THIS IS NOT INVESTMENT ADVICE.

Please speak with a registered investment advisor or other qualified financial professional before making any investment decisions.

Commentary

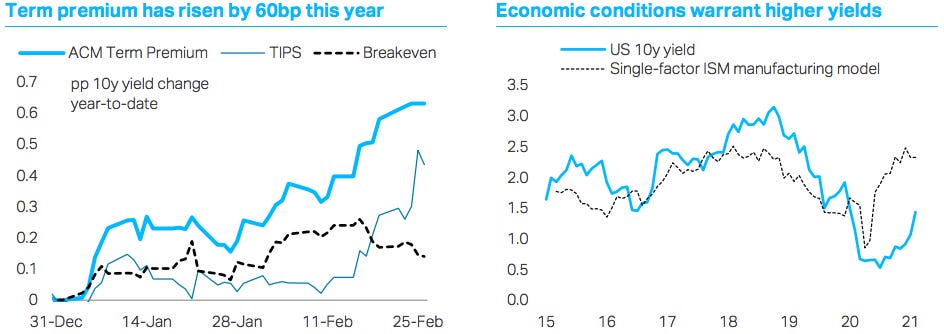

It was a week to remember for global government bond markets. The US 10 year treasury yielded 1.35% at the close of business on February 19th. This past Thursday, the 7 year treasury auction results came at 4 basis points cheaper than the pre-auction fair value; this is an historically large concession (“tail”) for the auction. What’s more, participation from money managers was bleak. The weak auction prompted a crescendo of activity that saw 10 year yields spike above 1.60%. Central bankers in Australia, Europe, the UK, New Zealand, etc. have demonstrated their awareness of rising rates in the bond markets and have said that they are watching how these moves will impact financial conditions. Their counterparts in the United States however have taken a more sanguine view; Federal reserve members have been unified in the expression of their belief that rising rates are a reflection of an improving economy and brighter prospects as a result of optimism surrounding the COVID vaccine and an impending pickup in activity. After Thursday’s frenzy, bond markets settled and the 10 year closed the week at 1.46%. Stocks did not respond well to the dramatic moves in rates, the S&P500 finished the week down 2.5% while the tech-centric Nasdaq was down 5% for the week. Below, you’ll find a slightly abridged summary this week.

Chart of the Week

If you would like to receive the Weekly Macro Summary directly to your mailbox every Sunday, please subscribe. It’s free.

ECONOMIC DATA

The Atlanta Fed’s GDPNow forecast for Q1 growth is currently tracking at 8.8%, down from 9.5% last week.

The New York Fed’s Nowcast forecast for Q1 growth is currently 8.7% up from 8.3% last week.

The share of the population having received a first COVID vaccine for various countries:

Israel: 53.1%, UK: 26.9%, US: 13.6%, Spain: 4.4%, Germany: 4.3%, Italy: 4.1%, France: 3.9%

Daily pace of new doses administered is at 1.5mln in the US.

Covid-19 cases have declined by 73% from the Jan 11 peak.

The number of persons hospitalized is down 55% from the peak peak to 58.4k.

Job Postings on Indeed.com are 5% above Pre-COVID levels

December S&P Case-Shiller home price index rose 0.8% for the 20-City index. This is a new record and follows a 1.1% increase in November. The seasonally adjusted annualized pace for December is in the 97th percentile of all months.

All of the 20 cities surveyed posted 12-month gains, with nine showing double-digit rises.

Related data point: FHFA House Price Index for purchases rose 3.8% from Q3 to Q4, the largest quarterly gain on record. Prices rose in all 50 states.

New home sales +4.3% m/m in January, 923k-unit pace, consensus expectations was a 1.7% rise.

December had a significant upward revision, from 1.6% m/m to 5.5% m/m

Prior 3 months were all revised higher bringing the average to 896k annualized units from 873k.

US Durable goods orders +3.4% in January, well ahead of consensus that was looking for +1.1%.

9th consecutive monthly increase and December revised up from +0.5% m/m, to +1.2% m/m.

Orders rose broadly almost across all components, but core capital goods orders were slightly weaker than expected at +0.5% m/m, below consensus expectations of +0.8%.

German IFO business climate index up to 92.4 from 90.3.

Beat was primarily driven by the expectations component. Had the largest monthly rebound since July.

“The German economy is looking towards recovery again” -Klaus Wohlrabe, Ifo Economist

Confirms the strong forward looking sentiment for the German economy that was expressed in last week’s ZEW survey.

Bottom Line: While current conditions are poor because of lockdown effects, optimism regarding the near future is incredibly strong.

US Conference Board Consumer Confidence had an upside surprise with a boosted outlook in the current labor market and economy’s progress. The index is at a three-month high of 91.3. The highest level in 2020 was 132 pre-pandemic.

Strength was led by survey on present situation which rose 6.5 points to 92.

Jobs plentiful minus jobs hard to get improved from -2.5 to 0.7, the highest level since November. Despite the strength, keep in mind that this labor market differential figure was 32 in February 2020.

This upbeat sentiment aligns with the recent developments we have seen with the $1.9tln economic stimulus package and steady increase in vaccine distributions.

CENTRAL BANKS

Fed Chair Powell testified before the House, “the economy is a long way from our employment and inflation goals, and it is likely to take some time for substantial further progress to be achieved.”

Regarding rising rates, “In a way, it’s a statement of confidence on the part of markets that we will have a robust and ultimately complete recovery.”

Emphasized that accommodative measures would remain in place until “substantial further progress” was achieved and that the labor market’s recovery, thus far, was insufficient toward the objective.

The economy, “has not made substantial further progress in the last 3 months.”

Acknowledged that the Fed anticipates a pick up in inflation this year as a result of base effects and pent-up demand but does not believe “that those effects should either be large or persistent.”

“Inflation dynamics do change over time, but they don’t change on a dime.”

“There really hasn’t been [a strong connection between budget deficits and inflation.”

Inflationary risks are, “[weighted to] the downside for a long time.”

ECB President Lagarde delivers keynote speech at opening plenary session of the European Parliamentary Week.

Fiscal and monetary policies can reinforce each other to address “shielding and transforming” the euro area economy during the pandemic crisis.

“Fiscal policy can help brighten economic prospects for firms and households, thereby strengthening monetary policy transmission... people who consider government support to be more adequate display less precautionary behaviour. Those people are in turn more likely to respond to favourable financing conditions and increase their consumption.”

ECB intends to continue supporting the economy, “the overall policy mix, however, remains essential...firms and households will only be able to take full advantage of favorable financing conditions if national policy measures are deployed to help monetary policy unfold its full potential.”

“Risk-free overnight indexed swap (OIS) rates and sovereign yields are particularly important...Accordingly, the ECB is closely monitoring the evolution of longer-term nominal bond yields.”

The RBNZ leaves the monetary policy stance unchanged as expected. Their QE problem is to buy NZ$100b of bonds by the end of June 2022.

Forecasts were upgraded as expected, but unemployment rate still expected to rise again over H1 2021.

Highlighted the “unevenness” of the recovery’s significant uncertainty about the outlook.

Operationally able to take rate negative if necessary.

The Reserve Bank of Australia purchases AUD7bln of 3 year bonds in order to defend their 0.10% target rate for the maturity.

The RBA now holds more than 60% of the target April 2024 bond.

ECB Chief Economist, Lane, “We will purchase flexibly according to market conditions and with a view to preventing a tightening of financial conditions that is inconsistent with countering the downward impact of the pandemic on the projected path of inflation.”

BOE Chief Economist, Haldane, “There is a tangible risk inflation proves more difficult to tame, requiring monetary policy makers to act more assertively than is currently priced into financial markets.”

Richmond Fed President Barkin, “Inflation is not a one- or two-month spike in prices; inflation is a change in expectations for the medium and long term.”

“There are disinflationary pressures that are quite profound & seem to be continuing. As long as you’ve got those disinflationary headwinds, it’s just going to be hard for businesses to believe that you’re going to have the market power to increase prices.”

St. Louis Fed President, Bullard, “Growth prospects improving and inflation expectations rising; the concordant rise in the 10-year Treasury yield is appropriate.”

Federal Reserve Vice Chair Clarida, “downside risk to the outlook has diminished.”

“The settings of monetary policy are entirely appropriate not only now, but – given my outlook for the economy – for the rest of the year.”

Kansas City Fed President, George, “Most of the rise in the 10-year Treasury this year appears to reflect an increase in the real yield that is the interest rate controlling for inflation compensation. Much of this increase likely reflects growing optimism in the strength of the recovery and could be viewed as an encouraging sign of increasing growth expectations.”

EU calls on financial leaders of the G20 (the world’s top 20 economies) to be careful not to withdraw economic stimulus and accommodation too early. The message was agreed to by all EU countries.

“Fiscal policies should remain supportive as long as necessary, and not be prematurely withdrawn.”

“The fiscal response going forward should continue to be carefully calibrated and regularly reviewed, in light of the uncertainty associated with the pandemic...and the need to avoid policy cliff-edge effects.”

PUNDITRY

Goldman: “investors ask whether the level of rates is becoming a threat to equity valuations. Our answer is an emphatic ‘no’...the 300 bp gap between the S&P 500 forward EPS yield of 4.6% and the 10-year US Treasury yield ranks in the 42nd historical percentile.

Feedback

Thank you for subscribing to the Primary Dealer Review. If you have any questions or comments, please email me directly at primarydealer@weeklymacro.com and I will get back to you.

Do you know someone who would like to receive this publication? Please feel free to share the Weekly Macro Summary with them.

Legal Information and Disclosures

This weekly summary expresses the views of the author as of the date indicated and such views are subject to change without notice. The author has no duty or obligation to update the information contained herein. Further, the author makes no representation, and it should not be assumed that past investment performance is an indication of future results.

Moreover, wherever there is the potential for profit there is also the possibility of loss.

This weekly summary is being made available for educational purposes only and should not be used for any other purpose. The information contained herein does not constitute and should not be construed as an offering of advisory services or an offer to sell or solicitation to buy any securities or related financial instruments in any jurisdiction. Certain information contained herein concerning economic trends and performance is based on or derived from information provided by independent third-party sources.

The author believes that the sources from which such information has been obtained are reliable; however, it cannot guarantee the accuracy of such information and has not independently verified the accuracy or completeness of such information or the assumptions on which such information is based.

This weekly summary, including the information contained herein, may not be copied, reproduced, republished, or posted in whole or in part, in any form without the prior written consent of the author.