There’s No Place Like Home: The Continued Rise of the Housing Market

Weekly Macro Summary 11/22/2020

THIS IS NOT INVESTMENT ADVICE.

Please speak with a registered investment advisor or other qualified financial professional before making any investment decisions.

Commentary

Ahead of a shortened week in markets because of american Thanksgiving, we’re delivering an abridged summary. Once again, you’ll see a significant focus on the continued rise of the US housing market. As we noted during our October 25th newsletter, “housing is arguably the most important data point to watch in order to measure COVID’s impact on the economy as well as prospects for a recovery…there is a significant secular demographic tailwind driving the housing data. Coming out of the global financial crisis, household formations in the US were below historical averages for many years. It is only recently that the data has approached the historical average levels but the magnitude of the shortfall from 2008 - 2016 left an extraordinary amount of pent-up demand that still exists.”

Chart of the Week

From JP Morgan, “We have been surprised to see a quick rebound in overall spending in data through November 15, with our primary spending tracker jumping back to its highest levels since the bump fromAmazon Prime Days in mid-October.”

Thanksgiving Holiday

We will not be compiling a weekly macro summary next week. We will resume delivery on December 6.

If you would like to receive the Weekly Macro Summary directly to your mailbox every Sunday, please subscribe. It’s free.

ECONOMIC DATA

Atlanta Fed GDPNow is currently tracking at 5.6% for Q4, up from 3.5% last week.

New York Fed GDP Nowcast remained unchanged from last week at 2.86% for Q4.

US retail sales miss expectations in October.

Retail sales +0.3% in October to $553.3bln vs +0.5% expected, slowest monthly gain in the post-pandemic period.

Top performers y/y by kind of business: Nonstore retailers +29.1%, building materials +19.5%, sporting goods +12.4%.

We wonder if the rebound is coming to a halt due to a.) restrained business activity as a result of a rise in coronavirus infections and a pickup in lockdown mandates and b.) extended unemployment benefits due to expire.

US weekly jobless claims ticked up this past week breaking a four-week streak of declining claims.

Claims +31k up to 742k vs 710k expected.

Initial claims filed for the Pandemic Unemployment Assistance program +24k to 320k as of 11/14.

China’s economy continues its strong expansion.

Industrial production +6.9% y/y vs 6.7% expected.

Manufacturing +7.5% m/m.

Retail sales +4.3% y/y vs 5.0% expected; marking the third successive month of expansion for retail sales, up from 3.3% in September. Ex-auto +3.6% y/y.

Interesting data point: rural area consumption +5.1% vs +4.2% in urban areas.

Fixed asset investment +1.8% YTD vs 1.6% expected, mainly due to a large increase in mining, farming, and quarrying investment.

US homebuilding continued its remarkable performance in October.

Housing starts +4.9% m/m in October, +14.2% y/y.

Single-family housing starts +6.4% to 1.179mln units, the highest level since April 2007 and marking the sixth straight month of increasing single-family starts.

Building permits for future home building unchanged m/m at 1.545mln, +2.8% y/y.

October existing home sales posted their 5th consecutive month of gains.

+4.3% m/m to 6.85mln vs -1.1% expected (+26.6 y/y).

Median price of existing home sales +15.5% y/y to a record high of $313k.

Total housing inventory declined to just 1.42mln which represents 2.5 months of supply - a record low.

All four major regions realized m/m and y/y growth, with the Midwest experiencing the greatest monthly increase:

Northeast: existing home sales +4.7% m/m, +30.4% y/y.

Midwest: +8.6% m/m, +28.1% y/y.

South: +3.2% m/m, +26.5% y/y.

West: +1.4% m/m, +22.8% y/y.

Number of US bankruptcy filings continue to spike surpassing the total for 2009.

Bankruptcies for US companies with more than $50mln in liabilities that have filed for chapter 11 or 7 bankruptcy.

The Conference Board’s Leading Economic Index signals headwinds, rate of recovery has decelerated.

The LEI +0.7% m/m to 108.2, “Downside risks to growth from a second wave of COVID-19 and high unemployment persist.”

Mortgage credit availability increased in October as reported by the Mortgage Bankers Association.

The Mortgage Credit Availability Index (MCAI) increased by 2.3% to 121.3 in October; the first increase since July (increase in the index = loosening lending standards).

The total number of loans now in forbearance decreased 20bps to 5.47%, the 11th week in a row of declines.

CENTRAL BANKS

US Treasury Secretary Steven Mnuchin instructed the Fed to close down its emergency lending facilities and return unused money designed to support small and medium sized businesses, and state and local governments, in a letter on Thursday to Fed Chairman Jerome Powell.

In the letter, Secretary Mnuchin requested the Fed return unused Treasury funding for 9 of 13 emergency facilities by December 31.

“This will allow Congress to re-appropriate $455bln, consisting of $429bln in excess Treasury funds for the Federal Reserve facilities and $26bln in unused Treasury direct loan funds” - Mnuchin

The Fed responded with a statement Thursday afternoon, “The Federal Reserve would prefer that the full suite of emergency facilities established during the coronavirus pandemic continue to serve their important role as a backstop for our still-strained and vulnerable economy.”

91% of respondents in BAML’s fund manager survey are expecting a stronger economy over the next 12 months. The most bullish outlook from the survey for the economy since March 2002.

FIXED INCOME, CURRENCIES, COMMODITIES

IMF: Rising national debt is a recurring theme among developed economies

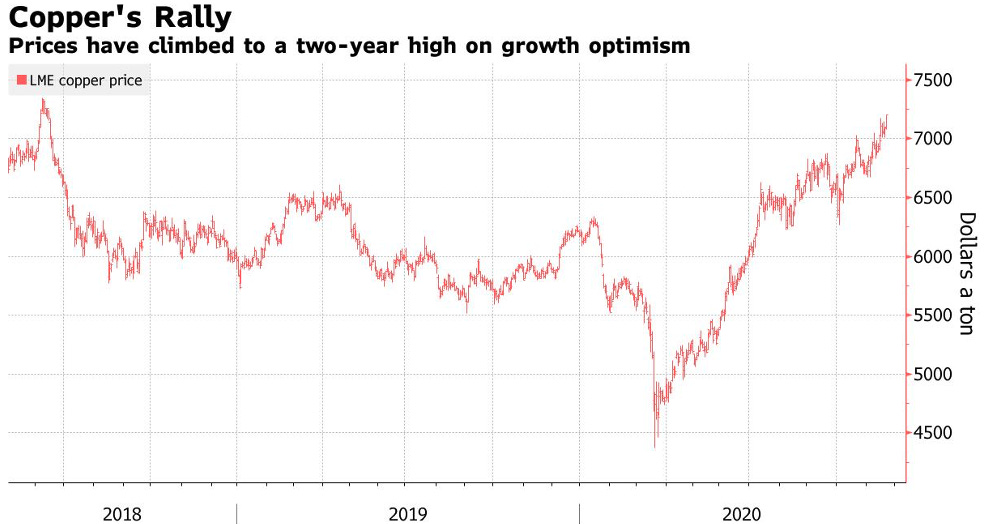

Copper closed the week at a two-year high on hopes for a continued global recovery

TD: “Our real-time commodity demand indicator continues to print new yearly highs, suggesting the vaccine announcement catalyzed a new reflationary impulse in commodities.”

EQUITIES

Is Value Investing dead? Michael Mauboussin argues that value investing is alive and well and value factoring may be floundering. As Charlie Munger has always said “All good investing is value investing.”

Fundamental value investors should focus on gaps between price and value for individual securities. The present value of future cash flows, not misleading multiples, are the source of value, says Michael.

Earnings and book value no longer mean what they used to. Tangible assets, such as factories, were the foundation of business value in Graham’s time. Yet intangible spending, such as research and development, has been on the rise for decades.

The Boeing 737 Max has been cleared to fly by the Federal Aviation Administration (FAA) after a twenty month hiatus. The Max was involved in two fatal crashes in Ethiopia and Indonesia, killing 346 people. In order to garner public support, FAA Administrator Steve Dickson said he’d be “100 percent comfortable with my family flying on it.”

Boeing (NYSE: BA) closed on Wednesday 11/18 at $203.30. The stock has traded as low as 89.00 and as high as 373.77 in the last 52-weeks and still well below its all-time high on March 1, 2019.

The first return flight for the Boeing 737 Max will be an American Airlines route from Miami to NYC on December 29th.

Walmart (NYSE: WMT) reported their third quarter results. The stock closed the week at $152.12, just below its 52-week high of $153.40.

U.S. Same-Store Sales excluding fuel are up 6.4% in 3Q20, while E-Commerce Sales jumped 79% on strong Grocery Demand and physical distancing precautions.

International Revenue expanded modestly at 1.3%, with the strongest growth coming from Canada at 7.7%.

Target Corp. (NYSE: TGT) reported strong third quarter results as the stock has returned 34.4% for the year.

Adjusted EPS expanded 105% in 3Q20, as revenue jumped 21% with same-store sales increasing 20.7% and transactional tickets increasing 15.6%.

Online Sales continues to highlight strong growth increasing 155% v.s. 31% a year earlier. Same-Day services grew 217%.

Lowe’s (NYSE: LOW) continues to benefit from the work-from-home trends, closing the week at $149.60. Shares are up 25% ytd

Total Sales increased 28.3% in 3Q20 from a year ago, same-store sales +30.1%. Transactional tickets increased 13.7%.

The Home Depot (NYSE: HD): Total Sales +23.2% from a year ago and same-stores sales +24.1% for 3Q20. The average transactional ticket rose 10%.

"Customers responded to our larger assortment of animatronics, inflatables, and yard decor, as evidenced by our 12-foot giant skeleton, which sold out before October, helping drive a record sell through for the eventq"

Making the House a Home: a study by the National Bureau of Economic Research (NBER) found that households spend on average $3,700 more in the months before and the first year following new home purchases. Is there a thematic trend here that continues to perform despite the ongoing pandemic?

The housing market has continually outperformed other sectors this year. The iShares U.S. Home Construction ETF (ITB), which seeks to track U.S. equities in the home construction sector has returned 27.53% through the end of September.

The Consumer Discretionary SPDR Fund (XLY), which is made up of 93% consumer cyclical companies (Amazon, Home Depot, Lowes, Target and TJ Maxx make up a majority of the top holdings) has returned 17.19% through the end of September.

NBER’s research argues that new home purchases will further stimulate the market for durable consumption by increasing goods and services that complement the home. You can see the relationship in the chart below (the NHSLTOT Index is new seasonally adjusted single family home purchases). This begs the question: does correlation imply causation?

Individual investors in US stocks are finally turning optimistic after eight months of gains

November 12 AAII US Investor Sentiment hit its highest level since January 2018 at 55.84%

November 19 reading fell to 44.35% but it’s the first time since February that optimism has been above its historical average 38.0%) for consecutive weeks.

GEOPOLITICS

Following up on our coverage of the Grand Ethiopian Renaissance Dam (GERD), Ethipoia is currently in a state of duress, with military and political conflicts on the rise. The GERD is at the center of the conflict, the project which will produce electricity from the Blue Nile River, has reached a critical stage. The Eastern Nile riparian states (specifically Egypt, Sudan and Ethiopia) most affected by the dam’s construction may go to war to resolve their disputes if peaceful cooperation does not emerge.

The United States has recently cut aid to Ethiopia worth $130 million on the back of a phone call with Sudanese Prime Minister Abdela Hamdock and Isreali Prime Minister Benjamin Netanyahu in October 2020, blaming Ethiopia for breaking ‘the deal’.

Russia intends to build a naval base in Sudan, an expansion announced a year after Russia’s first geopolitical summit.

Would be the second naval base outside of former Soviet Union territory.

Action follows a pattern of increases in arms sales and various investments in natural resource projects to gain a stronger foothold in Africa in competition with the US and China.

Land will be provided to Russia for 25 years, with options to extend.

Will be a huge boon for Russia’s naval presence as the country has historically lacked warm-water port access.

Could be a bane to US as an executive order was recently signed to remove Sudan from the list of state sponsors of terrorism.

Last week Pervuvian political unrest led to the election of a third president in a week. A centrist technocrat, Franscico Sagasti will follow Manuel Merino, who was met with five days of mass protest until his resignation. Congress had impeached Martin Vizcarra and replaced him with Merino earlier that week following his anti-corruption campaign and poor handling of the COVID pandemic in Peru.

Peru’s economy -30% in Q2, worst of any major emerging market, second highest COVID death toll per capita globally under Vizcarra.

Current president Francisco Sagasti: an industrial engineer, former World Bank official, elected by congress. Verdict is still out on whether his centrist background will be able to command enough support to settle the masses.

Feedback

Thank you for subscribing to the Primary Dealer Review. If you have any questions or comments, please email me directly at primarydealerreview@gmail.com and I will get back to you.

Do you know someone who would like to receive this publication? Please feel free to share the Weekly Macro Summary with them.

Legal Information and Disclosures

This weekly summary expresses the views of the author as of the date indicated and such views are subject to change without notice. The author has no duty or obligation to update the information contained herein. Further, the author makes no representation, and it should not be assumed that past investment performance is an indication of future results.

Moreover, wherever there is the potential for profit there is also the possibility of loss.

This weekly summary is being made available for educational purposes only and should not be used for any other purpose. The information contained herein does not constitute and should not be construed as an offering of advisory services or an offer to sell or solicitation to buy any securities or related financial instruments in any jurisdiction. Certain information contained herein concerning economic trends and performance is based on or derived from information provided by independent third-party sources.

The author believes that the sources from which such information has been obtained are reliable; however, it cannot guarantee the accuracy of such information and has not independently verified the accuracy or completeness of such information or the assumptions on which such information is based.

This weekly summary, including the information contained herein, may not be copied, reproduced, republished, or posted in whole or in part, in any form without the prior written consent of the author.