THIS IS NOT INVESTMENT ADVICE.

Please speak with a registered investment advisor or other qualified financial professional before making any investment decisions.

Commentary

The S&P500 had one of its best single-month performances of the past 40 years in November; it finished up 11%. The Russell 2000 closed up 18% and the US equity markets were led higher by a 28% and 16% rally in energy stocks and financials, respectively. So, what now? Work done by Bespoke Investment Group shows that in the last 40 years, when the S&P 500 has been up 10% or more year to date through the end of November, the market has averaged another +2.25% in December. You could successfully argue that the stock market’s performance and valuations are detached from the current underlying economic fundamentals. Alternatively, you could argue that the stock market is forecasting a tremendous rebound in economic growth and activity in 2021 and 2022. We tilt toward the latter. We’ve highlighted the worrisome disparity of recovery for low-wage versus high-wage income earners this year. This past week a couple of Federal Reserve officials articulated an acute awareness of the unevenness in the economic landscape. What does it mean? The Fed Funds rate will be at 0 for a long time to come.

Chart of the Week

If you would like to receive the Weekly Macro Summary directly to your mailbox every Sunday, please subscribe. It’s free.

ECONOMIC DATA

Atlanta Fed GDPNow is currently tracking at 11.2% for Q4, up from 5.6% on 11/20.

New York Fed GDP Nowcast is currently at 2.52% for Q4 down from 2.86% on 11/20.

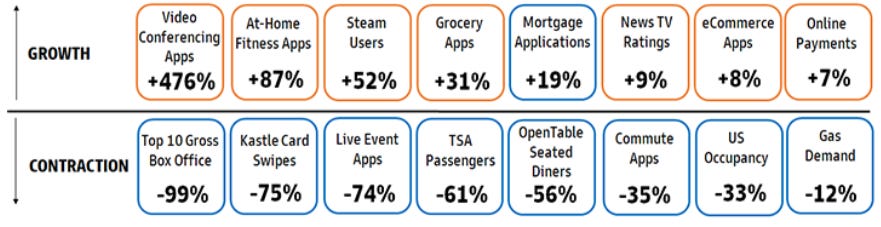

Goldman Sachs Tracking the Recovery, Week of Dec 2:

US nonfarm payrolls +245k vs +470k expected and +610k in October. A few worrisome underlying data points:

Labor force participation declined, 400k fewer people working or actively seeking a job. This caused a “bad” fall in the unemployment rate to 6.7% from 6.9% in the prior month.

Couriers +82k were ⅓ of the month’s gains, Storage & Warehousing accounted for +37k... these two industries are being driven by increased online sales as well as holiday shopping.

The Wall Street Journal reported on Wednesday that UPS placed shipping limits on several large retailers, including Gap and Nike, in order to manage a surge in e-commerce. Stricter COVID restrictions caused an online shopping boom and that led to capacity constraints. “The National Retail Federation estimated that online shopping jumped 44% over a recent five-day stretch that included Black Friday and Cyber Monday.”

-93k in the headline figure was the result of layoffs of temporary census workers

Leisure & hospitality were a huge disappointment with +31k versus 270k average the past 3 months. Restaurant employment was also week, it fell for the first time since April (-17k).

Retail trade payrolls -35k, according to BLS this was the result of, “less seasonal hiring in several retail industries.”

Average hourly earnings +0.3%m/m and average weekly hours held steady at 34.8 hours.

2.76mln people still remain on “temporary unemployment” which could provide a significant boost to job growth in the coming months if the economy can stay afloat during the most recent lockdown measures taken in parts of the country in response to a spike in COVID hospitalizations.

US ADP Employment falls short of expectations +307k vs +440k expected.

October was upwardly revised higher to 404k from 365k.

Small and medium sized business posted largest gains, +110k and +139k respectively.

Service industry +276k jobs, Leisure and hospitality +95k, a positive sign as this was a sector of the economy that had experienced the most severe job losses.

US ISM Manufacturing 57.5 in line with expectations - 7th consecutive month of expansion.

“Of the 18 manufacturing industries, 16 reported growth in November” (15 reported growth in October).

New orders, production, employment, and inventories fell versus October.

Employment component shows contraction, 48.4.

China’s November official manufacturing PMI 52.1 vs 51.5 expected.

Recovery is being led by new orders and production. Increase in total new orders exceeded export new orders, suggests domestic demand catching up to international demand.

Business expectations now at a five-year high.

New Zealand business confidence rises to a 3 year high.

Activity Outlook index now back to pre-COVID levels.

House prices in NZ rose 9.2% y/y, the fastest appreciation in 3 years.

Housing confidence survey showed New Zealander expectations for house price appreciation is now at a 24-year high.

Australian Q3 GDP higher than expected at +3.3% q/q (2.5% expected). Was -7.0%q/q for Q2.

Consumer spending is driving the rebound, +8%q/q versus -12.5% in Q2.

Despite the rebound, economic output is still almost 4% below last year’s levels.

Retail sales for October also bounced +1.4%m/m in October versus -1.1%m/m in September.

Japanese Industrial Production index has 5th consecutive monthly rise, +3.8% m/m.

Index now at its highest level since March (95), pre-COVID level was 99.5 in February.

Production was up in 12 of 15 industries.

Autos at the the highest level since September 2019.

Shipments highest since February and inventories down for the 7th consecutive month.

Sweden manufacturing PMI rises to 59.1 in November, surprises positively versus expectations of 58.

This is the highest reading for the data since December 2017.

New orders at the highest since September 2017.

On the downside, employment subcomponent still in contraction at 49.5.

Sweden services PMI for November also surprised higher, rose to 58.6, the highest level since end-2018.

Korean November exports +4% y/y lower than 7.5% expected but better than October’s -3.6%. (C: 7.5%; Oct: -3.6%).

Exports to China +1.0% y/y, exports to the US+ 6.8%, EU +24.6%.

German factory +2.9%m/m in October.

Foreign orders are the key driver, surmise from other data points that China is the biggest catalyst.

CENTRAL BANKS

Fed Chair Powell testified at the Senate Banking Committee on Tuesday, 12/1, to discuss the CARES Act.

Regarding the recent expiration of programs and the call from the Treasury for the return of unused capital, “The CARES Act assigns sole authority over its funds to the Treasury Secretary, subject to the statute's specified limits. The Secretary has indicated that these limits do not permit the CARES Act-funded facilities to make new loans or purchase new assets after December 31 of this year. Accordingly, the Federal Reserve will return the unused portion of funds allocated to the lending programs that are backstopped by the CARES Act in connection with their termination at the end of this year. As the Secretary noted in his letter, non-CARES Act funds in the Exchange Stabilization Fund are available to support emergency lending facilities if they are needed."

During the testimony he warned that downside risk of small businesses closures are elevated.

Unemployment rate among low-income earners is still a substantial risk to the economic recovery.

Fed Governor Brainard also commented on the disproportionate effects of the pandemic on low-income households and emphasized the importance of additional fiscal support, “additional fiscal support is essential to bridge past COVID's second wave in order to avoid labor market scarring, reductions in crucial state and local services, and bankruptcies. Such additional support is critical to turn this K-shaped recovery into a broad-based and inclusive recovery that is stronger overall.”

SF Fed President Daly presents “2020 Lessons, 2021 Priorities.”

Three lessons from 2020:

1. “We are all interconnected”

2. “The impact of economic shocks does not fall equally”

3. “Persistent and pervasive differences in outcomes limit our economic prosperity”

Five priorities for 2021:

1. “Help to bridge the economy across disruptions caused by the virus”

2. “Return to full employment and sustainable 2% inflation”

3. “Remember that the Fed’s tools are powerful”

4. “Ensure that the Fed can finish”

5. “Ensure that the Fed’s work helps everyone”

ECB President, Christine Lagarde writes article in “L’ENA hors les murs” magazine, “The future of money – innovating while retaining trust.”

Use of physical cash will decrease moving into the digital age.

Highlighted the significant increase in digital transactions during the pandemic.

“The ECB wants to ensure the euro remains fit for the digital era.”

Use of crypto assets may represent a threat to financial stability and monetary sovereignty, expressed concern about crypto asset class’s ability to act as store of value.

The Reserve Bank of Australia left monetary policy unchanged at its December meeting. Their current bond purchase program is AUD$100bln over 6 months that ends in May of 2021.

Emphasized that the bank's actions have lowered borrowing costs, lowered the value of the AUD and are supporting asset prices.

Asset purchases are the preferred method of further stimulus if warranted, "the Board will keep the size of the bond purchase program under review."

Expects the economic recovery to be "uneven and drawn out...dependent on significant policy support."

On the topic of financial stability risks, on Tuesday RBA Governor Lowe said that in the current environment “a protracted period of high unemployment” is more of a risk to financial stability in than excess borrowing.

The Reserve Bank of India (RBI) has kept its repo rate unchanged at 4% and will commit to maintaining an ‘accommodative stance’ for as long as necessary. Inflation is projected to hold steadily in around the 5.8% range for the fourth quarter of fiscal year 2021.

Shaktikanta Das stated “Financial sector entities like banks and NBFCs should give the highest priority to quality of governance, risk management and internal controls.”

The Senate narrowly confirmed the nomination of Christopher Waller to the Federal Reserve’s Board of Governors on Thursday, with a vote of 48-47. Waller has a Ph.D in economics from Washington State University and will remain on the board until January 2030.

As an executive vice president of the St. Louis Fed, Waller’s research has focused on how the Fed’s communication affects financial markets and on the benefits of an independent central bank.

Christopher Waller will be Trump's fourth addition to the Board of Governors.

BoJ Deputy Governor Masayoshi Amamiya, “Recovery in overseas economies is expected to be varied and is likely to remain dependent on the course of COVID-19. Thus, it is necessary to continue closely monitoring developments in overseas economies, taking into account downside risks.”

Regarding Japan: “As the impact subsides globally, the economy is projected to keep improving further with overseas economies returning to a steady growth path. That said, this baseline scenario of the economic outlook entails high uncertainties and risks are skewed to the downside.”

BOJ Board Member Suzuki reiterates his view that, “It is desirable for the yield curve for super-long-term JGBs to become steeper at a moderate pace with the Bank keeping 10-year JGB yields at around 0%, in that financial institutions can improve profits on their investment and the Bank can achieve financial system stability while monetary easing is prolonged.”

FIXED INCOME, CURRENCIES, COMMODITIES

Bitcoin touches another new high this week at $19,914. Previous all time high was $19,511 from December 2017. In 2020, Bitcoin has rallied 150%. The value of bitcoins outstanding currently sits at $500bln!

Billionaire hedge fund manager, Paul Tudor Jones becomes the latest institutional investor to embrace bitcoins potential. He told Yahoo Finance that he expects bitcoin to go “substantially higher” as the trend for digitalization continues. He also believes that cryptocurrencies could trade like the metals market, with bitcoin trading as a precious metal and other cryptocurrencies trading like industrial metals.

Oil rose for the fifth consecutive week in response to a new OPEC+ deal. The committee agreed to add 500k barrels a day to the market next month and then hold monthly meetings to determine subsequent moves.

“The fact that February’s production levels are still under discussion puts more uncertainty ahead for the coming OPEC+ meetings.” -Rystad Energy

OPEC+ had previously been expected to maintain cuts until at least March but with the speedy approval of a vaccine, several producers expect that to be lifted sooner rather than later.

Energy stocks have rallied another 10% through the first 4 days of December after returning 28% in November!

The House of Representatives passed a landmark bill that would decriminalize marijuana at the federal level. The bill aims to remove it from the Controlled Substance Act, as well as expunge some marijuana-related convictions.

The law authorized a 5% sales tax on marijuana products and provides micro loan opportunities for small marijuana businesses. This comes after legal cannabis sales soared to a record level over the Thanksgiving weekend. (See Weekly Summary from Oct 11, 2020 for a market perspective)

EQUITIES

The Financial Times published a column entitled: "Robo-surveillance shifts tone of CEO earnings calls: Trading algorithms leave a mark with deeper focus on the spoken word". The piece outlines the evolving nature of the language that CEOs choose to use on earnings calls as a result of AI-driven hedge funds that respond instantaneously to key phrases used by management when reporting their results.

High-speed hedge funds have implemented natural language processing algorithms that instantaneously respond to earnings calls, social media posts and regulatory documents for information that could be market-moving.

“Natural language processing is a form of artificial intelligence where machines learn the intricacies of human speech. With NLP, quant hedge funds can systematically and instantaneously scrape central bank speeches, social media chatter and thousands of corporate earnings calls each quarter for clues."

Luke Ellis, the CEO of publicly listed asset manager, Man group, says that "Machines can pick up a verbal tick that a human might not even realize is a thing.” Ellis is in a unique position to understand the structural shift that's occurring. His company is publicly listed, so he leads earnings calls, and they are also the operator of one of the largest hedge funds in the world.

The number of machine downloads, scraped by such strategies, of quarterly and annual reports in the United States has risen from 360k in 2003 to 165mln in 2016 and has likely grown significantly since the last report.

Authors of a recent research study that explored this dynamic write that, “More and more companies realize that the target audience of their mandatory and voluntary disclosures no longer consists of just human analysts and investors... a substantial amount of buying and selling of shares [is] triggered by recommendations made by robots and algorithms which process information with machine learning tools and natural language processing kits.”

The paper also found changes in tone expressed by management on earnings calls, “Managers of firms with higher expected machine readership exhibit more positivity and excitement in their vocal tones, justifying the anecdotal evidence that managers increasingly seek professional coaching to improve their vocal performances along the quantifiable metrics.”

“The paper found that companies have since 2011 subtly tweaked the language of reports and how executives speak on conference calls, to avoid words that might trigger red flags for machines listening in.”

Industry experts suggest that the investor relations departments of publicly listed company are running different versions of their releases through such algorithms internally, before releasing them publicly, to see which versions perform the best.

November concluded as a reversal month for several sectors within the S&P after the index rose 10.8% m/m, marking the biggest monthly gain for the index since April.

Russell 2000 +18.3% in November, recording its best monthly performance.

Dow +11.9%, the best monthly gain since January 1987 and its best November since 1928.

Nasdaq +11.8%, its best November since 2001.

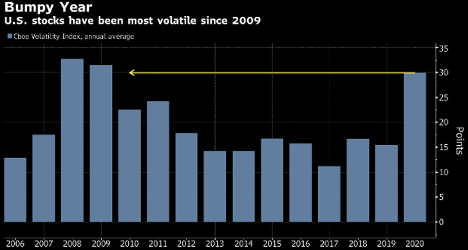

This has been the most volatile year for U.S. stocks since 2009 as measured by the VIX index.

Options activity (see below) combined with economic uncertainty have been key drivers for the persistent elevated vol level.

Options trading is more popular than ever. Options market continued its boom going into December with the 20-day moving average hitting a record high of over 20mln option contracts.

Over 35mln call options were exchanged the day before Thanksgiving, another record high.

Pfizer Inc. (NYSE: PFE) is now planning to distribute up to 50mln doses of its vaccine, down from the original estimate of 100mln due to a slower-than-expected manufacturing scale-up and raw material shortages.

Pfizer’s currently expects to produce 1.3bln doses in 2021

Important to note that the distribution cut is only expected for 2020. Estimates for 2021 have not been revisted lower

Airbnb is scheduled to IPO on December 10, 2020 with a $35bln valuation. Implies a price range between $44 - $55 per share. Their most recent valuation was $18.1bln in April of this year.

Airbnb lost $696.9mln for the first nine months that ended in September 2020 on a revenue base that fell 32%y/y at $2.5bln

According to the company’s S-1 filing, there are 4mln users in over 220 countries as of November 16, 2020.

At the peak of the pandemic, gross bookings fell 127% y/y (that number is more than a 100% decline because of refunds).

The pandemic appears to have altered consumer behavior regarding their travel patterns. Airbnb has realized a higher average spend on individual bookings: Gross booking volumes are down 28% y/y but gross booking value is down 17%

Warner Bro. Entertainment announced that it will stream all of its 2021 movies on HBO Max, concurrent with their theater releases.

The agreement is intended to last for only one year, but it begs the question about whether a permanent change in movie releases could be the end result.

GEOPOLITICS

Congress has set the stage for delisting a select number of Chinese stocks from US markets after the House of Representatives on Wednesday unanimously passed the Holding Foreign Companies Accountable Act.

All foreign companies with US stock listings will have to comply with US audit oversight rules within a three-year window.

Although this bill applies to any foreign company, the spotlight remains on China whose companies are notorious for lax oversight. The total market capitalization of US-listed Chinese stocks stands at $2.2tln.

An example of such fraud is Chinese EV company, Kandi Technologies who is accused of faking sales in order to receive a $160mln US investment.

PUNDITRY

Louis-Vincent Gave, Chief Executive of Gavekal: Are we due for a shift in the world's reserve currency?

Recent economic developments that have taken place as a result of the pandemic, especially in the Western world, have created trends and opportunities that Gave believes will set the stage for a switch in the reserve currency.

The response to Covid has led to an increase in debt per capita in some countries significantly more than others:

Some of the most prominent increases include the US which has realized a $12,800 increase in debt per capita, $7,000 in Germany, and $5,300 in France.

On the opposite side of the spectrum, China's debt per capita has only increased $1,200.

This type of evolution will more than likely hinder the Western world's arsenal of future policy options, forcing policy markets to embrace yield-curve controls and limit upward interest rate movement.

Japan and Europe have already gone down this path.

Gave posits that managing the rising public debt levels will be critical policy issue the US will have to address in the near future.

"…there are no historical examples, outside of Japan, where that doesn’t lead to massive and very fast inflation, massive currency debasement, or both."

China has been experiencing an influx of fintech solutions across Southeast Asia, the Middle East, and Africa through WePay and Alipay.

One of China's biggest roadblocks to a successful transition to a digital renminbi will be gaining the public's trust after decades of social instability.

The recent vote for the Holding Foreign Companies Accountable Act might play a critical role in facilitating the development of the digital renminbi.

With US-listed Chinese stocks facing potential delisting, the Hong Kong market might attract lucrative investment and can be a key stepping-stone in the digital renminbi's internationalization.

"Most Westerners saw the intervention as the death of Hong Kong, but China guaranteed Hong Kong would be China’s capital markets for the foreseeable future."

Bridgewater’s Karen Karniol-Tambour: The Biggest Investment Opportunity for Americans is China.

In order to get the economy moving when interest rates are at zero, and there has been an influx of printed money, there needs to be a coordinated effort when it comes to monetary and fiscal policy.

The standard 60/40 stocks to bonds asset allocation will need to be reimagined if bond yields remain so close to zero.

The US and Europe will need to shift toward a government-directed industrial policy to stay competitive with countries like China. That is achievable through nonpartisan politics and using fiscal policy as the most powerful level.

China’s dual circulation (an economic strategy that emphasizes increased domestic demand, self-reliance for high-tech goods, and selectively opening the economy to foreign companies) will be pertinent for investors to understand because there are significant opportunities to be had.

Diversifying into China will be the greatest investment opportunity post-Covid because of the country’s economic size, policies, and potential.

The biggest investment opportunities will be in companies that solve global issues (i.e. climate change).

Covid-19 will cause analysts to view tail risk with more scrutiny. For example, many don’t perceive climate change to be a key issue in markets but there are considerable tail risks involved.

GDP is no longer a good proxy to determine human well-being. Alternative data points will need to be analyzed to get a better understanding of prosperity. Such metrics include inequality, pollution levels and education.

ESG investing will continue to rise in popularity as investors look to profit from a sustainable future.

Feedback

Thank you for subscribing to the Primary Dealer Review. If you have any questions or comments, please email me directly at primarydealerreview@gmail.com and I will get back to you.

Do you know someone who would like to receive this publication? Please feel free to share the Weekly Macro Summary with them.

Legal Information and Disclosures

This weekly summary expresses the views of the author as of the date indicated and such views are subject to change without notice. The author has no duty or obligation to update the information contained herein. Further, the author makes no representation, and it should not be assumed that past investment performance is an indication of future results.

Moreover, wherever there is the potential for profit there is also the possibility of loss.

This weekly summary is being made available for educational purposes only and should not be used for any other purpose. The information contained herein does not constitute and should not be construed as an offering of advisory services or an offer to sell or solicitation to buy any securities or related financial instruments in any jurisdiction. Certain information contained herein concerning economic trends and performance is based on or derived from information provided by independent third-party sources.

The author believes that the sources from which such information has been obtained are reliable; however, it cannot guarantee the accuracy of such information and has not independently verified the accuracy or completeness of such information or the assumptions on which such information is based.

This weekly summary, including the information contained herein, may not be copied, reproduced, republished, or posted in whole or in part, in any form without the prior written consent of the author.