Elevated Volatility Amid Elevated Uncertainty

Weekly Macro Summary 10/17/2020

THIS IS NOT INVESTMENT ADVICE.

Please speak with a registered investment advisor or other qualified financial professional before making any investment decisions.

Commentary

Barring the passing of a significant stimulus package in the United States, it is expected that there will be little to drive markets outside of their recent ranges until the election. You may recall that last week we highlighted that the VIX (the US benchmark volatility index) had closed above 20 for 158 trading days, the longest streak since during the global financial crisis. Despite rising stock prices, implied levels of volatility are elevated across many asset classes relative to the past 15 years. Implied 3 month volatility for the S&P500 is in the 80th percentile. Implied volatility for the Chinese Yuan and Mexican Peso (a proxy for emerging market currencies) are both in the 90th percentile. Oil and high yield bond implied volatility are both in the 80th percentile. What this means is that the market is expecting a bumpy road over the next 3 months and the cost to protect against falling asset prices is high. More simply, there seems to be a lot of fear priced-in. Despite all this, the Russell 2000, a small-cap stock market index more likely to resemble the business environment in the United States, has rallied nearly 13% since September 23rd outperforming the S&P500 by nearly 6 percentage-points. It’s worth repeating the old Wall Street adage once again, “The Market climbs on a wall of worry.” There seems to be plenty of worry in the markets but does anyone think that the stock market can rally furiously again in the 4th quarter? Contrarians, take note.

Chart of the Week

Our chart of the week shows the countries that are expected to make the largest contributions to global economic growth in 2021.

Source: Bloomberg

If you would like to receive the Weekly Macro Summary directly to your mailbox every Sunday, please subscribe. It’s free.

ECO DATA

Atlanta Fed GDPNow is currently tracking at 35.2% for Q3, unchanged from last week.

New York Fed GDP Nowcast stands at 13.79% for Q3, down from 14.0% last week.

US Core CPI rose +0.19% m/m, in line with expectations. +1.7% y/y.

Used autos had the largest 1 month jump since 1969 (+6.4% m/m). Contributed most of the gain in headline CPI.

Over the past 3 months used car prices have increased at an annualized rate of 75%. Had it not been for used car prices rising, the core CPI would have fallen in September.

Rents +0.12%m/m after +0.09% in August. Compares to an average monthly rate of +0.27% for 2019.

Gold fell 1.5% and long term treasury bonds rose 0.75% largely in response to the weak inflation data.

Source: Morgan Stanley

US September headline PPI rose 0.4% m/m (+0.2% expected), core PPI same (+0.4% vs +0.2% expected).

Y/Y rate up now +0.7% from 0.3% in August.

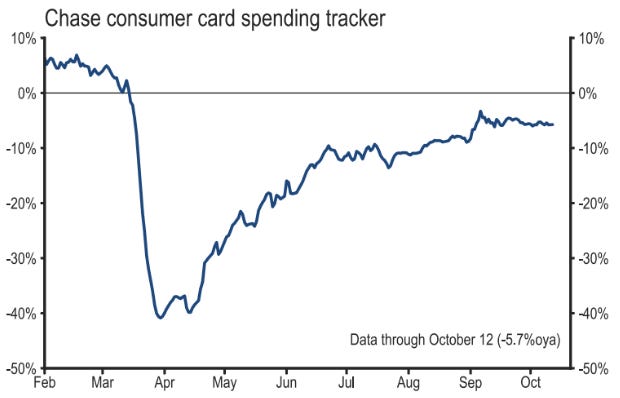

US Retail sales +1.9% m/m (+0.8% consensus), core retail sales +1.5%m/m.

Retail goods spending +8.2% y/y strongest reading since 2011.

Consumer spending was positive in 12 of 13 categories.

Retail sales are now $22bln (4%) above pre-Covid level from February 2020.

Source: Citigroup

Source: JP Morgan

US Industrial Production for September was weaker than expected -0.6% m/m (0.5% expected.

Manufacturing -0.3% m/m with durable goods manufacturing -0.5% after rising 0.6% in August.

U.S. NFIB small business sentiment rises to 104.0 from 100 in August. Low point was in April at 91.

This is the highest reading since February's 104.5.

Strength was broad-based (9 of 10 components improving).

The percentage of firms expecting a better economy now sits at 32% from 24% last month.

Small business plans to increase employment have reached their highest level since August 2018.

Source: Morgan Stanley

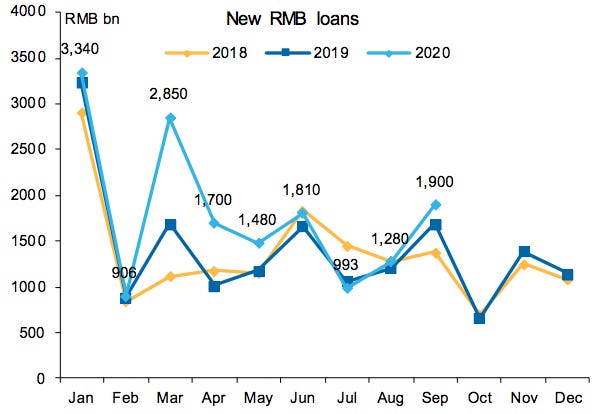

China credit data was broadly stronger than expected this week.

New Total Social Financing (TSF) was RMB3.5tln (3.0tln expected). The 13.5%y/y growth rate is the strongest since 2017 and tracks at approximately a 10% nominal GDP growth rate.

Source: Macquarie

China's Exports +9.9% y/y in September.

Imports with a huge surprise at +13.2% y/y versus consensus expectations of unchanged. The major factor was a 24.7% (y/y) rise in imports from the US versus just a 2% rise in August.

Canada’s manufacturing capacity utilization ratio is now at 75.8%, about 4% below last year’s levels.

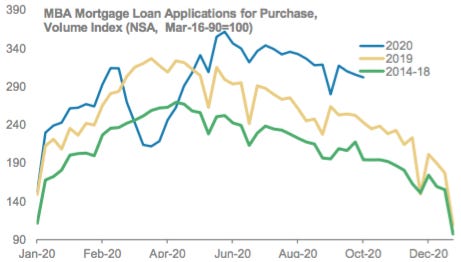

US MBA Mortgage Applications fell 0.7% last week, but are still 36.6% higher from a year ago.

Refinance loans continue to dominate, made up 66% of the applications

Source: Mortgage Bankers Association

Initial Jobless Claims 898k this past week versus 825k expected

This is the largest one-week increase since July, a troubling sign as the labor market tries to recover. The 4 week moving average of initial claims rose for the first time since July.

Continuing claims fell 1.16mln to 10mln but analysts speculate that the drop likely reflects more workers exhausting benefits rather than an improvement in the employment landscape.

Claims rose despite estimates from California being held at prior levels when the state paused filings in mid-September.

Source: Citigroup

U.S. had 1.5mln Business Applications in Q3, a 77% increase from Q2

Through September, new business applications stood at 3.2mln, compared to 2.7mln for all of 2019.

Fastest pace of new business growth in over 10 years.

Source: U.S. Census Bureau

CENTRAL BANKS

Bank of England further explores Negative Interest Rates

Sam Woods, deputy governor wrote in a letter to banks, “We are requesting specific information about your firm’s current readiness to deal with a zero bank rate, a negative bank rate or a tiered system of reserves remuneration - and the steps that you would need to take to prepare for the implementation of these.”

Fed Vice Chair for Supervision Quarles gave a speech titled, “What Happened? What Have We Learned From It? Lessons from COVID-19 Stress on the Financial System”. Offered 3 main lessons.

“Short-term funding markets proved fragile and needed support – the commercial paper market and prime and tax-exempt money market funds, as key examples.”

“The Treasury market is not immune to the problems of short-term and dollar funding markets.”

“The regulatory framework for banks constructed after the GFC, with the refinements and recalibrations we have made over the last few years, held up well.”

US Federal Reserve Vice Chair, Clarida: “flow of macro data received since May has been surprisingly strong, and GDP growth in the third quarter is estimated by many forecasters to have rebounded at perhaps a 25%-30% annual rate.”

“Low interest rates feed into the broader economy through housing construction, car purchases,and equipment and software orders.

“There is a lot of excess savings that will fuel pent-up demand.”

Reserve Bank of Australia Governor Lowe indicates that the RBA will making a shift toward focusing on actual, rather than forecast, levels of inflation in its policy decision making framework. The move is similar to the one that the US Federal Reserve made recently with their transition toward Flexible Average Inflation Targeting.

As a result of the shift, the RBA does not expect to raise rates for at least 3 years.

3 areas of internal RBA debate that he outlined:

How effective further easing will be

Impact on financial stability

What is happening internationally

Lowe's comments led the Australian Dollar to fall 2% this week as markets now expect additional monetary stimulus is inevitable by the RBA.

The IMF released a comprehensive study on the pandemic’s impact on public finance. According to the IMF:

Governments have injected nearly $12 trillion of fiscal stimulus into the global economy and have increased their budget deficits an average of 9 percentage points of GDP.

Global public debt is on track to surpass 100% of GDP in 2022.

In the last 5 years, advanced economies averaged a debt level of 105% of GDP and emerging markets averaged a debt level of 48% of GDP.

In the next 5 years, the IMF estimates that advanced economies will average a debt level of 125.6% and emerging markets 67.6% of GDP.

The paper prescribes significant public investment focused on digital infrastructure in order narrow the gap in disparities for access to information, education, and work opportunities.

Researches hypothesize that an increase in public investments by 1% of GDP would create 7 million jobs directly, and between 20 million and 33 million jobs via indirect effects

Kristalina Georgieva, IMF Managing Director:

“Today we face a new Bretton Woods “moment.” A pandemic that has already cost more than a million lives. An economic calamity that will make the world economy 4.4 % smaller this year and strip an estimated $11 trillion of output by next year. And untold human desperation in the face of huge disruption and rising poverty for the first time in decades.”

Source: Goldman Sachs

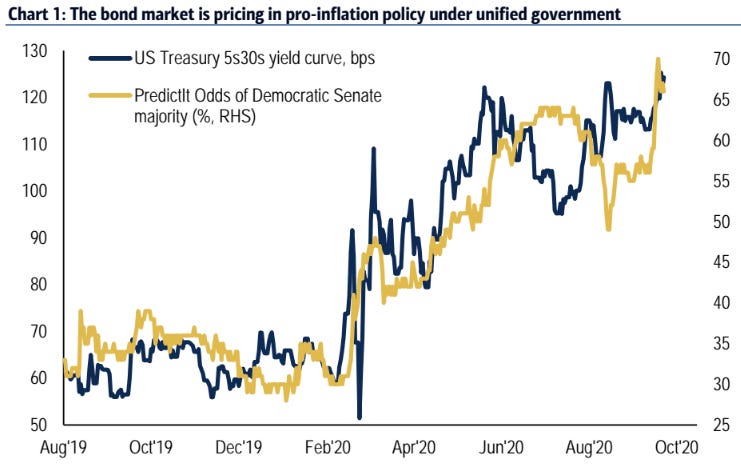

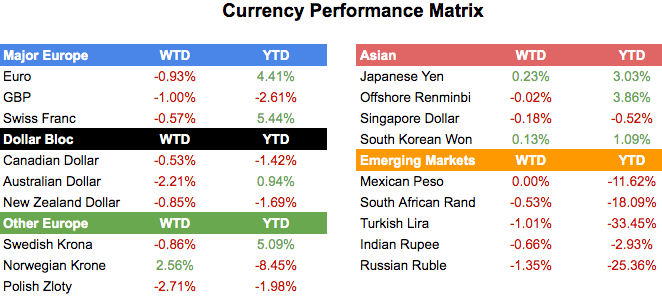

FIXED INCOME, CURRENCIES, COMMODITIES

What’s going on with China’s Yuan? We feel the story is not being covered widely enough. The onshore Yuan (USD/CNY) has appreciated by slightly more than 5% year to date making it one of the best performing currencies in the world versus the dollar.

The People’s Bank of China has been reluctant to cut policy rates which has resulted in an elevated 10 year bond yield relative to major developed economies.

The widening yield differential seems to have provided support for the currency and it’s possible that further capital flows into the economy may find its way into the bond market or the local stock and property markets.

China 10yr Bond Yield Differential to G4 countries (in basis points)

Source: Citigroup

Citigroup notes that Switzerland has met the objective criteria to be labeled a currency manipulator by the US Treasury.

The US Treasury Foreign Exchange Report timing has been disrupted recently but the bank expects the report to be released in October. There are 3 criteria that all must be met for a country to be considered a currency manipulator by the United States:

Bilateral Trade: “A significant bilateral trade surplus with the United States is one that is at least $20 billion over a 12-month period.”

Current Account: “A material current account surplus is one that is at least 2 percent of gross domestic product (GDP) over a 12-month period.”

Currency Intervention: “Persistent, one-sided intervention occurs when net purchases of foreign currency are conducted repeatedly, in at least 6 out of 12 months, and these net purchases total at least 2 percent of an economy’s GDP over a 12-month period.”

The global fixed income market currently has $16.5tln of negative yielding bonds. Digital currency proponents argue that this has catalyzed the recent rally in bitcoin.

“Going forward, the search for yield is likely to be a major driver of growth in bitcoin’s price and adoption,” Stack Fund CEO Matthew Dibb.

Bitcoin has rallied nearly 200% over the past seven months concurrent with the rise in negative yielding debt levels

Last week we noted that Square, Inc. announced that it made a $50mln investment in bitcoin

“We believe that bitcoin has the potential to be a more ubiquitous currency in the future,” said Square CFO Amrita Ahuja.

Stone Ridge Holdings Group announced Tuesday it raised an additional $50mln in funding to stash 10,000 bitcoin with its crypto subsidiary NYDIG.

Source: Bloomberg

US oil inventories fell by 3.8mln to 489.1mln barrels

Total motor gasoline inventories decreased by 1.6mln.

Distillate field inventories decreased by 7.2mln.

Propane/propylene inventories decreased by 1.9mln.

Commercial petroleum inventories also decreased by 16.8mln barrels.

China, the world’s top crude oil importer, took in 11.8mln b/d of oil in September, up 5.5% from August and 17.5% y/y

Ports have focused on increasing storage capacity because facilities were almost full in July and August after the Chinese purchased huge quantities during April’s oil sell-off.

OPEC’s Secretary-General Barkindo said this past week that OPEC+ alliance will ensure oil prices do not fall again when it meets to set policy at the end of November.

“We have to be realistic that this recovery is not picking up pace at the expected rate in the year. Demand itself is still looking anemic.”

In its latest primary dealer questionnaire, the US Treasury Department asked the primary market makers of Treasury securities the following question, “In response to increased borrowing needs, Treasury has increased coupon auction sizes for nominal coupons and FRNs, but has kept TIPS auction sizes unchanged since 2019. Should Treasury consider increasing TIPS auction sizes in the near-term to meet future borrowing needs and, if so, when and at what tenors (5-, 10-, and 30-year)?”

The market has read this to imply that the Treasury is will likely be increasing the size of TIPS issuance.

EQUITIES

JPMorgan reports earnings. Solid results with Q3 revenue at $29.9bln vs 28.2bln est.

EPS of $2.92 way ahead of $2.22 consensus. +9% y/y.

15% annualized return on equity keeps JPM the leader for major US banks.

CEO Jamie Dimon said on the call that if we see further aggressive fiscal stimulus in the US, then the bank has over-reserved it’s loan losses but if there is a lack of stimulus then the bank feels it is likely under-reserved. If the economy recovers in-line with the Federal Reserve’s base case assessment, Dimon projected that the size of the over reserve would amount to approximately $10bln.

In the event of a double-dip recession, Dimon forecast the bank would need to reserve an additional $20bln to its balance. This scenario entails an unemployment rate persistently at around 12%.

The bank added $611mln to provisions for credit losses in Q3 after $10.5bln in Q2.

Citigroup reports Q3 revenue of $17.3bln in line with $17.2bln expected.

EPS: $1.40 ahead of $0.91 estimated by the street.

$1.9bln in credit losses in Q3 down from $2.2bln in Q2.

$314mln added to loan loss reserves versus $5.6bln in Q2.

Citi’s net interest margins fell to record lows.

Goldman Sachs Q3 EPS: $9.68 vs $5.60 expected, revenue was $10.8bln vs $9.4bln expected.

Fixed Income trading revenue was 50% higher than a year ago, Equities trading 10%.

Investment banking revenue of $1.7bln is 7% higher than Q3’19.

AMC, the largest movie-theater operator, said in a regulatory filing on Tuesday that the company, “will require additional sources of liquidity or increases in attendance levels. The required amounts of additional liquidity are expected to be material.”

To date the company has reopened 83% of US theaters but has not yet been permitted to re-open them in New York, Los Angeles and San Francisco. Those 3 markets make up 25% of box office sales.

Earlier this year, AMC sold 9 million shares for proceeds of $37.8mln

Last week Cineworld (the UK operator who owns Regal Cinema in the US) announced that it would close down all of it’s American theaters.

Delta reports revenue of $2.6bln for Q3 down vs consensus $3bln.

Pretax loss of $2.6bln & EPS of -$3.30 versus estimates loss of $2.5bln and -$3.10 respectively.

$21.6bln in cash + funding available with a burn rate of $24mln per day during the quarter.

The company has reduced the burn rate to $18mln a day in September from $27mln in June.

Pushed their cash breakeven estimate to Spring 2021 from end of 2020.

Source: WSJ

Taiwan Semiconductor revenue of $12.1bln versus $11.5bln expected, up 29% y/y.

EPS of 90 cents beat estimates of 77 cents.

TSM is the the world’s largest contract chip manufacturer.

“Our third-quarter business benefited from the strong demand for our advanced technologies and specialty technology solutions, driven by 5G smartphones, [high-performance computing] and IoT-related applications...Moving into fourth quarter 2020, we expect our sequential growth to be supported by strong demand for our industry-leading 5-nanometer technology, driven by 5G smartphone launches and HPC-related applications.”

LVMH posts 12% growth in Q3 for its fashion and leather goods business. Overall business revenue is down 7% to €11.96bln this year

The best performing brands have been Louis Vuitton and Dior

Other brands under the LVMH umbrella had steep declines during the pandemic.

Despite the overall sales slump, UBS analysts note that “Valuations for the luxury sector have remained surprisingly resilient. The sector currently trades at a 96% premium to MSCI Europe Index compared to a usual 48% long-term average.”

GEOPOLITICS

China is rumored to have imposed an import ban of Australian coal. The story has not been officially confirmed, but IHS reported that two China-bound cargoes have been diverted to India.

Australian mining giant, BHP has stated that some of their Chinese customers have asked for a deferral of purchases.

Brexit talks have seen positive momentum since a large hiccup a few weeks ago in which the UK threatened to leave without a deal.

Expectations among experts are high to see final compromises in the following week with some speculating that it’s possible for a final written text to be presented as early as next week after the European Council summit.

Countries are opening their borders to migrants from Hong Kong and Belarus for both humanitarian reasons and the opportunity to hire highly skilled and educated workers.

In Hong Kong: Months of protests were met with a national security law that seemingly grants police investigative powers with little oversight for crimes outlined in very broad and uncertain terms

In Belarus: President Alexander Lukashenko was met with protests following an election that many claimed was rigged. Lukashenko has been president for 26 years.

To deal with the civil unrest, the government cut internet access, jailed dissidents, and conducted police raids. Some are speculating that the country will no longer hold elections.

Belarus’ neighbors: Ukraine, Lithuania, Poland, and Latvia have all rolled out varying policies and programs to assist in the transition for IT firms and their employees to their respective countries.

“As of September, a dozen Belarusian tech firms were already in the process of moving their operations to another country, and more than 170 companies had either already relocated part of their staff out of Belarus or are looking at options of doing so.”

Hong Kongers are being eyed by the west as similar efforts are being pushed, varying from citizenship potential (UK) to visa options for skilled workers (Australia) and potentially expedited asylum applications for those involved in the protests (US).

“One immigration lawyer describing the likely exodus as being part of “the greatest human capital harvest in recent memory.”

“Two economists at the London-based Centre for Economics and Business Research have estimated that UK GDP could be boosted by as much as £40 billion ($52 billion) from the migration of skilled Hong Kongers.”

Countries that are generally the least responsible for greenhouse gas emission are disproportionately economically impacted by natural disaster damage.

“The United Nations report also concluded that frequency, cost, and fatality of storms are all on the rise, which means these disparities are only likely to increase.”

“Some types of disasters discussed in the report, like volcanic eruptions and earthquakes, aren’t linked to global warming. But for those that are growing most quickly, in particular floods and tropical storms, there is a large and mounting body of evidence linking them to climate change. Scientists are even getting better at attributing specific weather events to man-made climate change, something they were once loath to do. A recent review of more than 300 peer-reviewed studies of individual disasters found human fingerprints on 78% of them.”

Less developed nations are more likely to underreport economic losses, the actual loss of GDP is likely to be considerably higher depending on the country.

Source: Quartz, UN Office for Disaster Risk Reduction

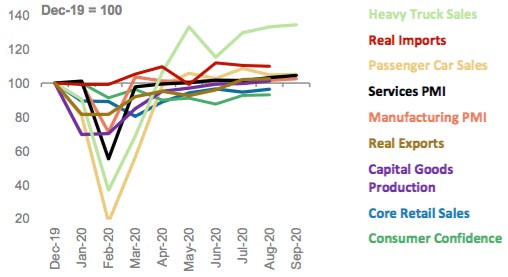

Recovery of Key Economic Indicators in major countries relative to Pre-COVID, via Morgan Stanley

United States

Euro Area

Japan

UK

China

Feedback

Thank you for subscribing to the Primary Dealer Review. If you have any questions or comments, please email me directly at primarydealerreview@gmail.com and I will get back to you.

Do you know someone who would like to receive this publication? Please feel free to share the Weekly Macro Summary with them.

Legal Information and Disclosures

This weekly summary expresses the views of the author as of the date indicated and such views are subject to change without notice. The author has no duty or obligation to update the information contained herein. Further, the author makes no representation, and it should not be assumed that past investment performance is an indication of future results.

Moreover, wherever there is the potential for profit there is also the possibility of loss.

This weekly summary is being made available for educational purposes only and should not be used for any other purpose. The information contained herein does not constitute and should not be construed as an offering of advisory services or an offer to sell or solicitation to buy any securities or related financial instruments in any jurisdiction. Certain information contained herein concerning economic trends and performance is based on or derived from information provided by independent third-party sources.

The author believes that the sources from which such information has been obtained are reliable; however, it cannot guarantee the accuracy of such information and has not independently verified the accuracy or completeness of such information or the assumptions on which such information is based.

This weekly summary, including the information contained herein, may not be copied, reproduced, republished, or posted in whole or in part, in any form without the prior written consent of the author.