev Sanyal, a principal economic adviser in the finance ministry.

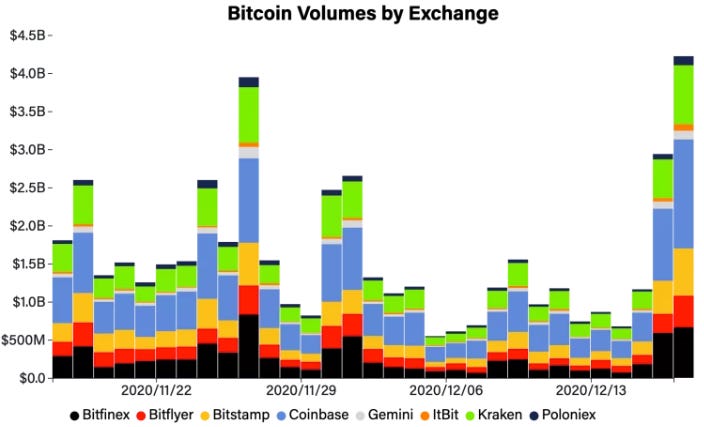

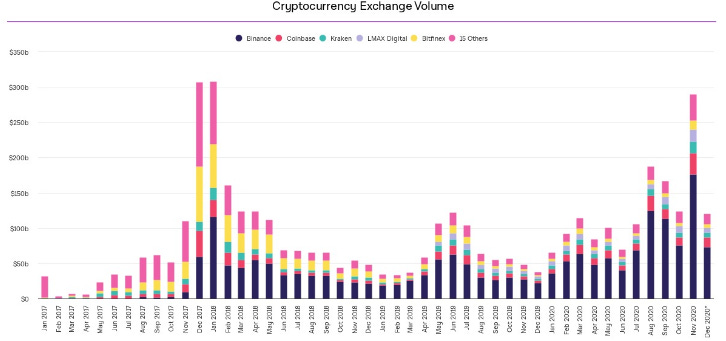

Bitcoin extended its rally this week setting a new high on Thursday of $23,770 on higher-than normal daily volume. By Saturday, bitcoin had surpassed $24,000

Trading volume for the currency in recent months has spiked aligning with the enormous amount of public interest it has received this year.

Volume on Thursday across the eight major exchanges as tracked by CoinDesk was over $4.0bln.

Monthly exchange volume shows a different story (see below). Exchange balances for December will most likely not top November’s tally, potentially hinting fatigue in the recent bull run.

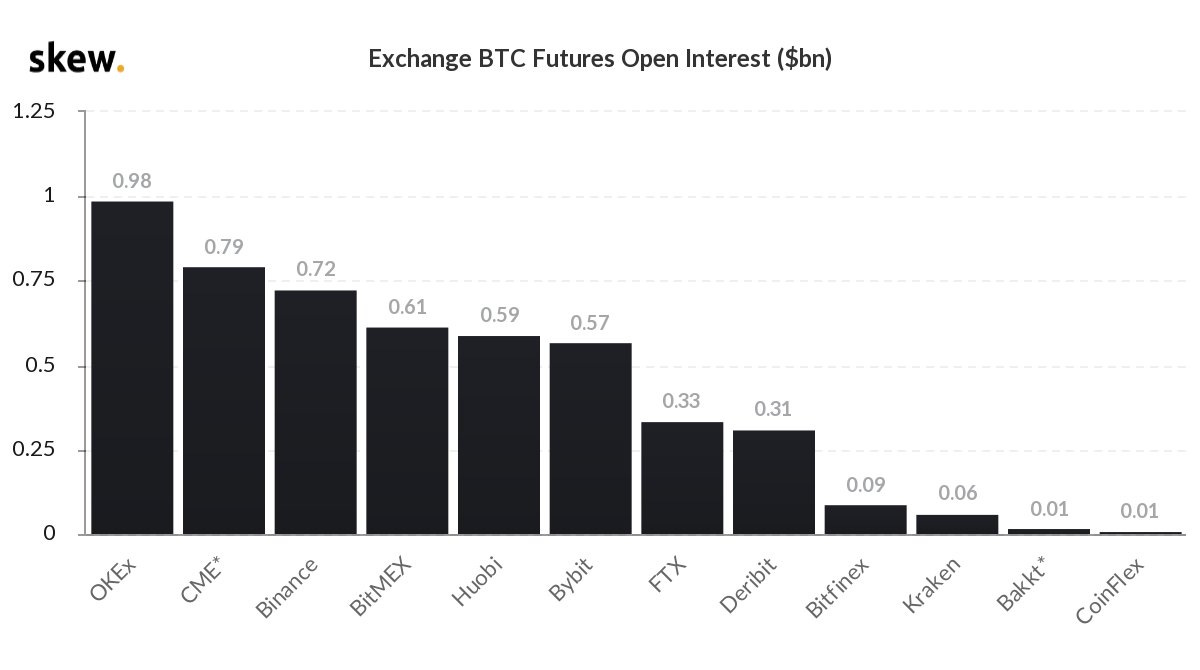

In light of the recent interest surrounding cryptocurrencies, the Chicago Mercantile Exchange (CME) announced Wednesday it will launch a futures contract for ether, the second-largest crypto by market value.

Futures will be listed on February 8, 2021; more than three years after Bitcoin futures went live.

Recent spike in institutional demand for the coin pushed the CME to become the second-largest Bitcoin futures platform by number of open contracts as of October.

Macro hedge fund manager, Brevan Howard recently emerged as a significant partner for One River Asset Management who recently acquired $600mln worth of cryptocurrencies.

EQUITIES

Coinbase announced on Thursday the filing of an S-1 with the SEC indicating its intention to IPO. Coinbase, founded in 2012, is the largest U.S. cryptocurrency exchange.

In 2018, Tiger Global led a funding round that valued Coinbase at more than $8 billion. The company has 35 million verified users in more than 100 countries and more than $25 billion in assets on its platform.

Investors go risk-on and global: Flow data from Arbor Research, as of December 1, shows that investors continue to pour money into equities increasing with the share of flows into domestic and global equity markets increasing relative to other assets categories

Logica Funds, Policy in a World of Pandemics, Social Media and Passive Investing: A research report presented by the volatility hedge fund explores how markets dynamics have changed since passive investing was introduced in the 70s.

The market no longer moves on collective decision making or the efficient market hypothesis, instead strategies that include passive investing and synthetic attempts to generate yield by systematically selling volatility now are the primary reasons why the market moves

“In particular, the simultaneous rise in ‘yield enhancement strategies’ which sell volatility across asset classes, especially equities, in order to generate additional income. These strategies have exploded in popularity since the Global Financial Crisis and the associated collapse in traditional fixed income yields to historical lows. The provision of this volatility by market participants to broker dealers creates conditions under which localized volatility is minimized. As long as dealers remain net long volatility, what is referred to as ‘long gamma’, then dealer hedging activity dampens volatility. When dealers find themselves short gamma, as occurs when markets have been subjected to an outside force like the XIV ETF blowup in February 2018, the US-China trade war escalation in Q4-2018 or the COVID-19 pandemic, then volatility can rise sharply as dealers rush to sell more of the index into the already falling markets in order to hedge their exposure.”

The depth of the market has also fundamentally changed because passive investors do not react to external factors like active investors do. When active investors are met with an external event, they will attempt to reduce risk, i.e. selling. Passive investors do not have the same reaction function.

“In 2013, it was possible to execute nearly 9,000 S&P futures contracts ‘at the front of the book’ (light blue line below). In recent days, that number has fallen to only 9 contracts. In dollar terms, in 2013 it took a $750MM order to “move the market”… today it takes a $1MM order. [The market is] not just less liquid, [but] orders of magnitude less liquid.”

GEOPOLITICS

Rockefeller Foundation, established more than a century ago by oil tycoon John D. Rockefeller, has announced plans to divest from fossil fuels in an effort to allocate more towards green investments.

The plan, which has already begun, will cut its more than half fossil fuels allocation to less than 1% in the near future, with no official timeline given at this time.

Chun Lai, Rockefeller’s CIO said in an email: “We actively narrowed the resources portfolio to less than a handful of managers who place strong focus on ESG integration and avoided dedicated investments in the heaviest emitting fossil fuels.”

U.S. Blacklists more than 60 Chinese Firms in an effort to protect ‘U.S. national security’. These companies will join firms like Huawei Technologies, a list that denies the companies access to U.S. technologies such as software and hardware.

The Commerce Department said in a statement: “This action stems from China’s military-civil fusion doctrine and evidence of activists between SMIC and entities of concern in the Chinese military industrial complex.”

PUNDITRY

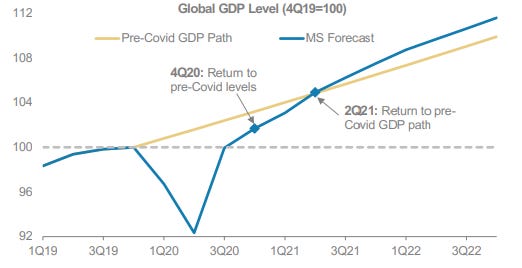

Morgan Stanley, “Bull Market Could Have a Long Way to Run.”

4 Reason to remain bullish:

“New bull markets have begun with a recession and have typically run for years not months.

The health crisis has brought unprecedented monetary and fiscal stimulus that is likely to become structural in nature—a policy regime shift.

Economic data surprises and positive earnings revisions support our V-Shaped recovery and higher equity prices.

Operating leverage should drive meaningful upside to consensus earnings next year.”

Operating Leverage Is Underappreciated. “Speed and depth of unemployment cycle and cost cutting should drive unprecedented operating leverage next year.”

The average stock in the S&P 500 could outperform the broader index by 2:1 so MS prefers equal weighted indices versus market cap weighted.

Equal Weighted Index Typically Outperforms Market Cap Weighted Coming Out of Recessions

Morgan Stanley Forecast of US GDP Path

Fiscal Policy Is Different this Time and Suggests “Helicopter Money” Is Here

Greater Fiscal Has M2 Growth at Unprecedented Levels―What’s the Cost?

Small Caps Have Typically Outperformed Large Caps Coming Out of a Recession

Feedback

Thank you for subscribing to the Primary Dealer Review. If you have any questions or comments, please email me directly at primarydealer@weeklymacro.com and I will get back to you.

Do you know someone who would like to receive this publication? Please feel free to share the Weekly Macro Summary with them.

Legal Information and Disclosures

This weekly summary expresses the views of the author as of the date indicated and such views are subject to change without notice. The author has no duty or obligation to update the information contained herein. Further, the author makes no representation, and it should not be assumed that past investment performance is an indication of future results.

Moreover, wherever there is the potential for profit there is also the possibility of loss.

This weekly summary is being made available for educational purposes only and should not be used for any other purpose. The information contained herein does not constitute and should not be construed as an offering of advisory services or an offer to sell or solicitation to buy any securities or related financial instruments in any jurisdiction. Certain information contained herein concerning economic trends and performance is based on or derived from information provided by independent third-party sources.

The author believes that the sources from which such information has been obtained are reliable; however, it cannot guarantee the accuracy of such information and has not independently verified the accuracy or completeness of such information or the assumptions on which such information is based.

This weekly summary, including the information contained herein, may not be copied, reproduced, republished, or posted in whole or in part, in any form without the prior written consent of the author.