The Semiconductor Surge

01/24/2021

THIS IS NOT INVESTMENT ADVICE.

Please speak with a registered investment advisor or other qualified financial professional before making any investment decisions.

Commentary

Over the last year, we have covered the rapid rise of technology, accelerated by the Covid-19 pandemic. In recent news, Taiwan’s exports have rapidly risen, with technology and semiconductor exports up 30% over the prior year in each of the last two months. Investors are taking notice, with US semiconductor stocks up 10% in 2021 alone.

Morgan Stanley’s Chairman of Global Semiconductor Investment Banking, Mark Edelstone, is focused on a few key trends, highlighted below:

Acceleration of the move by companies from their own computer infrastructures to cloud services is expected to continue post-pandemic. “We are only about 10 percent of the way there in terms of what can move to the cloud.”

“I think [post-pandemic] we will increasingly see semiconductors as a core competency for companies. They start with software, develop a chip to drive it, and go to market as a systems company.”

What We’re Watching: Who’s investing in R&D, are those investments in next-gen technologies, and have they continued to invest. As Gordon Moore, Intel’s co-founder once said, “You can't save your way out of a recession,” and we take the same view for this industry with the current pandemic. Slowing down means falling behind, and we’re closely following those who aren’t.

Chart of the Week

McKinsey Semiconductor Segment Revenue - Pre-Covid and Current Forecasts

If you’d like to support the ongoing publication of the Weekly Macro Summary, please share the publication with one of your friends or colleagues. Thank you for your readership.

ECONOMIC DATA

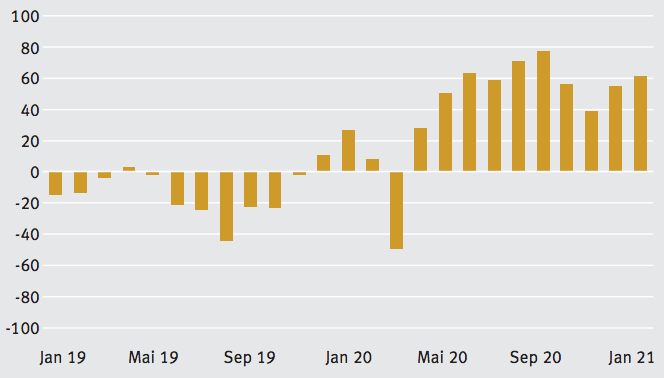

Goldman Sachs, “The Re-opening at a Glance”, % change y/y for week ending January 17th

US Existing Home Sales increased +0.7% to 6.76 million in Dec 2020, beating forecasts of 6.55 million.

Median existing-home price was $309,800, +12.9% YoY.

Total housing inventory was 1.07 million units, -16.4% from November and -23% YoY.

Unsold inventory remains at an all-time low.

Existing home sales hit 5.64 million, the highest level since 2006, for all of 2020.

Lawrence Yun, NAR's chief economist: "This momentum is likely to carry into the new year, with more buyers expected to enter the market. Although mortgage rates are projected to increase, they will continue to hover near record lows at around 3%. Moreover, expect economic conditions to improve with additional stimulus forthcoming and vaccine distribution already underway."

US Markit Manufacturing PMI indicator for January up to 59.1 from 57.1 in December, 3 points higher than the consensus forecast.

Output increased to 60.5 from 58.3.

New orders to 59.5 from 56.5.

Employment up to 54.8 from 52.2.

Services PMI rose to 57.5 in January from 54.8 also stronger than expectations of 53.

Philadelphia Fed manufacturing surprises, rising 15 points in January to 26.5. Consensus was for an unchanged reading.

The rise was broad-based. New orders +28 points, employment +17 points, prices paid + 20 points, shipments +11 points, inventories +5 points, delivery times +13 points.

Australian consumer sentiment -4.5% m/m retraces previous month's gain.

Despite the retracement the index is still above its long-run average level and consumer sentiment remains at positive levels.

The weakness reflects a combination of increases in virus cases in Dec/Jan and the resulting economic restrictions.

German’s January ZEW indicator of economic sentiment was stronger than forecast, 62 vs 59 expected.

Current conditions were -66 due to continued impact of COVID restrictions.

Participants expect better economic environment for the next 6 months.

Germany's vaccine rollout recently reached 1 million doses administered.

Taiwan’s December export order growth +38.3% y/y and now at a record high of $60.6bln.

Tech product demand +30%y/y after +30%y/y in November.

The Ministry of Economics sees January export orders rising between 44.5% and 48.7% y/y.

In the past two weeks we have covered the remarkable strength in Asian exports which indicates a significant pickup in economic activity in Q4.

Retail sales in Canada +1.3% m/m in Nov 2020, the 7th consecutive monthly gain.

Led by sales of food and beverages +5.9% and e-commerce sales at +2.7%.

Motor vehicle and parts dealers sales -0.9%, down for the first time since April.

Core retail sales (excludes gas stations) +2.6%.

CENTRAL BANKS

Reuters reported that The Bank of Japan (BOJ) will discuss ways to scale back their ETF purchase program as well as review its yield curve control (YCC) policy that caps interest rates across the government bond market. Under the YCC program, the BOJ guides short-term rates to approximately -0.1% and buys enough government bonds to keep the 10-year yield around 0%.

Policymakers’ are reportedly concerned about the size of the bank’s ETF holdings which currently stand at $337bln. This accounts for 80% of the country’s ETF market.

The BOJ will also consider allowing super-long interest rates to rise more.

The changes being considered are all intended to give the BOJ more flexibility and ammunition in the event of an economic downturn. With risk assets performing so well, the bank has internally discussed whether such significant ETF purchases are currently needed in order to provide accommodation.

“The move highlights how years of heavy-handed intervention has left the market reliant on the BOJ, essentially making the central bank a victim of its own success in terms of controlling market moves.”

Sources for the article who are familiar with the BOJ’s thinking said that, “Prolonged easing has made markets rigid and complacent, so the BOJ needs to change that.”

“The key is to heighten flexibility in the BOJ’s policy so it can respond to any big shock effectively.”

“There are questions on whether the BOJ needs to buy so much ETFs when stock prices are booming.”

“There’s room to make the BOJ’s ETF buying more flexible.”

“The BOJ wants to give itself more leeway on policy and dispel market concern its policy is unsustainable...But the communication strategy will be tricky.”

The ECB monetary policy decision was boring with no changes to policy and no surprises.

Rates were unchanged, the asset purchase program will continue at €20bn per month, and no changes to PEPP or TLTRO commitments.

Economic outlook was broadly unchanged but noted positive developments from Brexit deal and vaccinations.

Bank of Canada (BoC) leaves interest rate policy unchanged (as expected) and made no modifications to the asset purchase program.

Economic projections in its January Monetary Policy Report improved, in line with expectations.

While the economic outlook improved in the most recent economic forecasts, the BoC believes that the necessary conditions for a rate change would not come, "until into 2023."

The 4Q 2020 Euro area bank lending survey showed a net tightening of credit standards for loans to firms and households.

Primarily driven by banks’ perception of uncertainty surrounding the economic recovery restrictions.

Banks’ cost of funds and balance sheet situation did not contribute to the tightening.

FIXED INCOME, CURRENCIES, COMMODITIES

Major dry ice manufacturers are predicting a US dry ice shortage as vaccines take priority over standard uses.

COVID-19 vaccines have been developed. The next hurdle is efficient and safe distribution. Part of the safe distribution is making sure the vaccines are stored at their respective optimal temperatures: Pfizer-BioNTech at -70°C (-94°F) and Moderna -20°C (-4°F). The best method for doing so (so far) has been through freezers and dry ice.

This shortage can have a heavy impact on unexpected commodities, including cheeses and other perishables. “One of the things that's specifically a concern for Minnesota and the Midwest and Wisconsin is dry ice is used extensively to ship cheese cultures.” -Tim Walz, Minnesota Gov.

Small businesses focusing on fresh or pre-prepared food deliveries as well as other, less urgent, pharmaceuticals, may also suffer from the shortage.

EQUITIES

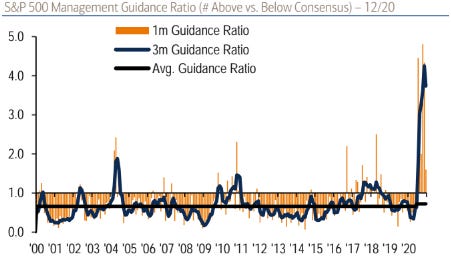

Earnings season has had a strong start. As of this writing, 13% of S&P 500 components have reported earnings.

86% have reported a positive EPS surprise and 82% have reported a positive revenue surprise. Total upside surprise for earnings has been +22% relative to expectations.

Total revenue for the companies that have reported were +0.7% y/y but total earnings, so far, are down 4.7% y/y for Q4.

A strange dynamic at play so far this earnings season, via Factset, “Companies that have reported positive earnings surprises for Q4 2020 have seen an average price decrease of -1.2% two days before the earnings release through two days after the earnings release...companies that have reported negative earnings surprises for Q4 2020 have seen an average price increase of +0.2% two days before the earnings release through two days after the earnings.”

The next two weeks will be the most active for earnings releases. 36% of S&P500 components will be reporting this week and 21% will report during the week of February 1.

The Nasdaq reached new all time highs, again, this past week. US Semiconductor stocks are leading technology higher. Those companies’ shares are up approximately 10% so far in 2021, outperforming the S&P 500 by almost 8%. The key drivers of the notable performance are:

Taiwan Semi announced a 54% y/y increase in capital expenditures. This amounts to a $28 billion investment to increase the capacity at its plants. This is a significant nod of confidence from TSM regarding their belief for the demand outlook going forward.

“Usually, historically, when you see TSMC’s capital expenditure numbers, it’s a good leading indicator of how they are seeing demand...they are very conservative about their capital expenditures number. They’re not going to be overly aggressive.” -Vontobel Asset

Global chip shortages: Vendors have highlighted chip shortages with lead-times for supply in excess of 9 months. Microchip and NXP have alluded to potential price increases in order to pass on costs to customers.

Market is anticipating more favorable tax and China policies from the new Biden administration toward foreign manufacturers of chips.

IBM dropped ~10% after missing analysts’ expectations.

IBM has had four straight quarters of declines following a transition to their new cloud-focused business model.

Revenues -6% to $20.4bln, Gross margins improved, up to 51.7%.

IBM expects its free cash flows to improve up to $12bln during 2021 following continued business line restructuring. It’s expected that their ‘managed infrastructure services’ should be generating sustainable revenue to some degree before the end of 2021.

GEOPOLITICS

After criticizing the Chinese government, Jack Ma has resurfaced for the first time in three months. He can be seen briefly speaking during a virtual event held on Wednesday.

Regulators suspended the initial public offering of his fintech company Ant Group Co. after Ma spoke about Chinese leaders and the “old men” of the global bank community.

Shares of Alibaba, the e-commerce giant that Ma co-founded jumped 8.5% in Hong Kong and were up a similar amount pre-market in the U.S.

The Prime Minister of Mongolia, Khurelsukh Ukhnaa has submitted his resignation and a proposal to dissolve his own government on Thursday.

This news comes on the back of protests in Ulaanbaatar by citizens unhappy with the government's Covid-19 response.

A new cabinet to be formed the week of 1/24/2021.

A controversial law has been passed in China that will allow the coast guard to use more aggressive tactics in the Western Pacific.

The law grants the coast guard more freedom to fire on foreign vessels and will take effect on February 1st.

China stated that the law is aimed at “safeguarding national sovereignty, security, and maritime rights,” and grants the coast guard to take “all necessary means” including the use of weapons, to stop or prevent threats from foreign vessels in Chinese waters.

PUNDITRY

Citigroup sees 5 potential drivers for higher inflation in 2021:

Arithmetic base effects: Prices dropped to very low levels in April and May as a result of a halt in economic activity. Comparing April ’21 prices to April ’20 means there will be large year-on-year changes but these are likely to be temporary.

Bounce back in depressed prices: Categories like hotel stays, airfares and apparel are well below normal levels and are likely to rebound once demand picks-up (travel) and excess inventory clears (apparel).

Demand confronting limited supply.

More general firming in rents: Measured shelter prices (direct and imputed) have continued to increase and house prices are rising rapidly.

Inflation expectations can support longer-term inflation: “Fed officials now emphasize the important of expectations around the 2% target in generating mandate consistent inflation. The move higher in both market and survey based expectations is therefore suggestive that inflation closer to 2% can be obtained.”

Morgan Stanley’s 3 Key Calls for 2021:

Return to pre-Covid-19 path: We expect the global economy to enter the next phase of its V-shaped recovery by reaching its pre-Covid-19 GDP path (i.e. where GDP would have been absent the Covid-19 shock) by 2Q21. We see upside risks to this view, given the prospects of further fiscal stimulus in the US. We see limited scarring effects on private sector risk appetite. As warmer weather sets in alongside the vaccination of the vulnerable segments of population, demand will rebound sharply from March/April, especially for Covid-19-sensitive sectors.

Return of EM growth cycle: EM growth will rebound on the back of both domestic and external tailwinds. Domestically, macro stability is in check and growth will get an uplift from the monetary easing that was undertaken last year. Externally, demand is being supported by stronger growth impulses in the US and China and rising commodity prices. Moreover, with the US current account deficit widening and US real rates remaining low, it will provide a conducive external backdrop for EMs. Five key factors supporting EM growth:

More manageable Covid-19 challenge.

Macro stability – inflation and current account – is in check.

US reflationary policies will widen its current account deficit, easing EM financial conditions.

China’s growth impulse will have positive spillover effects to EM.

Rising commodity prices will boost terms of trade for EM commodity exporters.

Return of US inflation: We expect US core PCE inflation to reach 2%Y by year-end, and cross it sustainably from 2022 onwards. With the growth recovery gathering momentum, and further fiscal stimulus in the works, the US economy could return to its pre-Covid-19 path even earlier than the 4Q21 timeline we envisage in our base case. Meanwhile, macro policies will remain very reflationary despite this growth backdrop, setting the stage for a rise in inflation.

Feedback

Thank you for subscribing to the Primary Dealer Review. If you have any questions or comments, please email me directly at primarydealer@weeklymacro.com and I will get back to you.

Do you know someone who would like to receive this publication? Please feel free to share the Weekly Macro Summary with them.

Legal Information and Disclosures

This weekly summary expresses the views of the author as of the date indicated and such views are subject to change without notice. The author has no duty or obligation to update the information contained herein. Further, the author makes no representation, and it should not be assumed that past investment performance is an indication of future results.

Moreover, wherever there is the potential for profit there is also the possibility of loss.

This weekly summary is being made available for educational purposes only and should not be used for any other purpose. The information contained herein does not constitute and should not be construed as an offering of advisory services or an offer to sell or solicitation to buy any securities or related financial instruments in any jurisdiction. Certain information contained herein concerning economic trends and performance is based on or derived from information provided by independent third-party sources.

The author believes that the sources from which such information has been obtained are reliable; however, it cannot guarantee the accuracy of such information and has not independently verified the accuracy or completeness of such information or the assumptions on which such information is based.

This weekly summary, including the information contained herein, may not be copied, reproduced, republished, or posted in whole or in part, in any form without the prior written consent of the author.