The Year Ahead: Vaccines, Volatility, Asymmetry, China, and Bitcoin

Weekly Macro Summary 11/15/2020

THIS IS NOT INVESTMENT ADVICE.

Please speak with a registered investment advisor or other qualified financial professional before making any investment decisions.

Commentary

On Monday, Pfizer announced that it had a vaccine ready for COVID-19 that had been shown to be effective in granting immunity to over 90% of patients in their trial with few side effects. It’s projected that by the end of the first quarter of 2021 enough doses will be available to protect 25 million Americans and by the end of Q2, the entire population.

We take care not to engage in hyperbole in our weekly summary but Monday's exuberant market reaction was one of the largest and most rapid rotations in the history of global markets. The S&P500 outperformed the Nasdaq 100 by the largest margin in over 20 years; The Russell 2000 traded “limit-up” pre-market; the 10 year Treasury yield rose 13 basis points; the KBRE regional bank index rallied 15.5%!; gold futures fell 5%, their largest single day decline since June 2013; Crude oil prices rose 8.5%; “Value” had a net return of 6.4%, the largest one-day gain since at least the mid-1980s; and the Long/Short momentum factor index fell 13.7%, its worst loss in history.

By Friday, with a vaccine on the horizon and the end of the pandemic in sight, the S&P 500 had achieved a new all-time high closing price. All of this occurred as COVID-19 cases and hospitalizations appear to be in the middle of a “2nd wave” in the US and Europe.

Chart of the Week

In the United States, as of September 24 2020, employment rates among workers in the bottom wage quartile decreased by 19.3% compared to January 2020 while employment rates for those earning over $60k have risen.

Source: Opportunity Insight

If you would like to receive the Weekly Macro Summary directly to your mailbox every Sunday, please subscribe. It’s free.

SPECIAL SECTION: STATE OF THE US ECONOMY & COVID-19

On Friday morning, James Bullard, and the St. Louis Fed, presented an update on the state of the US Economy. This section is a distillation of that presentation.

US macroeconomic news from May through October surprised dramatically to the upside.

Business sector adjustment to the pandemic has been rapid.

Monetary and fiscal policies have been exceptionally effective.

Downside risk remains substantial, national health policy will be critical to maintain economic momentum.

COVID-19 daily fatalities per 100,000 population have recently started to rise again despite being substantially below peak levels from March and April. As a result, US hospitalizations are rising.

12 states now have more than 10% of their hospital beds occupied by COVID-19 patients, a pandemic high. For now, no state is near the levels reached in the Northeast in April/May.

The most impacted state is Wisconsin with 15.5% of hospital beds occupied by COVID patients. In April, NY and NJ experienced 35-40%. In the summer, Arizona reached 27%.

The Midwest is the most impacted region. New cases rose 43% w/w through November 6.

At the current trajectory, the latest IHME model projected 38 states will exceed ICU bed capacity by February 1st and that the daily death rate would reach approximately 1900 per day through the end of January - the current 7 day average is 998.

US company second-quarter results demonstrated that, so long as simple precautions are taken, essential retail services can be provided with low risk which has allowed many firms to get back to business safely.

Going forward restrictions as a result of rising case counts are likely to be more targeted. We know a lot more about COVID-19 than at the beginning of the pandemic so, as a result, the impact on consumer confidence is likely to be much less severe than before.

National business restrictions in the US are not significantly different today from what they have been in recent months. The pick up in infection rates are probably coming more from personal interactions at the household level.

Source: St. Louis Federal Reserve

Source: JP Morgan

April 2020 is likely to have been the lowest point of the crisis.

Since then there have been substantial upside surprises in macroeconomic data releases.

Third-quarter real GDP growth, at an annualized rate of 33.1%, was the fastest on record.

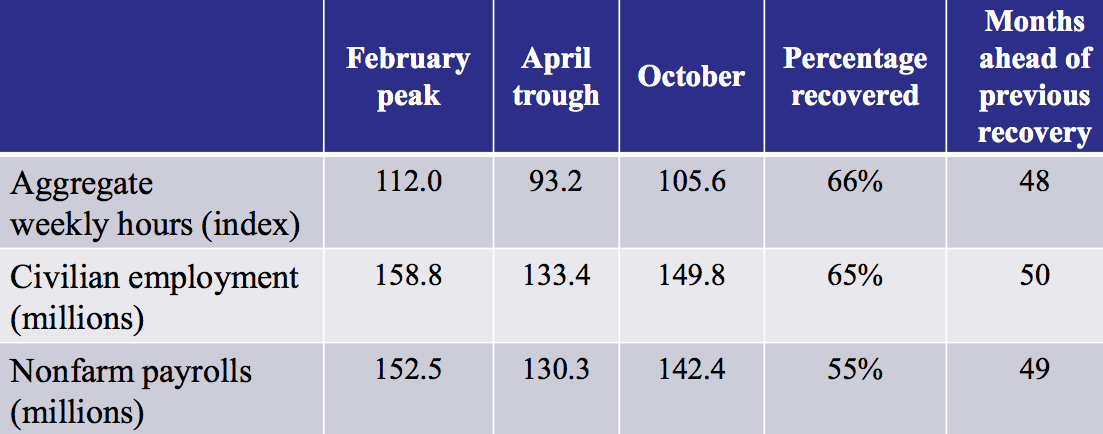

Employment has rebounded more rapidly than expected which indicates that layoffs were likely temporary as firms adjusted to the pandemic.

The temporary layoff category of unemployment has been more important in this recession compared with previous recessions.

The US labor market recovery is 48 to 50 months ahead of where it was following the 2007-09 recession.

If all those unemployed identifying themselves as, “on temporary layoff” are recalled and nothing else changes, the official unemployment rate would decline to 4.9%.

Source: St. Louis Fed

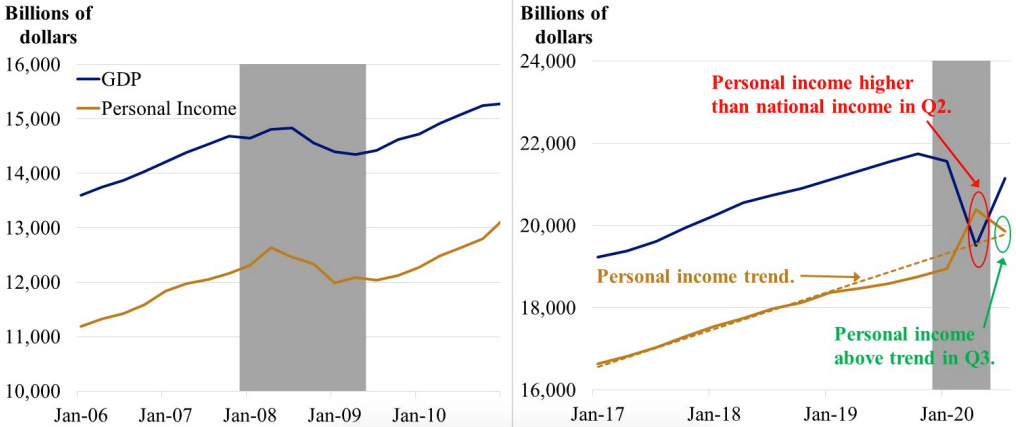

The US fiscal policy response to the pandemic has been valued at $3.2trln which is approximately 14.5% of US nominal GDP in Q4 of 2019.

The size of this response drove personal income up to an all-time high in the second quarter, the opposite of normal recession dynamics.

The actual shortfall in US real GDP for 2020 is likely to be approximately $500bln (2.5% of GDP).

Considerable resources are still pledged to combat the crisis in 2021

Source: St. Louis Federal Reserve

ECO DATA

Atlanta Fed GDPNow is currently tracking at 3.5% for Q4, unchanged from last week.

New York Fed GDP Nowcast stands at 2.86% for Q4, unchanged from last week.

US core and headline CPI were basically unchanged for the month of October, coming in lower than expected.

The trend in core CPI has moved lower since COVID. In February core CPI was up 2.4% y/y but that figure has fallen to 1.6%.

The drops in lodging prices (-3.2%) and apparel prices (-1.2%) were much larger than forecast. Lodging prices are now down to the lowest levels since February.

Producer Price Index (PPI) recorded an increase of 0.3% m/m which is lower from the previous month increase of 0.4% m/m.

Source: Citi

Source: JP Morgan

US JOLTS job openings +84k to 6.436mln in September (6.5mln expected).

September hirings -81k to 5,871k and hiring rate fell to 4.1% versus 4.2% in each of July and August.

Firing rate declined from 1.2% to 1.0% versus a pre-COVID average of 1.3%.

There has been a jump in government layoffs as a result of the end of Census work but despite that the total number of layoffs in the JOLTS report hit a new all-time low. Data goes back to December 2000.

Job postings from Indeed were down 14.0% yr/yr through the end of October.

Job quits rose 179k to 3,018k indicating rising confidence in prospects to find new employment.

Source: Wells Fargo

US initial claims better than expected 709K (735k expected).

Continuing claims in regular state programs declined 440k to 7.8mln, the lowest level since March.

The decline suggests that between 300-650k workers per week are finding work.

Source: JP Morgan

China’s October CPI +0.5% y/y, lower than +0.8% expected (-0.3%m/m).

The monthly drop was largely due to a sharp fall in food prices (specifically pork).

Source: JP Morgan

U.S. IBD/TIPP economic optimism index fell 5 points to 50.0 in November.

The economic outlook index fell to 47.0 from 54.1 in October.

The outlook on Federal policies fell to 47.3 from 52.6.

US NFIB small business optimism index unchanged at 104.0 in October, but uncertainty index rose 6 points to 98 which is the highest uncertainty reading since November 2016.

Expectations fell to 27% from 32%.

Plans to hire fell to 18% from 23%.

Those expecting higher sales increased to 11% from 8%.

Expectations for higher selling prices up to 15% from 13%.

Source: NFIB

Germany ZEW Indicator of Economic Sentiment fell 17 points from October down to 39 versus consensus expectations of 44. The slump coincides with the re-introduction of lockdowns as a result of worsening COVID figures.

Australian business confidence increased sharply in October, from -4 to +5, highest level since May 2019.

US November Consumer Sentiment Survey, Preliminary: -5pts to 77 (82 expected).

“The outcome of the presidential election as well as the resurgence in COVID infections and deaths were responsible for the early November decline.”

“Net declines in household incomes were reported in early November for the first time since March 2014, with the largest net declines reported by lower income households and those aged 65 or older. Job and income declines due to the COVID resurgence will diminish holiday purchases among lower income households, especially since no extension in federal jobless benefits and other income supplements are expected before year-end.”

Source: JP Morgan

Personal bankruptcies are projected to fall this year to 560,000, the lowest number since 1985, said Ed Flynn, an editor at the American Bankruptcy Institute Journal, citing data collected by the Administrative Office of the U.S. Courts. But next year that total could climb to over one million, he said.

Household debt is up by 13% since the financial crisis of 2008, and most of that increase is coming from student and auto loans, according to data from the Federal Reserve.

Job posting data as of November 9, 2020 shows a surge for the Transportation and Storage sector, creating a larger divergence between Tourism, Art and Entertainment, and other sectors shown below.

Source: ZipRecruiter

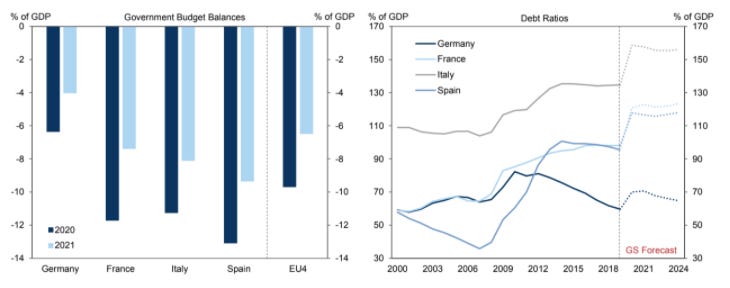

The COVID pandemic has caused many European countries debt-to-GDP ratios to rise quickly. Goldman Sachs research estimates that the deficits in Italy and Spain could spike to -9.7% and -11.6% in 2021.

Source: Goldman Sachs

CENTRAL BANKS

ECB Governor Rehn reiterated that the central bank’s December meeting would be about finally deciding in what form further accommodation would be provided: “which instruments, in which scale and duration.”

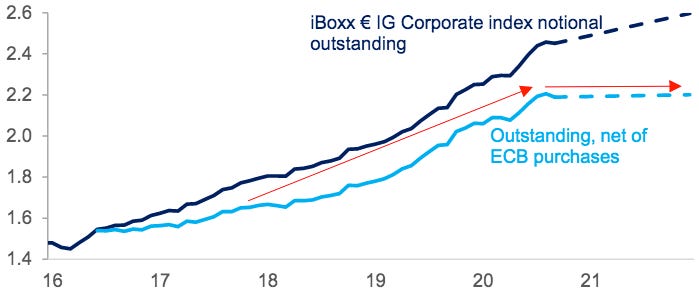

At the ECB Forum on Wednesday, participants clearly preferred 1.) Pandemic Emergency Purchase Program (PEPP) that purchases both public and private sector securities. 2.) Targeted longer-term refinancing operations (TLTROs) that offer banks inexpensive financing from which they can make make loans into the broader economy. ECB President Lagarde specifically addressed the importance of the duration of the programs being offered. Expect the ECB to continue to provide stimulus for a long time to come. In effect, the governing council has pre-announced more easing for December. Economists at Goldman forecast net purchases of securities until at least through 2023 and a first rate hike some time in 2025.

The current reintroduction of lockdowns in Europe have again halted consumption and slowed economic activity. The slowdown related to COVID means stimulus is not likely to help the economy due to the lack of activity and the potential credit risks that result from businesses being closed.

Source: Citi

Source: Goldman Sachs

U.S. Federal Reserve Bank of Dallas President Robert Kaplan says “the jury is out on the fourth quarter because of the resurgence of the virus.”

Kaplan sees U.S. 3.5% growth for GDP next year but it will be back-end loaded. It’s an open question how much scarring the U.S. economy suffers as a result of the pandemic and what harm that does to the country’s long-run growth potential, says Kaplan.

FIXED INCOME, CURRENCIES, COMMODITIES

Social bond issuance has soared in 2020 as interest in ethical investment rises.

Issuance of social bonds, which channel proceeds to specific socially beneficial projects has increased to $71.9bln in October, jumping nearly 4x this year so far according to data from Bloomberg.

These numbers paint a clear picture and show us a growing investor interest in funding social project that address rising unemployment, income inequality, and strains on housing, health care and various other vital systems.

Source: Bloomberg

Zambia is set to be Africa’s first sovereign default since the onset of the pandemic after missing a payment of more than $40mln last month.

The country reported that it will not be able to pay its $42.5mln interest obligation due Friday and has asked the bond holders of its $3bln Eurobon to suspend interest payments for six months.

Zambia is not the only country facing these difficulties. According to the IMF and World Bank, 11 sub-Saharan African countries are currently at high risk of debt distress and six sub-Saharan African countries are currently in distress

Source: IMF

Bitcoin continued its rally this past week after surpassing $16k, its highest level since 2018.

Bitcoin is now +123% YTD and +50% QTD as of November 12, 2020.

As discussed in last week’s publication, Bitcoin has greatly benefited this year from positive institutional and retail adoption.

The pandemic has also created a narrative in which some investors are worried about global inflation resulting from unprecedented monetary and fiscal stimulus. This has been another catalyst behind Bitcoin’s rise.

After a cash crisis in 2016 and shortages through 2018, India has embraced mobile payments.

“Mobile money has taken deep root in both sub-Saharan Africa and Asia, providing financial services to the underbanked and unbanked populations in these regions.”

Digitization of payments, led to companies introducing other products including: lending and credit, insurance, and pensions alongside banks.

Google currently holds the largest share in the space, entering in 2017.

China Construction Bank (CCB), the world’s second-biggest bank is set to issue $3bln in bonds tradable using Bitcoin after partnering up with Hong-Kong based fintech company Fusang.

According to South China Morning Post, the $3bln digital certificates of deposit are set to be traded on a digital exchange in Labuan, Malaysia.

This will be the first digital security issued by a Chinese bank on the blockchain technology.

The issues will be issued with a three month maturity and a minimum notional value as low as $100 each. They will offer approximately 0.75% interest.

OPEC’s Monthly Oil Market Report released on Wednesday trimmed its global oil demand forecasts for the remainder of 2020 and 2021, highlighting a weaker-than-expected economic outlook as a result of the recent surge in coronavirus cases.

World oil demand is now expected to be around 9.8mln bpd y/y in 2020, a downward revision of 0.3mln barrels from last month’s publication.

2021 oil demand growth is expected to rise by 6.2mln, a downward revision of 0.3mln barrels from last month’s report.

“These downward revisions mainly take into account downward adjustments to the economic outlook in OECD economies due to COVID-19 containment measures, with the accompanying adverse impacts on transportation and industrial fuel demand through mid-2021.”

Source: OPEC

US crude oil refinery inputs averaged 13.4mln b/d during the week ending November 6, 2020, -105k b/d from previous week.

US crude oil imports averaged 5.5mln b/d, +474k b/d w/w.

The four week average of crude oil imported is down 12.6% vs same time last year.

EQUITIES

As of this writing, 92% of S&P 500 have reported Q3 earnings.

84% of companies have reported a positive EPS surprise (versus a 5-year average of 73%)

78% of companies have reported a positive revenue surprise (versus a 5-year average of 61%).

Despite beating expectations, earnings and revenue are down 7.1% y/y and 1.6% y/y, respectively, for Q3

The forward 12-month P/E ratio for the S&P 500 is 21.6 versus a 5 year average of 17.3 and a 10 year average of 15.6.

India’s Tata Consultancy Services (TCS) announced it will acquire Postbank Systems (PBS), an operations and business consulting arm of Deutsche Bank for one euro, saving approximately 1,500 jobs from Deutsche restructuring.

Per the filing: “100 per cent of the shares will be acquired by TCS Netherlands BV (a subsidiary of TCS).” Significant assets and pass through contracts will be sold to Deutsche.

TCS is the fastest growing IT service company in Germany

Acquisition expected to add $310mln in revenue in 2021.

US federal and state prosecutors are pushing Google to split with its Chrome internet browser. The move could challenge the ad supported, free-to-use business model.

Browser hosts about ⅔ of the world's web traffic per Statcounter.

One problem regulators face is that they may end up pushing Chrome into the arms of other monopolies, i.e. Microsoft.

Chrome is the last major browser that does not yet automatically block third party cookies, earlier this year it was announced that they will follow the lead of other browsers within two years.

The reluctance to block cookies is because of Chrome’s targeted ad algorithms that track user behaviors to present relevant ads.

“As disruptive as nixing cookies would be for Google’s business, it would wreak far more havoc for third-party advertisers and the websites that depend on them for revenue.” Sinan Aral, MIT marketing professor

Such a direct attack at Google’s business model could be a troubling precedent for Silicon Valley as free services at the cost of advertisers has become a popular model over the past decade.

GEOPOLITICS

We cannot emphasize the importance of China’s actions in recent weeks. While the world is focused on the US Election and COVID-19, China continues to engage in inflammatory behavior demonstrating a desire to consolidate power in the Asia Pacific region. Last week, China forced out four Hong Kong lawmakers who were supporters of independence and labeled them an endangerment to national security.

An additional 15 law makers announced their resignation in response. The remainder of the legislator is populated almost exclusively by pro-CCP members.

Latest move ensures that official avenues of CCP opposition are no longer an option.

Elections were previously postponed, citing pandemic concerns, following a condemned local district election last November.

UK proposed the National Security and Investment (NSI) Bill to block mergers and acquisitions from foreign investors they believe compromise national security. The bill is primarily meant to protect UK industry from Chinese power.

Debates about Chinese influence have sparked a number of similar proposals across western countries including most recently Australia and the EU. China has also put in place its own foreign investment laws in 2019.

While China came to Europe’s rescue during the debt crisis in 2009, preventing numerous bankruptcies, tensions are on the rise as the UK and Germany find Chinese investment to be a security threat.

COVID shutdowns have created distressed situations for many corporations creating fears that China will use the opportunity to deploy capital and expand its influence.

Terms: “Foreign investors looking to buy British companies and intellectual property, or other assets in 17 key industries, will have to alert a new team of regulators within the Department for Business, Energy, and Industrial Strategy called the Investment Security Unit. The unit will assess prospective investments within 30 days and either green-light them or impose conditions.”

“If directors of foreign companies don’t follow those rules they could face jail time and fines of up to 5% of annual turnover, or a single fine of £10 million. If a transaction that is subject to mandatory notification isn’t cleared by regulators, it will be “legally void.” Controversially, the Investment Security Unit will have the power to review transactions up to five years after they take place, starting from the moment the NSI Bill becomes law.”

PUNDITRY

Goldman Sachs Top Ten Market Themes for 2021:

1. Vaccine-led Recovery to Lift Cyclical Assets

Global economic recovery to broaden and deepen next year.

Cyclical assets do not fully reflect the firm’s forecast of sustained expansion.

Policymakers will welcome, not prevent, easier financial conditions.

2. Navigating the Path

Market may look through weakness if medium-term (vaccine) news is solid but this creates a worse asymmetry for assets further out.

Despite a robust 2021, near-term risks from lockdowns and the “wait” for fiscal support.

Still vulnerability to “spot” risks in the next few months.

3. A Steeper Real Yield Curve

Expect a steeper nominal yield curve in the US and a much steeper real yield curve as breakeven inflation rises further which should fuel further USD weakness which should fuel further USD weakness.

Negative rates still unlikely, but weak inflation should limit upside for yields outside US.

4. Europe: Two Steps Forward, One Step Back

Policy actions in 2020 mean European assets offer better asymmetry than in the past.

Lockdowns mean Europe should underperform over the near term.

For now, pro-cyclical trades are better expressed in other regions.

5. China: Forging Ahead, with Assets in Tow

After a long cycle of underperformance, China growth to stay ahead in recovery.

China assets under-credited for that shift.

CNY (and North Asia FX) strength can extend further as renewed trade surpluses warrant more appreciation.

6. A New Commodity Bull Cycle

Structural underinvestment plus demand boosts from a vaccine-led recovery.

High oil inventories mean that upside may emerge more clearly after the winter

Non-energy commodities (metals and ags) have more near-term upside.

Commodity equities, credit, and related FX will be inferior expressions of the view.

7. EM Outperformance: More than Before, Less than Sometimes

EM asset recovery demonstrates value mostly in cyclical and commodity exposures.

Potential for forces—cyclicality, commodities, valuation, China—to come together, so scope for broader outperformance for the first time in years.

8. Rotations: Cyclical, North Asia in Focus but Vaccine News Key to Near Term

Cyclicals to outperform defensives in the base case.

North Asian markets have a favorable mix of exposures.

Macro forecast shifts generally more beneficial to “value” than “growth” but a clear rotation may need a sharper rise in real yields.

9. In Search of New (and Old) Safe Havens, Hedges and Diversifiers

Government bonds will be less effective as diversifying assets.

FX offers alternatives as do the more developed markets of EM rates.

Equity risk replacement or reallocation may help.

At higher yields, long-dated Treasuries could quickly regain hedging value.

10. Risks from Corona and Beyond

Health outcomes still the biggest risk.

Persistent lockdowns could amplify risks of corporate and fiscal “scarring” and might see renewed focus on European and EM sovereign tails.

Uncertainties over fiscal path and Senate outcome remain.

A stronger recovery could reintroduce rate and re-leveraging risk.

Legal Information and Disclosures

This weekly summary expresses the views of the author as of the date indicated and such views are subject to change without notice. The author has no duty or obligation to update the information contained herein. Further, the author makes no representation, and it should not be assumed that past investment performance is an indication of future results.

Moreover, wherever there is the potential for profit there is also the possibility of loss.

This weekly summary is being made available for educational purposes only and should not be used for any other purpose. The information contained herein does not constitute and should not be construed as an offering of advisory services or an offer to sell or solicitation to buy any securities or related financial instruments in any jurisdiction. Certain information contained herein concerning economic trends and performance is based on or derived from information provided by independent third-party sources.

The author believes that the sources from which such information has been obtained are reliable; however, it cannot guarantee the accuracy of such information and has not independently verified the accuracy or completeness of such information or the assumptions on which such information is based.

This weekly summary, including the information contained herein, may not be copied, reproduced, republished, or posted in whole or in part, in any form without the prior written consent of the author.