THIS IS NOT INVESTMENT ADVICE.

Please speak with a registered investment advisor or other qualified financial professional before making any investment decisions.

Commentary

In the United States, democrats now have control of the Senate (via a tie-break by the new Vice President). The completion of the, “Dem Sweep” reduces the likelihood of legislative gridlock and clears the path for significant fiscal expansion. On Friday, President-elect, Joe Biden, repeated his call to boost stimulus payments for Americans to $2,000 from the $600 that was passed in the stimulus bill from December. Soon-to-be Senate majority leader, Chuck Schumer, confirmed the likelihood of the boost in stimulus payments after he called it a priority for his agenda. Economist forecasts are estimating another $1trln of stimulus to be passed in the coming months, this is in addition to the $900bln passed in December. In response, the stock market continues to boom led by the Russell 2000 which is up nearly 6% so far for 2021. Our chart of the week shows a significant pickup in COVID related lockdowns globally as the virus’s spread and hospitalizations reach a new peak. Why are risk assets looking through this? Having dealt with a first wave and having become accustomed to COVID’s economic impact, countries have found ways to continue to operate with a work from home environment. In fact, in the United States, the unemployment rate for those earning over $60k per year has gone down since February 2020.

Chart of the Week

If you would like to receive the Weekly Macro Summary directly to your mailbox every Sunday, please subscribe. It’s free.

ECONOMIC DATA

Atlanta Fed GDPNow is currently tracking at 8.7% for the fourth quarter of 2020. The BEA will release their first estimate of the official Q4 2020 GDP estimate on Jan 28.

New York Fed GDP Nowcast is currently tracking at 5.5% for Q1 of 2021.

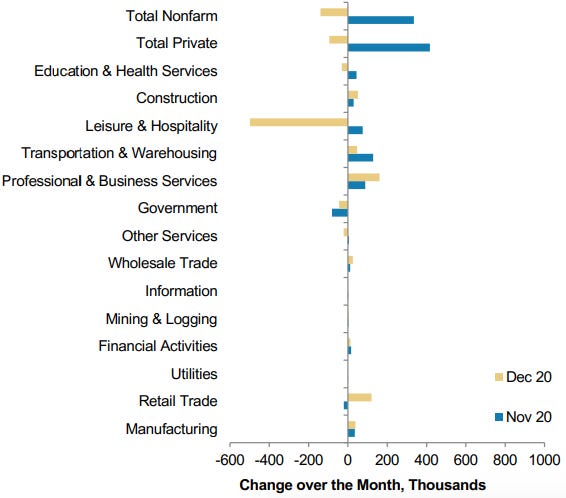

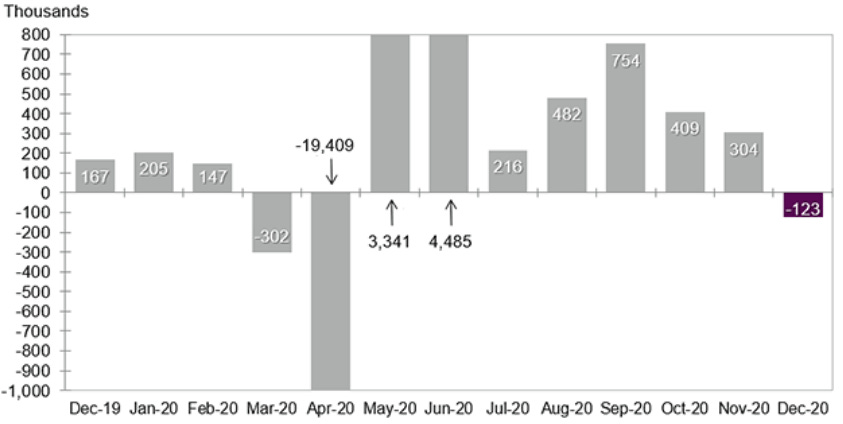

US Nonfarm payrolls -140k versus +50k expectations. Unemployment rate unchanged at 6.7%. The shortfall in jobs was the result of significant weakness in COVID sensitive sectors. Excluding leisure and hospitality jobs, payrolls rose by 403k in December with a decent breadth of industries adding jobs. It appears that the jobs lost were more permanent than temporary.

The prior two months saw upward revisions that totaled 135k and permanent unemployment fell in December by 348k, the largest one-month decline since Dec 2010.

Restaurants -372k, hotels -24k, recreational industries -92k.

US December ADP employment saw a -123k decline in private employment, a significant disappointment versus expectations of a 75k increase.

The decline was wide spread across manufacturing (-21k) and service-providing jobs (-105k).

US ISM services at 57.2 points in December, up from 55.9 in November and stronger than expectations for 54.5.

The data corroborates the strength in services employment we saw from the employment situation report.

14 out of 18 sectors are in expansion and those in contraction are COVID sensitive.

US December ISM manufacturing report rose 3 points to 60.7 in December (Forecast was 57.5). 8th consecutive month of expansion and the highest reading since Aug 2018.

Employment back above 50 at 51.5 versus 48 previously.

New orders now at the highest level since 2004.

Prices paid now at the highest level since May 2018.

“It is not shocking that the ISM figures would attain such heights in 2020, as the economic rebound after the lockdowns in the spring was unprecedented. However, it is stunning that the December figure was the highest of the year, exceeding the initial bounceback in the spring and summer and surging in the face of the intensifying virus spread.” - Stephen Stanley, Amherst Pierpont

Sweden’s manufacturing PMI for December 64.9 versus 59.8, the highest level in 10 years, export orders printed the strongest reading since 2004.

Switzerland’s manufacturing PMI +3 to 58.0, the highest level since Sep 2018.

Why these matter: The combination of strength from Sweden and Switzerland’s manufacturing PMIs suggests the recovery in Asia continues to be strong and bolstering export oriented countries in Europe.

Korea’s December export growth +12.6% y/y versus +6% expected. Confirmation of the aforementioned strength in Asia.

Semiconductor exports +30% y/y, highlighting strength in the sector.

German new factory orders +2.3% m/m versus consensus expectations of -0.5%, the country has seen persistent strength in its industrial sector. This is additional confirmation of the narrative seen above regarding Asian economic strength.

Germany’s imports and exports came in stronger than expected in November, +4.7%m/m and +2.2%m/m respectively.

November euro area retail sales -6.1% m/m, below the expectations of -3.4% on the back of reintroduction of lockdowns.

CENTRAL BANKS

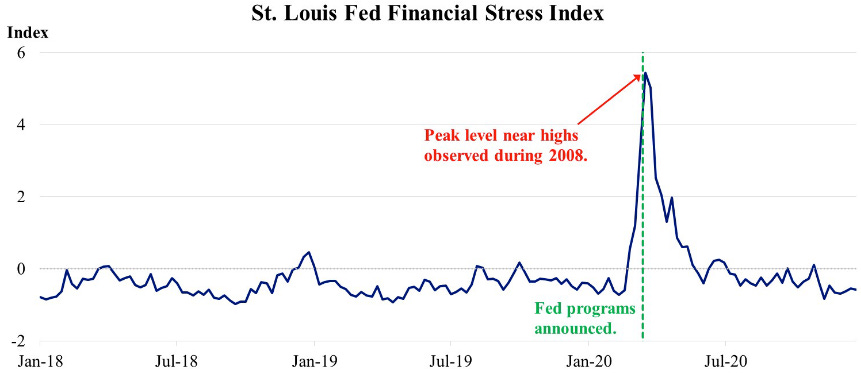

St. Louis Federal Reserve Chairman, Jim Bullard, delivered a presentation entitled, “The Pandemic Endgame Begins”.

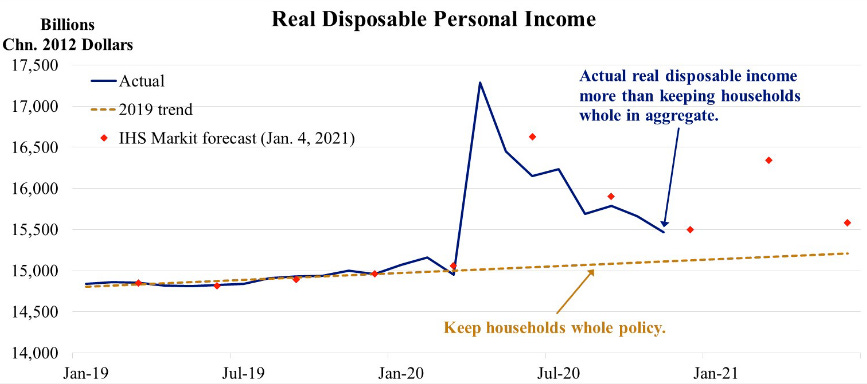

US total fiscal policy response was valued at about $3.148trln while the actual shortfall in US real GDP will likely be closer to $400bln - $500bln. There’s an additional $900bln of stimulus that was just signed into law that will be enacted in 2021.

As a result of the fiscal policy response, personal income was at an all-time high in the second quarter, the opposite of normal recession dynamics.

It appears that Apr 2020 will prove to be the lowest point of the crisis and that Q3'20 real GDP growth was the fastest on record.

For the Q4 2020, GDP looks to have grown above-trend pace

Employment has rebounded more rapidly than expected. This supports the idea that many layoffs were temporary as firms adjusted to the pandemic.

“If all those unemployed identifying as ‘on temporary layoff’ are simply recalled and nothing else changes, the official unemployment rate would decline to 5.0%.”

“If the ‘on temporary layoff’ category returns to a normal value (~1mln workers) and nothing else changes, the official unemployment rate would still decline to 5.6%”

“TIPS-based breakeven inflation, based on CPI inflation measures, could move considerably higher and still be consistent with a PCE inflation outcome modestly above the 2% target”

The ECB released the details of its asset purchase program (APP) purchases for December. Net purchases were €21.1bn.

The Pandemic Emergency Purchase Program (PEPP) net purchases were €57.2bln for December bringing the total for the program to €757bln.

The two programs combined have approximately €1.4trln of remaining purchasing power through Mar 2022.

Fed Vice Chair Clarida delivered a speech entitled, “U.S. Economic Outlook and Monetary Policy”.

“While the recent surge in new COVID cases and hospitalizations is cause for concern and a source of downside risk to the very near-term outlook, the welcome news on the development of several effective vaccines indicates to me that the prospects for the economy in 2021 and beyond have brightened and the downside risk to the outlook has diminished.”

“My economic outlook is consistent with us keeping the current pace of purchases throughout the remainder of the year” and “I myself would have no inclination or think there’s any need to think in the near term about adjusting the duration of the maturity of our purchases”

FIXED INCOME, CURRENCIES, COMMODITIES

The US 10 year yield rose above 1% for the first time since the beginning of March 2020. It finished the week at 1.13% up from 0.93% on 12/31/20. The 30 year yield also rose 22 basis points and finished the week at 1.87%.

The rise is in response to prospects for significant additional stimulus as a result of the Georgia state election.

The yield curve has steepened as rates have risen. The spread between the five-year and thirty-year treasury yield is the widest since Nov 2016.

Corporations are issuing debt at a blistering pace in the first days of 2021 as they attempt to get ahead of expectations that yields will continue to rise from here.

Already, $50bln of investment grade debt has been underwritten in January.

Rising interest rates and a steeper yield curve have historically correlated with stronger bank stocks. The financial sector has risen nearly 5% so far in January versus the S&P 500’s 2% rise.

Bitcoin is rallying. Again. This past week it reached new all time highs. Again. The world’s most popular cryptocurrency rose above $40,000 on Thursday.

The value of every cryptocurrency combined, including Bitcoin, Ethereum, Tether, etc. now have a total market value of exceeding $1 trillion.

This milestone market value comes on the back of continuous institutional adoption of crypto as an asset class

Oil rose $4/barrel (~8%) this past week as stockpiles declined after a busy holiday season and energy companies shuffle around their oil in storage to avoid tax bills.

Oil & Gas traders believe a Biden administration will crack down on US oil production, increasing regulations. Driving the price of oil up, Brent crude is now trading near $54.74 a barrel.

This past week, OPEC, Russia and other producers agreed to keep production steady while Saudi Arabia agreed to voluntarily cut oil production by 1 million barrels per day (bpd) in February and March.

Energy stocks are up just over 9% to start 2021.

EQUITIES

From the Wall Street Journal: "U.S. special-purpose acquisition companies (SPACs), which are publicly traded shell companies that use the money raised from an initial public offering to merge with another company, raised $82 billion in 2020—more than all the funding previously raised by SPACs."

9 days into 2021 the SPAC market has already seen 28 deals, marking it the 5th largest year out of the previous 13 years. That's 5.6 SPAC deals a day for the first 5 trading days of 2021.

Micron Technology, Inc. reported Q1 results for fiscal year 2021. Topping analysts estimates, the stock rose 1.5% after hours, after a 2.6% rise during normal trading hours to $79.11.

Micron’s main products are DRAM and NAND memory chips. DRAM is commonly used in PCs and servers, while NAND chips are used in smaller devices such as USB drives or digital cameras.

Revenue of $5.77 billion versus $6.06 billion for the prior quarter and $5.14 billion for the same period last year.

Net Income was $803 million, or 71 cents a share compared to $491 million, or 43 cents a share, a year ago.

Chief Executive Sanjay Mehrotra said: “Cloud is the long-term secular demand driver for our industry and, again, it is the trend of AI and ML and the workloads that are requiring more memory.”

On Wednesday, the New York Stock Exchange announced it will move ahead with plans to delist shares of three Chinese state-owned phone carriers under an executive order from the President.

China Telecom Corp. Ltd., China Mobile Ltd., and Hong Kong Ltd., will be suspended on Jan 11th.

The executive order signed by Trump restricts Americans from investing in securities issued by companies deemed to be linked to the Chinese military.

The Chinese government said the executive order was unjustifiable and limits competition. China warned that Trump’s order would hurt U.S investors domestic and abroad.

GEOPOLITICS

It’s been reported that 53 pro-democracy politicians and activists were arrested in Hong Kong.

The biggest crack down so far under the new national-security laws imposed by China in June.

Police also arrested an American human-right lawyer, John Clancey. He had been a critic of the recent laws and actions taken by the mainland to dissolve the long standing, “one country, two systems” policy for Hong Kong.

Billionaire and Alibaba founder, Jack Ma, is rumored to be missing. He has not been seen publicly for months in the aftermath of a speech he gave in October pushing back on criticism from Chinese financial regulators.

President Xi Jinping is rumored to have called off Alibaba’s IPO of its affiliate, Ant Group, in what was believed to be a push to align private companies with the states’ goals and interests.

Trade tensions continue to rise between Australia and China as Chinese cities go dark and Australian economy continues en route to contraction.

An unofficial ban on Australian coal has led to a sharp increase in the local coal price. China previously asked its power plants to limit coal imports for pricing control, a restriction that was eventually lifted with an exception in place for Australia, leading to city blackouts across mainland China.

China is the world’s largest coal consumer, its greatest source being Australia.

Australia’s economy was badly hit in 2020. Last year began with massive wildfires across the country followed shortly after by the pandemic. Australia now faces up to a 2.8% (Source: Capital Economics) contraction following these escalated trade tensions against China, one of its largest trading partners.

Highlights: China makes up 39.4% of goods exports, 17.6% of services exports (2019-2020), and is Australia’s second largest buyer of thermal coal.

The goods and services on China’s expanding tariff radar form nearly a quarter of Australia’s exports to China.

PUNDITRY

Goldman Sachs, “Risks to Global Growth from the New Virus Strain”

“Likely rapid spread in many countries. The new contagious strains are likely to spread quickly in most countries that do not have very strong prevention and containment strategies in place.”

“High virus spread for longer. The more infectious variant could increase virus spread in coming months in many countries. Looking further ahead, it could keep virus spread high for longer than previously expected.”

“Mixed effect on vaccination speed. A more contagious virus has an ambiguous effect on vaccination speed.”

“Near-term risk of additional restrictions and a higher vaccination bar to ease restrictions. A recent study in the Lancet estimates that offsetting a 0.5-0.6 increase in the reproduction number might require a “hard lockdown” consisting of school and workplace closures, bans on public events and gatherings of more than 10 people, internal movement limits, and stay at home requirements.”

A higher bar for herd immunity.

“Some downside tail risk of forced re-vaccination campaigns over the longer term. While coronaviruses mutate relatively slowly, evolutionary pressure from widespread transmission (and possibly plasma- and antibody treatments) implies that we cannot rule out a downside tail scenario where countries would be forced to rapidly re-vaccinate their populations with adjusted vaccines at some point if the efficacy of existing vaccines against new strains dropped sharply.”

Feedback

Thank you for subscribing to the Primary Dealer Review. If you have any questions or comments, please email me directly at primarydealer@weeklymacro.com and I will get back to you.

Do you know someone who would like to receive this publication? Please feel free to share the Weekly Macro Summary with them.

Legal Information and Disclosures

This weekly summary expresses the views of the author as of the date indicated and such views are subject to change without notice. The author has no duty or obligation to update the information contained herein. Further, the author makes no representation, and it should not be assumed that past investment performance is an indication of future results.

Moreover, wherever there is the potential for profit there is also the possibility of loss.

This weekly summary is being made available for educational purposes only and should not be used for any other purpose. The information contained herein does not constitute and should not be construed as an offering of advisory services or an offer to sell or solicitation to buy any securities or related financial instruments in any jurisdiction. Certain information contained herein concerning economic trends and performance is based on or derived from information provided by independent third-party sources.

The author believes that the sources from which such information has been obtained are reliable; however, it cannot guarantee the accuracy of such information and has not independently verified the accuracy or completeness of such information or the assumptions on which such information is based.

This weekly summary, including the information contained herein, may not be copied, reproduced, republished, or posted in whole or in part, in any form without the prior written consent of the author.